Buy Euro-Dollar says Nomura

- Written by: Gary Howes

Image © European Commission Audiovisual Services

The Euro is set to extend a rally against the Dollar through the second half of this year says a new strategy note from investment bank Nomura which argues the worst might have already passed for the Eurozone economic data pulse.

Initiating a buy on the EURUSD, strategist Jordan Rochester says Eurozone data "rarely gets worse than this."

"We already know European data is poor. Data surprises are in the dumps so markets will be less reactive after that PMI surprise last week. Whether we like to admit it or not, part of FX’s mean reversion is driven by data surprises typically turning around when at the extremes," he explains.

The Eurozone economy is in recession according to official data and the most recent set of more timely economic surveys suggests the impulse continues to deteriorate with S&P Global's PMIs for June suggesting the economy contracted.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The Euro to Dollar exchange rate (EURUSD) fell on the same day that data was released, but is back above 1.09 at the time of writing, suggesting little appetite in the market to press the pair lower.

"If I was pushing short EURUSD I'd be worried about this mean reverting nature of data surprises (due a rebound)," says Rochester.

There are other factors to consider when approaching EURUSD, including the Federal Reserve, where Rochester reckons the appetite for further rate hikes is diminishing. "With the Fed introducing the “skip” and inflation in the US coming down convincingly, do you want to bet on a hawkish Fed (weaker EURUSD?)," he queries.

The strategist reckons the second half of 2023 will see the market firming its conviction that the Fed will begin cutting interest rates in 2024 in a development that can assist the Euro higher.

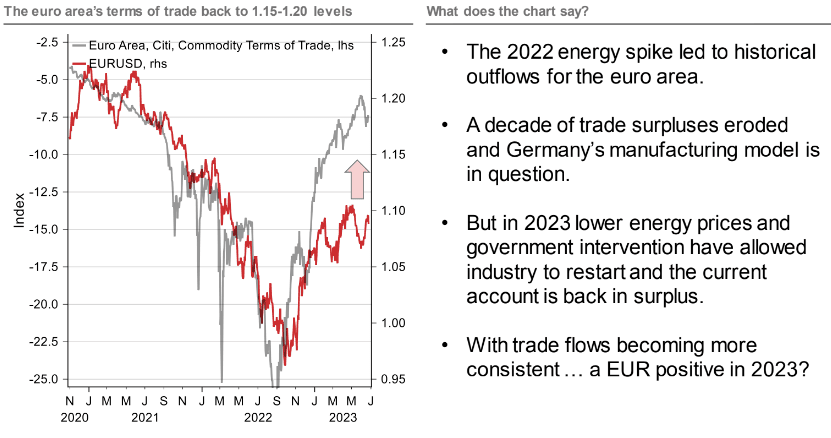

Image courtesy of Nomura.

The Eurozone's terms of trade dynamics are meanwhile much improved when compared to a year ago and this can be expected to offer further support to the single currency. "Euro's terms of trade might be the balancing factor - it would point to 1.15 towards 1.20: Natural gas prices remaining relatively constrained, oil too = Euro area trade flows in a much healthier place. Perhaps offsetting the rates story?" says Rochester.

Nomura's strategy team is long EURUSD and targets a move to 1.12 by end-August, with 1.16 next year likely and holding a conviction level of 3/5 for the trade.

"We maintain the view that it won’t take long for the recent EUR/USD whipsaw to end and that the situation for EUR in 2023 is almost opposite that of 2021. Energy prices are likely to stay low or fall, thanks to the global economy slowdown, supporting the euro area’s terms of trade," says Rochester.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes