Euro-Dollar Heads for Rare Weekly Decline

- Written by: Sam Coventry

Image © Adobe Images

The Euro to Dollar exchange rate looks set to print its first weekly decline in six weeks as a resurgent USD snaps the advance.

The Dollar index - a weighted measure of a basket of Dollar exchange rates - looks set to record a weekly advance thanks to fading hopes for near-term interest rate cuts amidst ongoing U.S. economic data resilience.

"It's been a bad week for investors hoping to see a near-term rate cut by the Fed as expectations have been pushed out further towards the end of the year," says Raffi Boyadjian, Lead Investment Analyst at XM.com.

She says the hawkish commentary by Fed officials on Tuesday was underscored by the FOMC minutes on Wednesday and Thursday brought better-than-expected flash PMIs that pointed to a pickup in both business activity and prices in May.

"The composite PMI, covering both manufacturing and services, was the strongest in two years. The most worrying aspect of the S&P Global survey was the acceleration in input and output costs, with only employment registering some weakness," says Boyadjian.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The PMI data strengthens the case for 'higher for longer' stance from the U.S. Federal Reserve, which was reflected in a pullback in U.S. stock markets amisdt investor caution, which naturally supports the 'safe haven' USD.

"Markets are pricing less than two rate cuts by the Fed this year, with a 50% probability of a pivot to easing occurring in September," says George Vessey, Lead FX Strategist at Convera.

Euro-Dollar is down a third of a per cent this week but still holds the 1.08 level, which will bolster assumptions that the recent pullback is a contained counter-recovery setback.

Boyadjian notes the euro found support from a surprise rise in negotiated wage growth in nine Eurozone countries. Although the Q1 data – watched closely by the ECB – was impacted by one-off bonuses in Germany, ECB policymakers may now be wary of signalling more cuts after June.

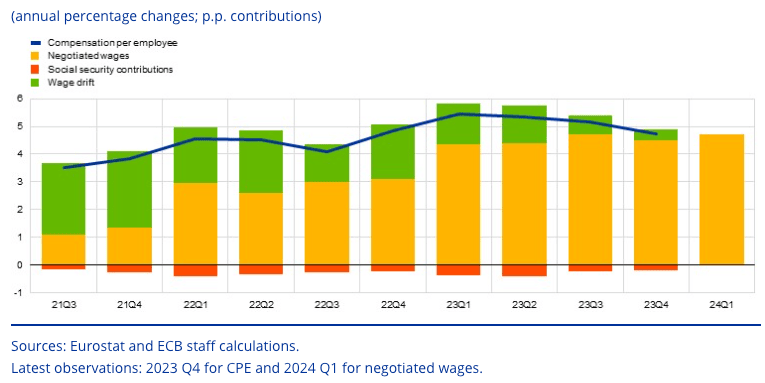

Above: Decomposition of compensation per employee (CPE) growth in the euro area.

Data from the ECB saw an increase in negotiated wage growth in the first quarter of 2024 to 4.7% – after it slightly moderated from 4.7% in the third quarter of 2023 to 4.5% in the fourth quarter of 2023

"This signals that negotiated wage growth has remained elevated in the euro area," says Sarah Holton, an economist at the ECB. "Wage growth is expected to remain elevated in 2024."

The ECB is expected to cut interest rates in June, but this has long been priced into the Euro and is, therefore, of little consequence to price action.

What will matter going forward is the evolution of expectations for subsequent interest rate cuts.

The odds of a follow-on rate cut in July will have retreated following these wage data developments that were released on the day Eurozone PMIs showed continued economic expansion in May.

Euro-Dollar can stay supported should the ECB caution against expecting a rapid rate cutting cycle next .