EUR/USD Rate Drops 0.90% After U.S. Inflation Print Leaves ECB High and Dry in June

- Written by: Gary Howes

Image © Adobe Images

Rising U.S. inflation means the European Central Bank will cut interest rates ahead of the U.S. Federal Reserve, creating a policy divergence that will potentially weigh on the Euro to Dollar exchange rate.

The Dollar rose sharply across the board after U.S. inflation printed at 0.4% month-on-month in March, taking the annual change to 3.5%, up from 3.2% in February. The core, 'super core' and services components all showed upside pressures to domestic inflation were building and not falling, as the Fed was hoping would be the case at this point in time.

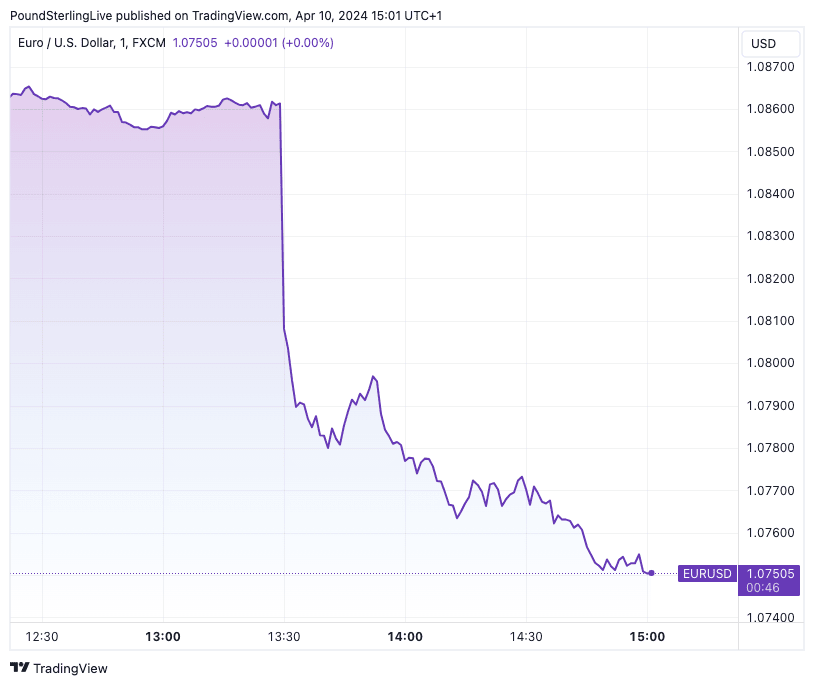

The Euro to Dollar exchange rate dipped 0.90% to 1.0773 in the 45-minute window following the release as markets lowered the odds of an interest rate cut at the Fed being delivered at the June policy meeting.

In fact, the odds of a July rate cut have also fallen, with September now emerging as the most likely start date.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Futures markets show investors are now pricing in around 45 basis points of cuts through year-end, whereas the figure stood at approximately 70bp just one day ago.

“This aggressive repricing in US interest rates has provided solid support for the dollar, which we think appears well placed to post further advances against its peers in the near-term," says Matthew Ryan, Head of Market Strategy at Ebury.

Core inflation, which excludes volatile energy and food prices and is thus decisive for the underlying trend, has amounted to 0.4% in each of the last three months, making for an annualised rate of 4.5%. This is well above the levels the Federal Reserve can tolerate.

Above: EUR/USD in the two hours following the U.S. inflation release. Track EUR/USD with your own custom rate alerts. Set Up Here

"It is now very hard to also discount the risk that firm demand in the economy is keeping services prices elevated with solid consumer spending and a jobs market that just keeps on giving. That will keep the Fed on hold until the dust settles," says Ali Jaffery, an economist at CIBC Bank.

These inflation data come on the eve of the European Central Bank (ECB) policy decision, where interest rates are expected to remain unchanged and new guidance will be issued that points to a June rate cut.

The ECB has been condoning market bets for a June start date for some time now, observing that the same market pricing showed the Fed would also cut rates at this time.

"For the ECB, the question is whether the central bank will follow its propagated data-dependent approach or whether it favours a 'Fed-dependent' monetary strategy. 'Fed-dependent' means that the ECB prefers a risk-control strategy by acting together with the Fed," explains David Kohl, an economist at Julius Baer.

The prospect of the two central banks moving in tandem has underpinned Euro-Dollar valuations for a number of months now, ensuring a steady sideways trend in the exchange rate.

This stability will be questioned if the Fed and ECB diverge, with the Euro likely to come under pressure if the ECB moves to cut rates sooner, and faster.

"There are very few convincing reasons why the European Central Bank could not cut interest rates immediately, as lower inflation continues to drive real rates higher. The US Federal Reserve has much less urgency to cut rates given the strong growth backdrop," says Kohl.

Inflation in the Eurozone is meanwhile clearly on a trend back to the 2.0% target while lending remains supressed, leaving the ECB with dwindling excuses to remain policy rates at restrictive levels.