EUR/USD Rate Under Pressure, Beware a Hawkish and pro-USD Federal Reserve

The EUR/USD exchange rate is lower as markets reduce exposure ahead of the week's highlight - the US Federal Reserve decision.

- Stock market sentiment will likely remain a key driver of demand for euros over coming days

- Charts suggest further bullish potential, but with a formidable cap to keep strength contained

- Societe Generale: "1.06/1.05 will decide next leg of down cycle."

The Federal Reserve takes centre stage today and according to market pricing the probability of a rise at the March meeting is only 4% with traders becoming concerned about the risk of a US recession over recent months.

"Monetary policy will be unchanged at the rate announcement tonight - anything else would be a sensation," says Mattias Bruér of S.E.B Research and Strategy. "We believe in neither a hike today nor a new US recession in 2016."

However, Bruér thinks that developments in the US labour market, signs of rising core inflation and the fact that financial conditions have improved recently support their forecast for two rate hikes from the Fed in the Autumn which is a more agressive view than consensus.

If markets buy into this view over coming months then the dollar should strengthen notably.

S.E.B do not forecast any major revisions to the Fed's forecasts for growth and unemployment at the March meeting, but do not exclude the possibility the Fed actually may revise up its forecast for inflation.

"This means that one should not be surprised if the Fed's forecast for rates may well indicate a hike during the summer and two more rate hikes in the fall. Given the low market expectations, such an outcome may very well be interpreted as hawkish which among other things could benefit the dollar," says Bruér.

Commerzbank agree with the pro-USD bias adopted by S.E.B noting US Fundamentals are strong and markedly distinct from the euro-area, which means the Fed are likely to stick to their normalisation programme:

"The Fed is unlikely to hike rates further – but only for now. In the US, in contrast to the euro zone, full employment has been reached, with inflation pressure gradually increasing, particularly in services. Hence the Fed seems set to hike rates more strongly (i.e. twice) than expected by the markets, which will lend support to the US dollar and cause yields to rise," says a note from Commerzbank.

The economic recovery continues and inflation pressure is slowly rising.

"We indicate that higher inflation pressure is to be expected in services in particular. The Fed is therefore likely to raise interest rates more (twice) than the markets currently expect. This will support the dollar and cause yields to rise,” say Commerzbank.

EUR to USD to Potentially Head to 1.1250

Fundamentals and the Federal Reserve aside, the charts betray a slighltly positive bias towards the euro which could see further gains near-term, ahead of the eventual return of weakness.

