Too Early to fade Euro Downside say Strategists

- Written by: James Skinner

- EUR/USD seen below 1.11 & approaching 1.10

- After Fed rolls sleeves over inflation & lifts USD

- Fed Chair suggests four or more hikes in 2022

- ECB’s caution, patience seen weighing on EUR

Image © Adobe Images

The Euro to Dollar rate could edge lower still over the coming weeks, according to a range of analysts who cite the latest policy update from the Federal Reserve (Fed) for targeting a major support level located around 1.1002.

Europe’s single currency was approaching the round number of 1.11 on the interbank market Friday after giving up the 1.12 handle in the prior session when the U.S. Dollar was lifted across the board as the market responded to the latest monetary policy decision from the Fed.

"Whereas the FOMC is in a hurry to get ahead of the curve, the Governing Council seems to be comfortable remaining well behind the curve. As a result, the EUR-USD rate spread has slipped to new lows after the January Fed meeting and ahead of next week’s ECB meeting," says Valentin Marinov, head of FX strategy at Credit Agricole CIB, who described the single currency as “an attractive short” on Friday.

While the Fed’s official statement merely noted on Wednesday that it could be necessary for interest rates to rise in the near future, Chairman Jerome Powell suggested strongly in the subsequent press conference that liftoff could be announced at the next meeting in March.

Chairman Powell also provided a strong indication that U.S. rates could rise further after that, and faster than they did in the period following on from December 2015, which was when the bank lifted rates for the first time in its previous monetary tightening cycle.

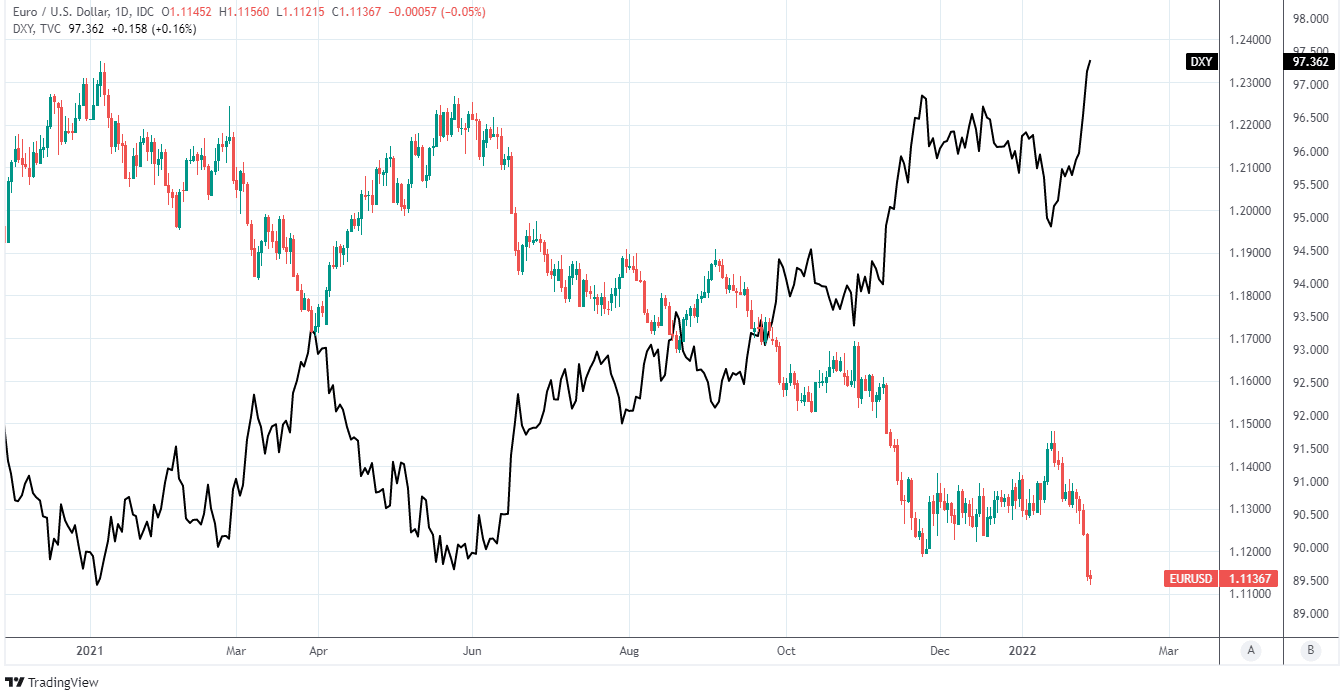

Above: Euro-Dollar rate shown at daily intervals with U.S. Dollar Index.

- EUR/USD reference rates at publication:

Spot: 1.1128 - High street bank rates (indicative band): 1.0739-1.0816

- Payment specialist rates (indicative band): 1.1030-1.1072

- Find out more about market-beating rates and service, here

- Set up an exchange rate alert, here

The Fed had waited a full year after December 2015 before lifting its interest rate for a second a time, from which point it proceeded to raise rates roughly once per quarter until the top of the target range for the U.S. Federal Funds rate reached 2.5% in December 2018.

But with the economy and labour market stronger than they were in 2015 - and U.S. inflation sitting at 7% as of December 2021 - Chairman Powell appeared to suggest this week that the Fed could get straight to raising rates each quarter and said nothing to rule out the bank going faster than that.

“While we expect 4 hikes this year and [quantitative tightening] in Q2, we think FX markets should position for the optionality of doing more earlier in the tightening cycle. Until the Fed lands on how it will kick this off, USD resilience remains,” says Mazen Issa, a senior FX strategist at TD Securities.

