Euro-Dollar Under Pressure: ECB Eyes French Risk Ahead of Sunday's Vote

- Written by: Gary Howes

File image of Marine Le Pen. Source, Marine Le Pen Officiel.

The Euro is losing ground again with analysts saying the upcoming French vote will sharpen investors' minds and members of the European Central Bank start to express an interest in the risks posed by the outcome.

The first round of voting in the French legislative elections takes place on Sunday, and the National Rally (RN) looks set to secure the most votes.

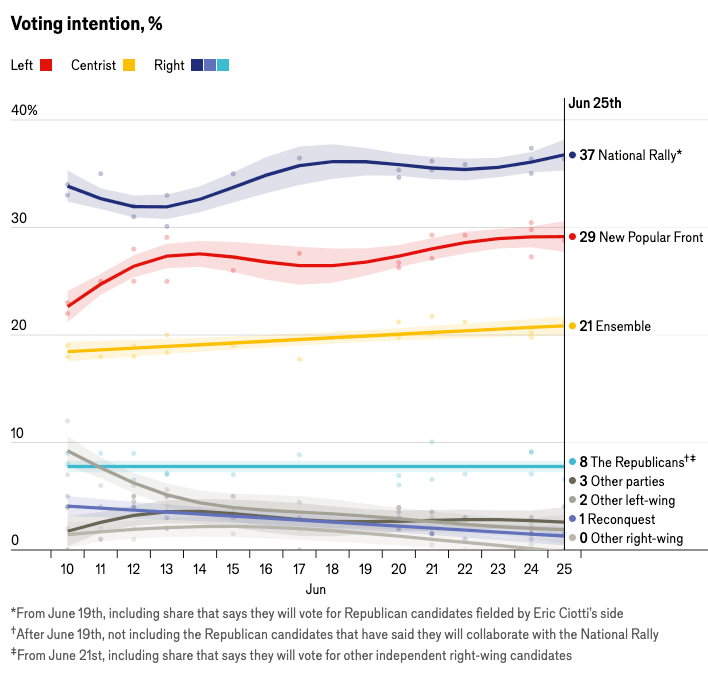

The Economist's poll tracker shows the RN leading, with 37% of the vote, ahead of the left-wing alliance of the New Popular Front (29%) and Emmanuel Macron's Ensemble (21%).

"EUR/USD traded in a narrow range around 1.0710. The spread between the French and German 10‑year government bond yields has narrowed slightly over the past two days, though remains historically elevated at 76bp. Political uncertainty in France will continue to keep a lid on EUR in our view," says Carol Kong, an analyst at Commonwealth Bank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

A poll of polls by Bloomberg published yesterday sees a widening of Marine Le Pen National Rally’s lead to over 35%, with the New Popular Front alliance stable at 28%.

Euro exchange rates will likely stay under pressure if investors sense policymakers at the European Central Bank (ECB) could react to developments in France in the coming weeks.

"The ECB may be getting more concerned about France," says Dr. Win Thin, Global Head of Markets Strategy at Brown Brothers Harriman. Suppose the ECB becomes concerned about potential risks posed by the rising cost of French debt, even if limited. In that case, they might adopt a more 'dovish' stance on monetary policy (i.e. be more inclined to cut interest rates).

Thin cites ECB Governing Council member Fabio Panetta, who warned, "political turnover physiologically translates into policy uncertainty: households and investors need to form a view on how incoming governments will handle many critical economic and political decisions. It can trigger capital outflows and currency depreciations, creating upward price pressures. But it could also shake confidence and weaken demand, halting or even reversing the fragile recovery we have seen so far."

Above: The Economist's poll tracker

Panetta added that "Central banks should be prepared to deal with the consequences of such shocks if and when they materialise. This implies a readiness to use the full range of tools at their disposal to adjust the monetary stance, addressing any threats to price stability, and protect the transmission mechanism of monetary policy."

The Euro fell sharply when the vote was unexpectedly called by Emmanuel Macron, but it has recovered some of those losses.

Analysts say this could be because the RN has sought to reassure voters that it won't do anything drastic enough to cause a fully-fledged bond crisis. Former UK Prime Minister Liz Truss's experience serves as an example of how markets can baulk at any attempts to increase spending or cut taxes without a credible plan to fund the moves.

"I'm respectful of institutions, and I'm not calling for institutional chaos," Le Pen said in an interview. "There will simply be cohabitation." RN's attempts to placate markets appear to have worked, at least to the extent the selloff has stabilised.

However, analysts are wary of further weakness in the Euro heading into Sunday's vote. "We see French election defensive positioning favouring a lower EUR/USD," says Francesco Pesole, a currency strategist at ING Bank.

Only a candidate who secures over 50% of the vote is elected during Sunday's election. Contenders who secure the support of at least 12.5% of registered voters go through to the final round on July 7th.

The bigger risk for the Euro would be the left-wing New Popular Front pulls ahead when voters go to the polls for the second time, as their spending plans are significant and would require a sizeable increase in borrowing, something bond markets might not be able to handle.

The NFP is a coalition of left-wing parties that includes Jean-Luc Mélenchon’s France Unbowed, the Socialist Party, the French Communist Party and the Greens. It plans to raise the monthly minimum wage to €1,600, impose price ceilings on essential foods, electricity, gas and petrol, repeal Macron’s deeply unpopular decision to raise the retirement age to 64 and invest massively in the green transition and public services.

Prime Minister Gabriel Attal said their agenda would present France with a "fiscal drubbing".

"It seems like the risk of a left-wing majority is seen as a tail risk for now," says Evelyne Gomez-Liechti, Rates Strategist at Mizuho.

When Macron called for a new vote, French bonds were sold, and the yield they offered investors shot higher, outstripping rises in comparative German bonds. This widening of the French-German spread is a classic signal that investors are attaching risk to France and will be a key guide to sentiment when markets open on Monday morning.