Euro-to-Dollar Week Ahead Forecast: Lion's Share of Gains Complete

- Written by: Gary Howes

Photo by: Sanziana Perju / ECB.

The Euro's uptrend against the Dollar is losing steam.

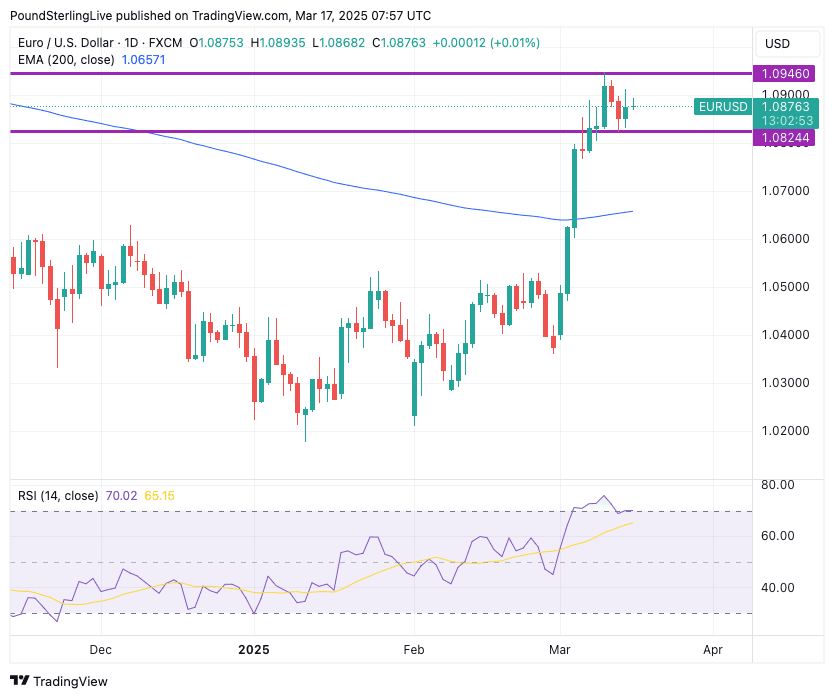

The Euro-to-Dollar exchange rate's 2025 recovery accelerated last week, rising to its highest level since November on Tuesday, when it hit 1.0946.

EUR/USD has broken above its 200-day moving average, shifting the exchange rate into an uptrend that advocates for a multi-week move higher.

However, it became overbought on short-term timeframes with a Relative Strength Index (RSI) level tabove 70. It has since pared some of those gains as overbought conditions unwind and is quoted at 1.0878 at the start of the new week.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

For now, the pullback looks to be a consolidation in an uptrend as opposed to the start of a more protracted pullback.

Dips are proving shallow, and the RSI is still pointed higher and advocating for more upside, even if it is still flirting with overbought conditions with a current reading of 70.

The upside target for the week ahead is a retest of the 2025 high at 1.0946.

Above: EURUSD at daily intervals.

Support looks to be building at 1.0824, with three tests of this level recorded last week, suggesting this is where dips are being bought into.

The overarching theme guiding price action in Euro-Dollar is the fading of the U.S. exceptionalism narrative that was so dominant in 2024, and this can continue.

U.S. economic growth has slowed amidst policy uncertainty coming from the White House, with the April 02 tariff announcements being judged as a key risk.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets judge that tariffs are unambiguously detrimental to the U.S. economic outlook, and the Dollar has struggled as Trump has pursued them.

At the same time, Euro exchange rates have been bolstered by the unexpected shift in policy in Germany towards more spending in order to rejuvenate the country's infrastructure and defence sector.

"The euro is benefiting from higher long-term yields and hopes for massive investment programmes. These could help to get the European (and especially the ailing German) economy back on track. After years of misery, this is finally a real glimmer of hope to stand up to the US dollar," says Birgit Henseler, an analyst at DZ Bank.

The Euro found strength on Friday after it was confirmed that the Green Party are on board with incoming Chancellor Friedrich Merz's plans to borrow more to spend on defence and infrastructure.

However, analysts warn of the potential for a more sober assessment of the outlook to emerge, which can weigh on the Euro.

Davide Oneglia, analyst at TS Lombard, says the recent experience of the €100bn special fund for the German army shows that permitting new projects is a lengthy process in Germany.

Currency analysts at Commerzbank warn the Euro could be set to fall "quite sharply" in the coming weeks as "euphoria" over Germany's spending plans are dealt a dose of reality.

Commerzbank economists do not expect Germany's planned stimulus to have an effect until next year at the earliest. They also warn that Germany has historically struggled to spend, even when the money is made available.