"We think EURUSD will trade in a 1.10/12 trading range for the time being (in line with our forecast). We do see risk of slippage below that range as a US-led real rate upswing remains intact. It is too early to fade EUR downside, but that could come as soon as the middle of the year," Issa also said.

Overnight-index-swap market pricing already implied before Wednesday that investors were expecting the Fed to lift rates three times in 2022, although since then the implied probability of four rate steps has risen to more than 100% while the Dollar has risen almost across the board.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The U.S. currency could potentially rise further, however, in price action that would push EUR/USD lower still because investors and traders had significantly lightened their exposure to the greenback ahead of this week’s Fed decision.

“The aggregate USD long position that has accumulated in recent weeks was slashed by USD7bn through Tuesday. This is one of the largest 1– week drawdowns in long USD positioning since mid-2020 by our reckoning. The overall USD long position now stands at a little over USD13, the lowest bull bet on the USD since mid-September,” says Shaun Osborne, chief FX strategist at Scotiabank, in reference to the week ending January 18.

The Dollar is well placed to advance against the Euro in part because caution and patience has continued to prevail at the European Central Bank (ECB), which has insisted that Eurozone inflation is likely to recede sufficiently of its own accord so as not to merit an interest rate rise any time soon.

Like many other central banks, the ECB struggled for years to generate enough inflation to meet mandated targets before the coronavirus crisis and was also perceived to have lifted its interest rate too soon during the period after the Eurozone debt crisis.

The ECB’s Governing Council could be slower in responding to rising inflation pressures than other central banks precisely because of earlier difficulties generating inflation, and due to a likely reluctance to risk withdrawing its monetary policy support for the Eurozone too soon.

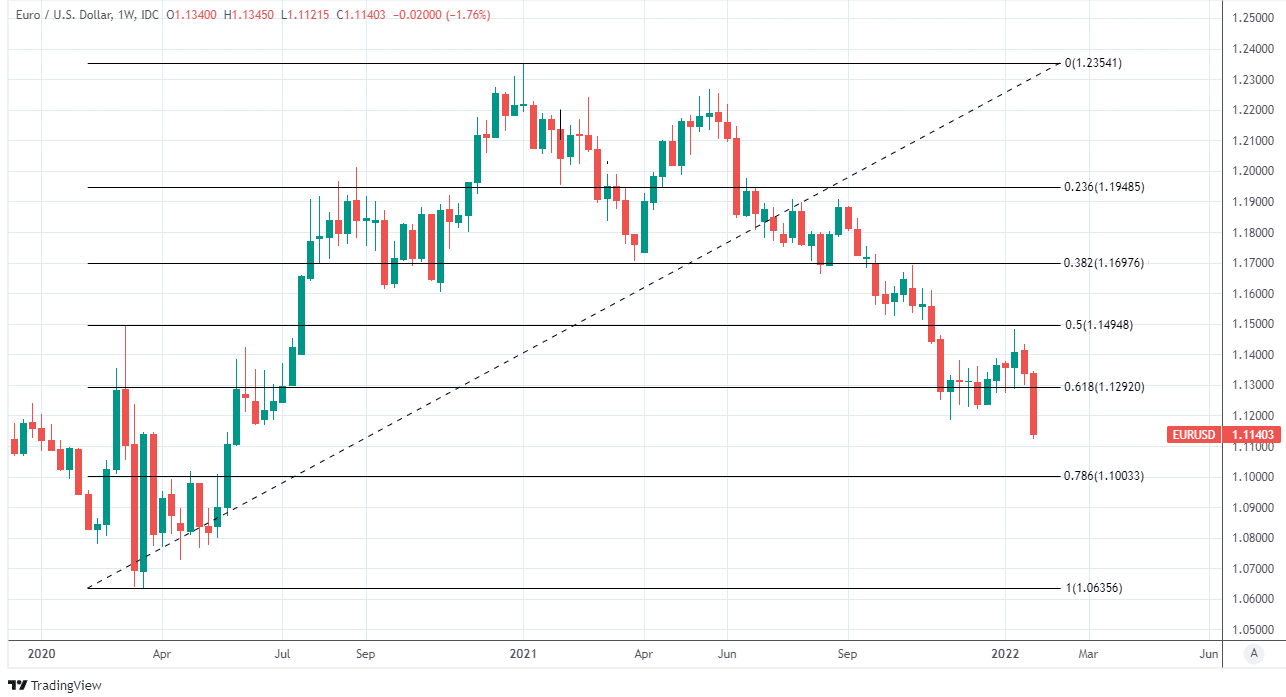

Above: Euro-Dollar rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating likely areas of technical support.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“EUR/USD has broken clear of support at 1.1180 and looks headed towards 1.10. Reading Carsten Brzeski's ECB preview suggests next week's ECB meeting will offer little interest rate support to the Euro,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

Expectations of divergence between the ECB and Federal Reserve have weighed heavily on the Euro-Dollar rate during at least the six months leading up to January 2022 and could be likely to burden the single currency further over the coming weeks.

Many analysts have suggested this burden could pull the Euro-Dollar rate down to 1.10 in the near future, although this threshold also coincides closely with a major level of technical support that could act to frustrate further declines in the single currency for a period at least.

“We maintain our view that the corrective phase is over and core downtrend resumed. We thus look for a retest of the lows of last November and June/July 2020 at 1.1186/68,” says David Sneddon, head of technical analysis trading strategy at Credit Suisse.

“We look for this support to now be ideally removed with ease with support then seen next at 1.1046 ahead of our 1.1019/02 main objective – the 78.6% retracement of the 2020/2021 bull trend and top of the base from April/May 2020. We would then look for a fresh phase of consolidation to develop from here,” Sneddon and colleagues wrote in a Thursday review of the Euro-Dollar rate’s charts.