Euro-to-Dollar Week Ahead Forecast: Cooling from Overbought

- Written by: Gary Howes

Image © Adobe Images

The Euro surge needs to unwind overbought conditions this week.

The Euro-to-Dollar exchange rate (EUR/USD) went from below 1.04 last Monday to peak at 1.0889 on Friday afternoon before eventually closing the week at 1.0835, taking the week's advance to 4.41%, the biggest in 17 years.

It's little wonder, then, that we enter the new week thinking it appropriate for some consolidation of those rapid gains to occur in the short term.

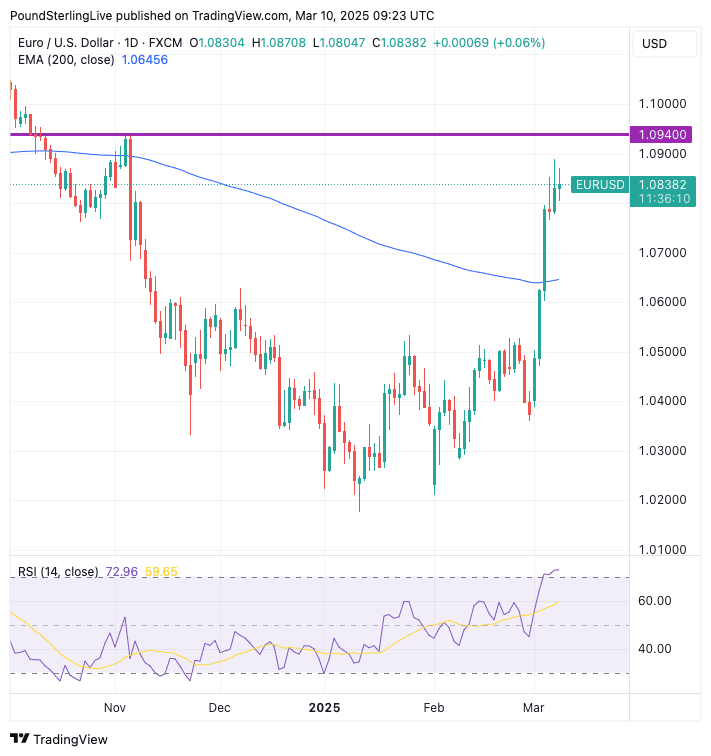

The daily chart's Relative Strength Index (RSI) is at 72.29, where a reading above 70 signals that it is technically overbought and highly suspectible to a mean revertion:

Above: EURUSD at daily intervals with the RSI in the lower panel.

The odds of the RSI reverting back below 70 are highly elevated, so the exchange rate must consolidate or retreat. This is the playbook for the week ahead.

This leaves us forecasting a range of 1.0762 to 1.0930 (the November 2024 high) for the week ahead.

"In the very near term the EUR/USD rally could stall in our view in part because the squeeze of the substantial market shorts seems to have run its course," says Valentin Marinov, Head of FX Research and Strategy at Crédit Agricole.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Bigger picture, the recent advance saw Euro-Dollar slice through the 200-day exponential moving average at 1.0645, which shifts the market from downtrend to uptrend, according to our Week Ahead Forecast model.

So, although the near term is prone to consolidation, the broader setup has turned constructive, and we look for a steady progression higher to 1.1068 and then the 2024 highs at 1.12.

The Euro's gains are driven by a dramatic rise in German government bond yields - they went up by approximately 40bp during last week - after political leaders agreed to a €500BN infrastructure spending plan as well as making significantly more money available for defence.

The German spending decision impacts the Euro via ECB policy, as it is inflationary. Thus, the market sees far less scope for ECB rate cuts in the coming weeks and months.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

However, there is still reason to exercise caution, as the U.S. President will likely soon detail plans to tariff European imports.

Regarding the Euro's outlook, Dominic Schnider, a strategist at UBS Chief Investment Office, says, "Once U.S. tariffs on the EU are announced and implemented, we look for a setback to lower levels. "

Nevertheless, most analysts we follow see last week's decision by German politicians to break the country's long-standing debt rule as a potential watershed moment for FX markets.

Most have been reluctant to radically alter their forecasts, but all agree that, based on recent developments, the strength of the euro is a major risk to current expectations.

"Upside risks to our current EUR/USD outlook," says Marinov.

"We will be reviewing the outlook and decide whether to frontload the EUR/USD strength that we expect in the medium to long term," he adds.

The German spending decision is inflationary, meaning the market sees far less scope for European Central Bank interest rate cuts, which supports bond yields and the Euro.

The EUR's focus will be on Germany this week, where the spending plans are expected to be passed.

Over the weekend, the CDU/CSU, which won the recently held elections, and the SPD detailed plans for boosting growth.

"If implemented, the envisaged reforms coupled with more public spending will likely strengthen the German economy noticeably," says Holger Schmieding, economist at Berenberg Bank.

Berenberg thinks the plans will boost German economic growth from 1.2% for 2026 and 1.0% for 2027 to 1.4% for both years. German inflation is forecast to rise to 2.4% in 2026 and 2.5% in 2027 after 2.3% this year.

Tariffs have backfired for the Dollar. Image: Trump and Commerce Secretary Howard Lutnick in the White House.

The Dollar has meanwhile played an equally important part in the Euro-Dollar's rally, with broad-based weakness accelerating following last Tuesday's decision by the U.S. to pursue tariffs on Canada, Mexico and China.

The tariffs themselves are textbook positive for the Dollar as they are inflationary, but markets are now more concerned that the tariffs, alongside erratic policy making, likely to be significant headwinds to U.S. growth.

Given this, the market has raised bets for the number of Federal Reserve rate cuts to come in 2025 to three, whereas just one cut was 'priced in' in early February.

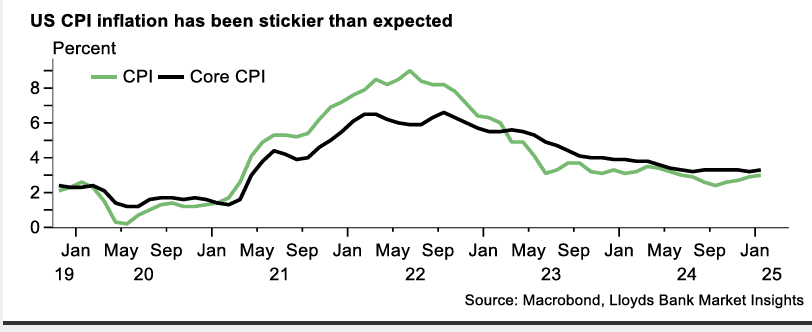

If this week's U.S. inflation report (Wednesday) undershoots expectations, these bets will rise further, weighing on the U.S. Dollar.

However, "we also believe that many negatives are in the price of the USD by now given that the markets are already pricing in three Fed cuts in 2025," says Marinov.

Therefore, a significant surprise in the inflation numbers will be needed to materially undermine the USD.

Headline inflation is forecast to drop to 2.9% in February due to lower energy prices, partially offset by higher food prices. Core inflation is forecast to fall to 3.2%.

The potential for upside surprises is elevated, however. In January, both headline and core inflation increased compared to December. While some of this rise can be attributed to seasonal adjustment issues, persistent inflationary pressures also played a role.

Fears over looking tariffs and the general policy uncertainty surrounding Donald Trump also hint at upside surprises.