"This year, growth in the euro area could even be weaker if Trump follows through on his tariff announcements on EU imports in the near future. In short, we expect the EUR-USD exchange rate to fall quite sharply in the coming weeks," says Michael Pfister, FX Analyst at Commerzbank.

U.S. tariffs on the EU remain a risk and could tip an export-oriented economy like Germany’s back into recession. This is according to a recent warning from Joachim Nagel, who serves as the President of the Deutsche Bundesbank and is a member of the Governing Council of the European Central Bank.

While the charts suggest that the upside is preferred in the coming week, we think the lion's share of the rally is now complete, which is why the Week Ahead forecast is relatively contained.

To be sure, the potential for a pullback is growing, but we're not confident that this is the week for it to happen.

Euro Events to Watch This Week

Tuesday, March 18

📌 Germany ZEW Economic Sentiment (Mar)

Expected: 50.0

Previous: 26.0

🔹 Market Impact:

A higher reading suggests improved investor confidence, which could support EUR.

A weaker reading may indicate continued economic uncertainty, pressuring EUR.

📌 Germany ZEW Current Situation (Mar)

Expected: -80.5

Previous: -88.5

🔹 Market Impact:

A less negative print suggests stabilization in the German economy, which may support EUR.

A worse-than-expected figure would reinforce economic weakness, weighing on EUR.

Wednesday, March 19

📌 Eurozone CPI (Feb, Final YoY & MoM)

Expected: 0.5% MoM | 2.4% YoY

Previous: 0.5% MoM | 2.4% YoY

🔹 Market Impact:

If CPI remains high, it could reduce expectations of ECB rate cuts, supporting EUR.

A lower-than-expected inflation print may increase rate cut bets, weakening EUR.

Thursday, March 20

📌 ECB President Lagarde Speaks at EU Parliament Hearing

🔹 Market Impact:

Hawkish comments (concerns about inflation, delaying rate cuts) could boost EUR.

Dovish tone (focus on economic risks, openness to rate cuts) could weaken EUR.

Friday, March 21

📌 Eurozone Consumer Confidence (Mar, Preliminary)

Expected: -13.2

Previous: -13.6

🔹 Market Impact:

An improvement in confidence could signal better consumer sentiment, supporting EUR.

A weaker print suggests economic pessimism, potentially weighing on EUR.

U.S. Events to Watch in the Week Ahead

It's a busy week in the U.S., with investors keen to scrutinise the latest data for confirmation of an emerging slowdown.

With this in mind, the Federal Reserve's decision and guidance on the matter will prove to be the week's highlight for global FX.

Monday, March 17

📌 Retail Sales Advance (Feb, MoM)

Expected: 0.7%

Previous: -0.9%

🔹 Market Impact:

A strong rebound in retail sales signals robust consumer spending, supporting USD strength.

A weaker-than-expected print could raise concerns about slowing demand, potentially weighing on USD.

📌 Empire Manufacturing Index (Mar)

Expected: -2.0

Previous: 5.7

🔹 Market Impact:

A negative reading suggests deterioration in factory activity, potentially weighing on USD.

If the index exceeds expectations, it could signal manufacturing sector stabilisation, supporting USD.

Tuesday, March 18

📌 Industrial Production (Feb, MoM)

Expected: 0.2%

Previous: 0.5%

🔹 Market Impact:

A strong reading supports economic momentum, reinforcing USD strength.

A negative surprise could raise recession concerns, weakening USD.

Wednesday, March 19

📌 FOMC Interest Rate Decision

Expected Range: 4.25% – 4.50% (unchanged)

Previous: 4.25% – 4.50%

🔹 Market Impact:

If the Fed maintains a hawkish stance, USD could strengthen as rate cut expectations are pushed further out.

If the Fed signals easing, USD could weaken on expectations of lower future yields.

📌 Fed Chair Powell’s Press Conference

🔹 Market Impact:

Hawkish commentary (inflation risks remain, no rush to cut rates) would boost USD.

Dovish tone (highlighting economic risks, openness to cuts) could weaken USD.

Thursday, March 20

📌 Initial Jobless Claims (Week of March 15)

Expected: 225K

Previous: 220K

🔹 Market Impact:

A higher-than-expected number suggests labor market weakness, increasing rate cut expectations, which could weigh on USD.

A lower-than-expected print reinforces tight labor conditions, supporting USD.

📌 Philadelphia Fed Business Outlook (Mar)

Expected: 10.0

Previous: 18.1

🔹 Market Impact:

A sharp drop in business confidence could indicate slowing growth, potentially pressuring USD.

A higher-than-expected reading would signal resilient business conditions, supporting USD.