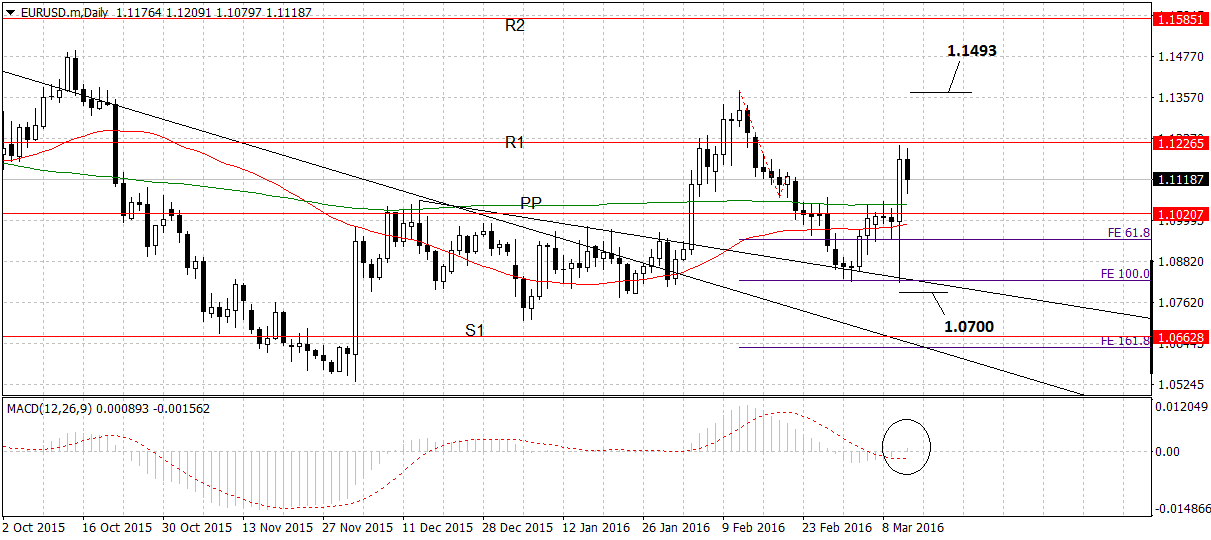

After testing key levels 1.06/1.05 last year, EUR/USD is undergoing broad consolidation.

The downtrend is still in place though argues Societe Generale's Stéphanie Aymes; "1.06/1.05 will decide next leg of down cycle.

"Short term though, the pair revisited February lows (1.08) and looks to show a rebound towards 1.1250. Graphical levels at 1.1460 will remain near term hurdle."

Our own analysis suggests the medium term outlook is that the pair will continue trading within a range between 1.0500 and 1.1500.

The exchange rate moved down to the lower 1.08s following the ECB meeting statement and then rose to 1.1217 after Mario Draghi’s statement that this would be the last time the ECB would cut interest rates.

The R1 Monthly Pivot at 1.1226 provided resistance to the surge higher in the euro, and the rate rebounded off it.

The monthly pivot is a line constructed from the previous month’s High, Close, Open and Low prices, which traders use to buy and sell at, and which it is likely to provide an obstacle to further gains.

The MACD indicator in the bottom pane has just turned positive, indicating more probable bullish potential.

A break above the February 11 highs at 1.1376 would be necessary to provide confirmation of more upside, to a target at 1.1495 October 2015 highs.

Confirmation of more down-side on the other hand, would come from a break below the 1.0800 level, to an initial target at 1.0700, and then the S1 Monthly Pivot level at 1.0663.

Stock Markets Matter for the Euro

As a popular source of funding both for the carry trade and to purchase emerging market assets, the euro is susceptible to being targeted and sold in risk-on environments.

The ECB’s move to lower even further base lending rates will make the euro even more attractive as a source of funding.

The carry trade involves investors buying a higher yielding currency such as the New Zealand dollar or the Brazilian Real using a lower yielding funding currency such as the euro or the yen.

The trader then benefits from the interest rate differential between the two currency’s countries.

"If risk assets continue to rally the unwind in the euro could persist and the pair could tumble all the way to 1.1000 level as the volatility seesaw continues. Ultimately however the pair remains under fundamental pressure and if at next week's FOMC meeting the Fed hints that it may resume its tightening cycle the downward move in EUR/USD will resume in earnest," says Boris Schlossberg of BK Asset Management.

According to Bank of America ‘risk-on’ is set to extend, so the euro may go lower:

“Central banks spur risk-on: in run-up to ECB/BoJ/Fed flows risk-on, particularly in credit...bond inflows ($6.1bn), equity inflows ($4.5bn), gold inflows ($1.0bn) and Money-Market outflows ($3.6bn).”

This risk-on is coinciding and fuelling a renewal of interest in emerging market (EM) assets:

“Largest inflows to EM debt in 12 months,1st inflows to EM equity funds in 5 months, largest 3-week inflow to High Yield bond funds in 3 years, 9th consecutive week of inflow to gold funds (longest streak since 2012).”

Be assured, a large amount of these flows will be funded using cheap euros, a dynamic that will likely keep the shared currency under pressure.

Risk-On, But Not For Too Long

Nevertheless, BofA add the proviso that ‘risk on’ will probably just be a temporary factor influencing the markets.

This could ensure any euro downside will ultimately be contained

“Risk assets about to top: ultimately markets about "rates" and "earnings", little else; central banks have played "rates card" as aggressively as they can; ECB done, BoJ has nothing in the tank, and any US macro strength will elicit Fed rate hike expectations(the Fed wants to tighten); EPS momentum simply not strong enough near-term to overwhelm Q2 risks of Brexit, BoJ failure, US politics, China debt deflation.”