Euro-Dollar Can Still Hold The Range Say Analysts, Despite ECB Rate Cut Signal

- Written by: Gary Howes

Image © European Central Bank

The Euro was not dealt a killer blow by the European Central Bank (ECB) as it created enough uncertainty regarding the interest rate path beyond June to support the currency.

The Euro to Dollar exchange rate (EUR/USD) has retreated to the lower end of the 2024 range at 1.07, but the decline could be more of a hangover to the midweek U.S. inflation surprise than negatives associated with the ECB.

The central bank pointed to a potential rate cut in June but did not sound like it was eager to let the market assume further rate cuts beyond here were 'in the bag', which ultimately offers the single currency downside protection.

"Market priced in 20bp of rate cuts by the June meeting. Thursday afternoon, 20bp is still priced in, i.e. near-term market pricing is virtually unchanged," says Ingvild Borgen, a strategist at DNB Markets. "This underscores that the changes in communication from the ECB and Lagarde were more or less exactly as expected."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The midweek U.S. inflation surprise has prompted caution across global markets, with rate cut bets fading for most developed market central banks. After all, if inflation surprises in the U.S., who says it won't elsewhere?

ECB President Lagarde addressed this fear and cautioned that the U.S. inflation picture was very different to that of the Eurozone and she remains confident the disinflation process will continue.

"The ECB is still on track to cut its policy rate at the June meeting.... This is in contrast with the Fed, which may be forced to change its monetary policy outlook decision due to continued strength in US economic data," says a note from Nomura.

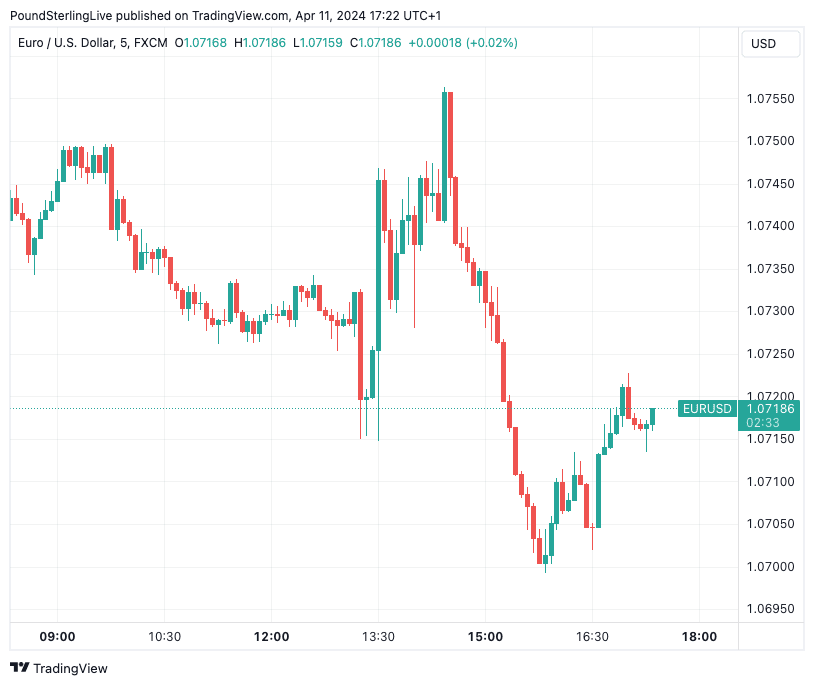

Above: EUR/USD at five-minute intervals showing the post-ECB fall and recovery. Track EUR/USD with your own custom rate alerts. Set Up Here

"This divergence in monetary policy pricing between the Fed and ECB has further widened the 2yr nominal yield differential (Germany-US), and the yield differential implies EUR/USD should be around 1.05," it adds.

However, Nomura notes Euro-Dollar is proving resilient and has not fallen significantly below the key level of 1.07 for some time.

The market has significantly lowered expectations for a June rate cut at the Fed and now sees between and one to two cuts for the entire year. This would suggest a significant divergence in interest rate expectations that should weigh on the Euro.

But Nomura says the Euro's resilience must be respected:

"Amid the uncertainty about the policy outlook, the range trading in EUR/USD is likely to continue, and a one-sided move in the currency is unlikely to occur anytime soon. We think the direction of EUR/USD will be more clearly determined when the ECB clarifies its rate cut path after its first cut, i.e. whether the ECB will deliver consecutive cuts from its first cut."

Although the Euro has proven relatively resilient in the immediate aftermath of the ECB decision, further losses can still be expected, warn other analysts.

"The EUR-USD exchange rate did not suffer from the ECB's communication. However, it should come as no surprise if the market's second thinking is different and the euro ultimately suffers," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank. "The ECB communication indirectly had negative aspects for the EUR."

Leuchtmann explains that Lagarde gave the impression at the press conference that a number of Council members were already scurrying around and would have preferred to cut the ECB's key interest rates yesterday. "It wants to cut as early as possible."

"Markets appear to be underestimating the prospect of a June move, with only 16bps of cuts currently priced in, i.e. only a 66% probability of a 25bp cut, despite the ECB rhetoric – much the same as the level just before the ECB announcement," says Ryan Djajasaputra, an analyst at Investec.

The Euro would likely be lower if the market had moved to fully 'price in' a June rate cut and added to expectations for the remainder of the year.

This can yet happen.