Euro-Dollar Under Pressure: German Situation is "Ugly – and Could Get Worse"

- Written by: Gary Howes

Image © Adobe Stock

Euro exchange rates were under pressure after the release of some "ugly" German economic data and economists warn the situation is unlikely to improve soon.

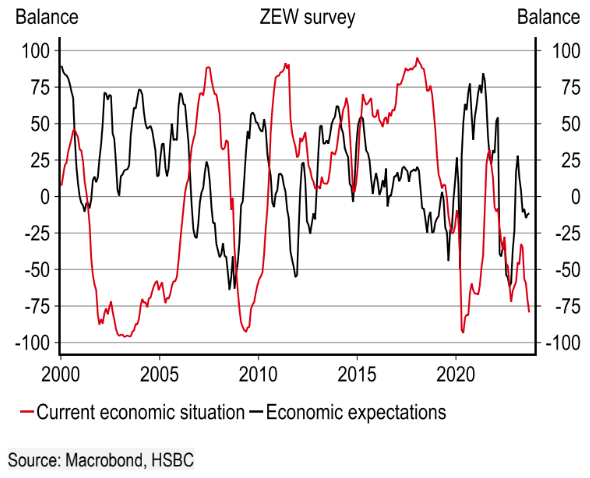

The German ZEW survey reported its current assessment plunged to its lowest level since August 2020.

The survey of financial experts revealed a net -79.4 sentiment for the current conditions, which was far worse than the -75.0 the market was expecting.

"September ZEW is another stark reminder that all is not good in the German economy," says Stefan Schilbe, Chief Economist for Germany at HSBC, who described the data as "ugly" before warning "it could get worse".

The Euro to Dollar exchange rate fell to 1.0712 in the wake of the release; losses that did also have a rebounding Dollar to thank.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

There was one bright spot as the expectations component of the survey gained 0.9pts to -11.4pts which is the second increase in a row.

"While one could argue that at least expectations improved and beat consensus forecasts, the rise was only minimal. In fact, the two monthly (August and September) increases only erased roughly half of the July drop," says Schilbe.

"Even more worryingly, expectations are still negative on balance, highlighting that a further deterioration is anticipated from the already extremely bleak current condition of the economy. Hence, market participants seem to remain sceptical that the government's 10-point plan is enough to improve the economy," he adds.

Above: "ZEW expectations gained a bit, but the assessment worsened rapidly" - HSBC.

The Euro has been under pressure through the course of August and September as investors brace for an economic slowdown and an end to the European Central Bank's (ECB) hiking cycle.

The ECB could surprise markets by hiking interest rates on Thursday - after all, inflation remains well above target - but most economists think that it would be the final such move as the economic slowdown will become too notable to ignore.

"Downside risks to growth are increasing or even materialising, now spreading into the services sector," says Antonio Villarroya, Head of G10 Macro & Fixed Income Strategy Research at Santander CIB.

Villarroya expects short-term Eurozone bond yields to come down in the wake of the ECB decision, a development that would offer a mechanical drag on the Euro.

"The end of the tightening cycle is near: even if the ECB opts to hike again (which continues to be our baseline scenario for the time being), room for the market to overreact to such a move in the form of overpricing rate hikes from here – similar to the kind of movement we saw after the July hike - would be much more limited now if it were to happen again," he explains.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes