Two-week Lows for EUR/USD Exchange Rate

- Written by: Gary Howes

Image © Adobe Images

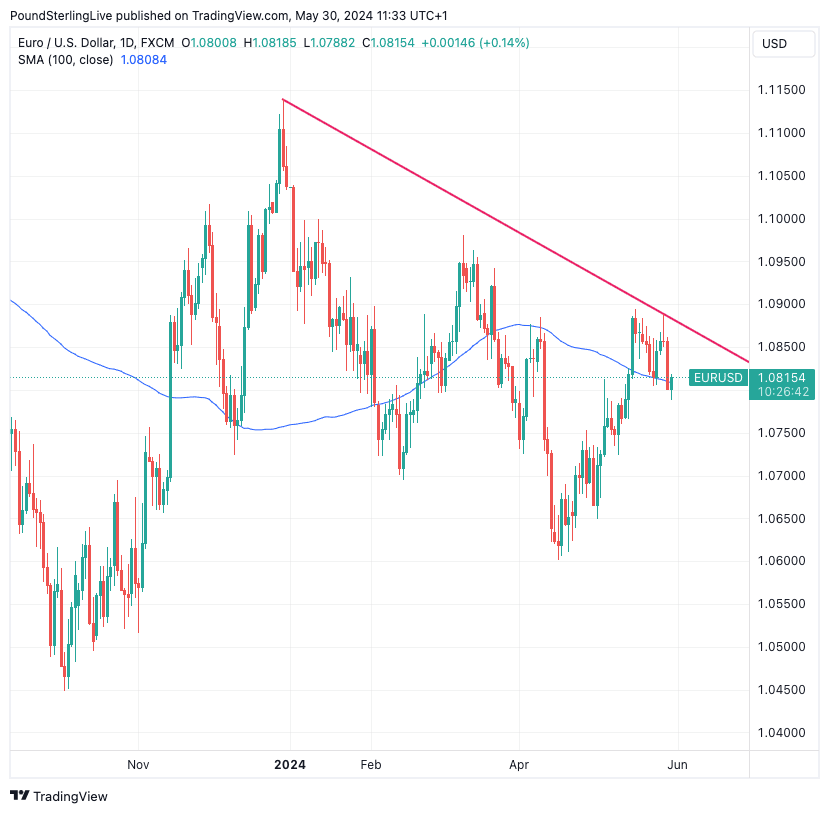

The Euro has fallen to a two-week low against the Dollar and will probably not revisit its Q2 2024 highs.

Analyst Shahab Jalinoos at UBS says he prefers to "sell EUR/USD towards the 1.0950 level we have seen as a high point for Q2".

The UBS analyst is targetting a retreat in Euro-Dollar back to 1.0500.

The call comes after the Euro to Dollar exchange rate fell to a two-week low at 1.0788 amidst a wider rally in the Dollar. The peak for the second quarter is at 1.0894, just shy of the psychologically significant 1.09 target.

"The U.S. dollar is gaining against its main counterparts with the euro/dollar pair dropping to a 2-week low. The catalyst for this move appears to be the bond market as the 10-year US Treasury yield is hovering above 4.6% for the first time since early May," says Achilleas Georgolopoulos, Investment Analyst at XM.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Rising U.S. bond yields push up the cost of finance not just in the U.S. but globally, constraining the growth outlook and causing a rerating in stock valuations. It also boosts demand for the Dollar as investors sell equity holdings and seek higher returns offered by U.S. bonds.

"This yield move was triggered by a series of weak bond auctions, but the main reason appears to be the Fed’s inability and unwillingness to turn dovish at this current juncture, as made evident by the recent Fedspeak," says Georgolopoulos.

Above: EUR/USD at daily intervals. Track EUR/USD with your own custom rate alerts. Set Up Here

The odds of a rate cut from the Federal Reserve by November stand at 50/50, having been higher just last week. Ongoing economic resilience suggests inflation won't fall enough to warrant a rate cut in the near-term, which can limit Euro-Dollar upside, particularly given the European Central Bank will cut interest rates next month.

"EUR/USD could subsequently struggle to establish itself above 1.09 in the near term, which could then pave the way for a retracement to our long-held forecasts of 1.07 for the end of June," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Downside risks for the Euro would involve the ECB indicating that it is willing to cut interest rates again in July. This is not the market's base-case expectation, but some members of the ECB's Governing Council argue that such a move would be appropriate.

"The only question that remains is whether the ECB should follow up with a back-to-back rate cut on 18 July or wait until it can mull over new quarterly projections for growth and inflation on 12 September. This will also depend on the incoming data of the coming weeks," says Felix Schmidt, an economist at Berenberg Bank.

Schmidt says Eurozone inflation is currently moving sideways while wage pressures remain elevated. Berenberg expects the ECB will opt for the calmer approach and cut rates only once rather than twice a quarter to bring the deposit rate from 4%.

If the ECB adopts this approach, it will limit the divergence in central bank policy and limit Euro weakness. But a hastier pace of rate cuts would put Euro-Dollar on course for a retest of this year's lows or even further.