EUR/USD: French Risks "Really Starting to Weigh Heavily"

- Written by: Gary Howes

-

File image of Emmanuel Macron, Copyright: European Union.

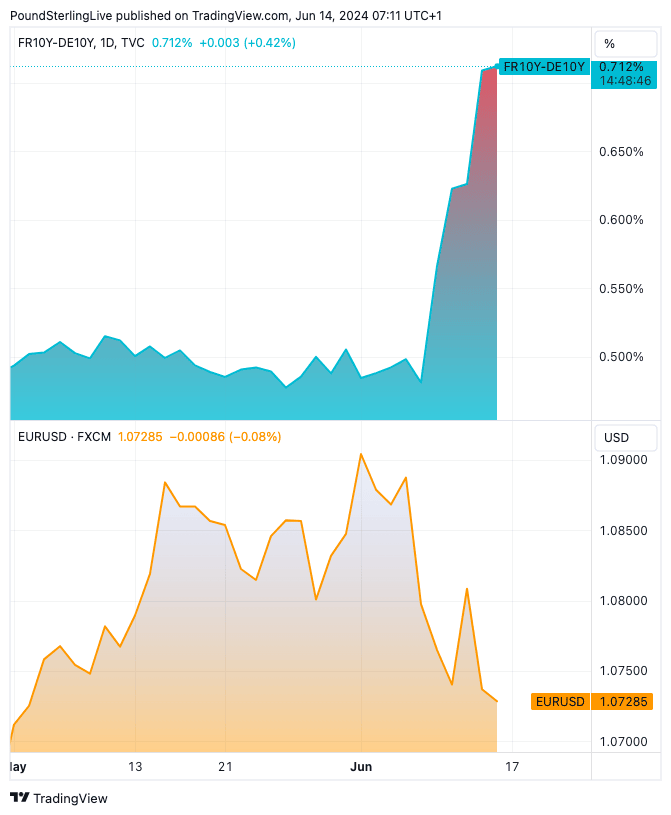

"The French:German 10-year sovereign spread briefly pushed beyond 70bp yesterday... That's bad," says Chris Turner, head of FX research at ING Bank.

The observation helps explain why the Euro to Dollar exchange rate has fallen to its lowest level since May, and why the Euro is falling more broadly.

"French political risk is really starting to weigh heavily on European FX and debt markets," says Turner, who expects the exchange rate to decline to 1.06 at some point next week.

Track EUR/USD with your own alerts, find out more here.

The above chart shows the spread between French and German ten-year bond yields has shot higher as investors sell French bonds in response to fears about the country's debt trajectory in the face of political uncertainty.

The chart shows that as the spread rises, Euro-Dollar comes under pressure, confirming a link between the currency and political anxieties.

The Euro's latest leg lower follows a Thursday poll showing the National Rally (RN) was gaining momentum in France. This raises fears for France's debt outlook, while an unexpected coalition of leftwing parties threatens to pressure President Emmanuel Macron further.

Euro-Dollar is at 1.0702 at the time of writing, its lowest level since May 02.

RN is on course to increase its parliamentary seats from 88 at present to 220 to 270 seats in the National Assembly, a survey by Elabe for the news channel BFMTV showed.

Such an outcome would ensure Jordan Bardella, the 28-year-old leader of RN, serves as Prime Minister, meaning France's President and Prime Minister will come from two separate parties.

RN is an anti-EU integrationist party, raising concerns about France's debt outlook and the broader integrity of the single European currency.

But trouble for French President Emmanuel Macron is also coming from the left, where a number of parties have agreed to form a coalition, which gives them a shot at winning a majority.

The left might be more pro-EU, but their spending plans risk blowing up France's already significant budget overshoot.

"It looks like the euro is taking another leg lower in early Europe today on news that the French parties of the Left are getting their act together to form a coalition and only run one candidate per district between them. This rare cooperation of the Left stands to suck support from President Macron's party further," says Turner.

Regarding the outlook for Euro-Dollar, Turner says to watch incoming polls, with a number expected to be released over the weekend.

"EUR/USD looks like it could press support at 1.0700/0720 today and could well make a run at 1.0600 next week," he adds.