Euro-Dollar Eyes 1.09 on ECB Haste / Fed Caution Story

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro looks set to stay under pressure against the Dollar as the ECB gears up for another interest rate cut, while the Federal Reserve shows it will carefully consider future developments.

A haste vs. caution setup emerges when we compare the interest rate outlook for the European Central Bank (ECB) and Federal Reserve, with the former likely to cut interest rates again next week.

ECB Governing Council member Francois Villeroy de Galhau told Franceinfo that “a cut is very probable" next week and "furthermore it won’t be the last."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The ECB was happy to signal at the time of its September meeting that a quarterly pace to the rate cutting cycle was appropriate, meaning the next cut would have fallen in December.

But a surprisingly weak inflation print for September appears to have turned the table and the ramp-up in rate cut expectations has pulled the Euro to Dollar exchange rate (EUR/USD) back from the brink of fresh 2024 highs.

"EUR/USD is under downside pressure near its 100-day moving average at 1.0934," says Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman. "USD faces additional upside potential because there is greater room for an upward reassessment in U.S. interest rate expectations relative to other major economies."

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

By contrast, expectations for the pace and quantum of Federal Reserve rate cuts have undergone a sizeable correction in October, with markets no longer seeing the likelihood of another 50 basis point rate cut.

"The hawkish repricing of Fed rate cut expectations has weighed on EUR/USD and helped to drag it back below support at the 1.1000-level this week," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

Hardman points out the Federal Reserve's stance "stands in contrast to market expectations for the ECB to speed up the pace of rate cuts at next week’s policy meeting."

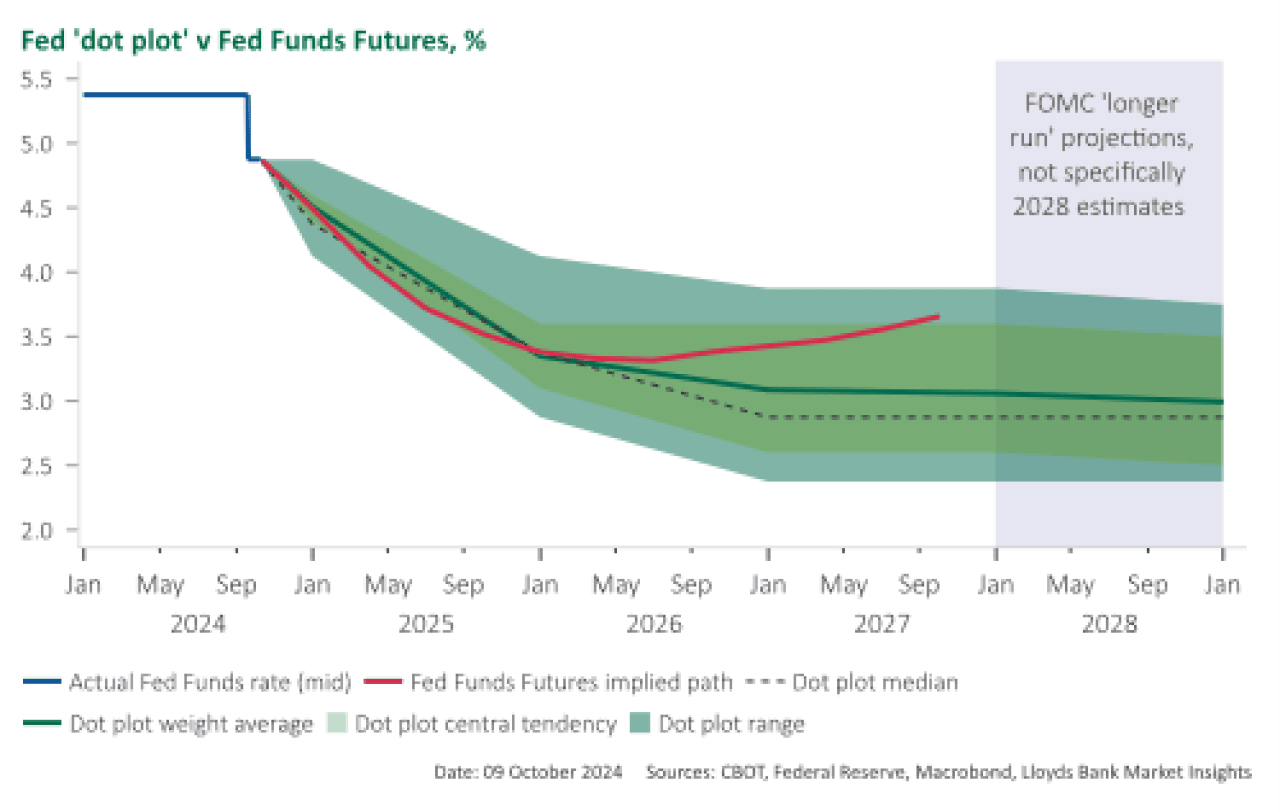

Above: Markets are aligned with the Fed's thinking. Image courtesy of Lloyds Bank.

The Federal Reserve cut interest rates by a blockbuster 50 basis points in September, but the minutes covering that decision revealed that the move was not unanimously supported.

Minutes showed "some" members of the policy-setting committee (the FOMC) were in favour of a 25bp cut, and a "few others" could have backed a smaller move.

This suggests the timing and scale of future cuts will be contested by a lively FOMC, drawing a line under expectations that the Fed was on autopilot to an interest rate level that could be considered as neutral for the economy.

"The FOMC September meeting minutes suggest the threshold for another 50 bp rate cut is high," says Haddad.

"The minutes have reinforced the perception amongst market participants that the Fed will be more cautious over the scale of further rate cuts in line with their plans to deliver smaller 25bps cuts at the upcoming policy meetings," says Hardman.

U.S. bond yields have risen throughout October as investors take stock of data showing the U.S. economy is starting to outperform expectations again, which naturally supports the Dollar.

Evidence that the Fed is alert to this and will respond if need be further bolsters this trade.

"For the Fed to deliver further larger 50bps rate cuts, it will require evidence of a sharper slowdown in the U.S. labour market which was not evident in the latest nonfarm payrolls report," says Hardman.

The Fed delivered the first cut since March 2020 as it cut the Fed funds rate by 50bp to 4.75%-5% and projected a total of 100bps of easing by year-end (50bp after the cut).

Market pricing shows investors are now on board with this, seeing approximately 40bps of cuts over the remainder of the year.

To be sure, this suggests the market might have overcorrected to an extent as this implies the market is no longer fully priced for two more cuts.

If pricing settles around current levels the Dollar's rally might fade.

That said, the U.S. election is now less than one month out, and the outcome is a 50-50 coin toss, which makes for potential volatility in FX markets.

Uncertainty linked to the election would create the febrile backdrop that tends to support the Dollar, so we see limited odds of a meaninful rebound in GBP/USD and EUR/USD.