Euro-to-Dollar Rate on Back Foot after PMI Collapse, Ahead of EU Meeting

- Written by: James Skinner

- EUR/USD on back foot after PMIs, ahead of EU Council meeting.

- Services PMIs hit all-time lows as 'lockdowns' cripple economies.

- Second half economic recovery no longer a foregone conclusion.

- EU leaders to decide on bloc's crisis response in 14;00 meeting.

Image © Adobe Stock

- EUR/USD spot at time of writing: 1.0790

- Bank transfer rates (indicative): 1.0410-1.0486

- FX specialist rates (indicative): 1.0626-1.0691 >> More information

The Euro-to-Dollar rate was on the back foot Thursday after IHS Markit PMI surveys painted a grim picture of April's Eurozone economy ahead of an EU leaders' meeting in which a crucial decision on the mutualised financing of a coronavirus recovery fund will be made.

European manufacturers saw business activity collapse back to financial crisis lows this month, IHS Markit surveys suggest, but it was the services sector where barometers of activity and output set fresh historic lows. All PMIs came in below expectations and may have aided the decline in the Euro-to-Dollar rate, which also comes ahead of an important 14:00 EU council meeting.

IHS Markit's PMI index for activity in the German services sector fell to 15.9 in April from 31.7 in March, setting a new all-time low in the process, while the services output index fell from 35 to 17.1. The manufacturing PMI also saw steep falls although these took the activity and output barometers only as far back as 2009 lows, with the activity index falling from 45.4 in March to 34.4 this month while the output index fell from 41 in March to 19.4 in April.

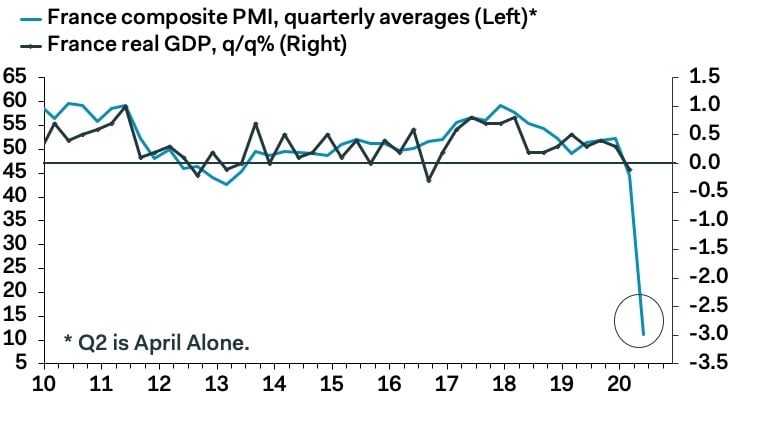

"These data are unimaginably grim, reflecting the severe hit to the French economy through the first part of Q2. The slump in the INSEE manufacturing gauge was driven by crashing expectations for production in the industry as a whole, as a well a steep slide in respondents’ outlook for their own business," says Claus Vistesen, chief Eurozone economist at Pantheon Macroeconomics. "The PMIs were, if anything even more horrible than the headline INSEE data."

Above: Pantheon Macroeconomics graph showing French PMI survey correlation with quarterly GDP growth.

Even more meaningful declines were seen in measures of French services and manufacturing activity when activity and output indices both fell to new record lows for both sectors. France has enforced a far more draconian 'lockdown' than Germany, which may have imposed a heavier price on the Eurozone's second largest economy. Survey respondents were also more pessimistic about the 12-month outlook than they've ever been in the survey's history.

German and French composite indices turned sharply lower this month, leading the decline in the broader Eurozone benchmark, which fell from 29.7 in March to 13.5. The Eurozone services PMI fell from 26.4 last month to 11.7 in April while the bloc's manufacturing PMI declined from 44.5 to 33.6.

"Any forecasts for H2 are extremely uncertain, but it now seems increasingly clear that governments will maintain restrictions in key sectors such as travel, entertainment and hospitality well into the third quarter," Vistesen says.

The data illustrate what analysts, economists and the market have increasingly come to expect ever since the coronavirus brought vast swathes of the continental economy to a standstill; a historic economic downturn that begins in the first quarter and builds quickly in the second. So far markets have assumed that a swift peak in outbreaks would lead to the lifting of 'lockdown' measures followed by a slow and steady return to normal, although this is far from certain given that many governments intend to continue with some form of 'social distancing' until year-end and because consumers may themselves remain in a risk-averse mood even after 'lockdowns' are lifted.

Above: Euro-to-Dollar rate shown at daily intervals.

"We are looking for signaling on the degree of solidarity more than the technical nature of whatever is agreed today," says John Hardy, head of FX strategy at Saxo Bank. "The stakes could not be bigger, and the market will not take kind to an obvious fudge, much less an Italy or a Spain walking out of the talks in a huff. The most positive scenario would be the EU lining up to support Spain’s creative solution."

The Euro slipped lower and fell below the 1.08 handle following the PMIs on Thursday although they were released ahead of a crucial European Council meeting in which the future unity, if not integrity of the bloc will be decided. Central and Northern European leaders will be asked again by 'periphery' countries on Thursday to put political and economic self-interests aside by helping to finance national coronavirus containment and recovery efforts in Southern Europe, where debt sustainability concerns are threatening responses to what are the continent's worst coronavirus outbreaks.

This has weighed on the Euro but it could weigh more heavily still if Thursday's 14:00 European Council meeting produces only more infighting and acrimony rather than the international cooperation the bloc's leaders so often advocate in favour of. The Euro had entered 2020 with the market looking for it to hit 1.15 by year-end but 1.05 is now a more common forecast for the single currency while some even see it falling as low as 1.02. Thursday's meeting will be key to just how low the Euro will go in the months ahead.

"If the leaders of the EU and Italy once again fail to counter the mounting anti-EU backlash in Italy, markets may still price in a higher risk that Italy may at some time in the future want leave the euro. The risk remains remote, in our view, but less so than before the serious dispute about the common response to the pandemic erupted in late March," warns Holger Schmieding, chief economist at Berenberg. "Chances are that EU leaders will not manage to defuse the conflict tonight. That could be a costly mistake. It is easier to impair than to repair trust. The longer the dispute rages, the bigger and the more generous would a future package have to be in order to achieve its political purpose."