Euro-to-Dollar Rate Weakness to be Short-Lived say Euro Bulls Eyeing EUR/USD back at 1.16

- EUR/USD extends 2020 losses

- ING say EUR/USD weakness here to stay for some time yet

- ABN AMRO say USD weakness a feature of 2020

- Citi say EUR can strengthen in 2020

Image © Adobe Images

- EUR/USD Spot rate: 1.1082, -0.03%

- Indicative bank rates for transfers: 1.0701-1.0779

- Transfer specialist indicative rates: 1.0923-1.0989 >> Get your quote now

The Euro-Dollar exchange rate has fallen back into the 1.10s as its 2020 decline extends further, however weakness is expected to be a short-term phenomenon according to a number of analysts we follow.

Short-term momentum has certainly sided with the Dollar of late, pushing the EUR/USD exchange rate to three-week lows this week and the break below the psychologically significant 1.11 level will likely increase attention on the performance of the single currency with a view to declines below 1.10.

Underpinning the Dollar's push higher of late is some robust economic data out of the U.S., with last week's retail sales cheering Dollar bulls as the figures suggested their is no need for the U.S. Federal Reserve to rush into a rate cut.

Therefore, it does appear that the EUR/USD's downside is currently more a Dollar story than anything else, particularly as the Euro is likely to remain sidelined ahead of Thursday's European Central Bank meeting.

"The Euro should largely look through this week's European Central Bank meeting, with EUR/USD risks remaining skewed to the downside. The attractive funding characteristics of the euro should be kept in place by the ECB for a while yet," says Petr Krpata, Chief EMEA FX and IR Strategist at ING Bank in London.

ING continue to see EUR/USD risks as skewed to the downside in coming weeks, with moves seen potentially extending to below the 1.10 level should the use of the Euro as a funding currency become even more pronounced or global economic data disappoint.

Talk of a Republican tax cut 2.0 may also add to a downward EUR/USD trend says Krpata, eyeing the implications of further U.S. economic growth that such stimulus would offer.

However, Euro weakness against the Dollar is seen as a potentially short-term phenomenon, for now at least, by a number of analysts who say the single currency should end 2020 a few big figures higher against the Dollar.

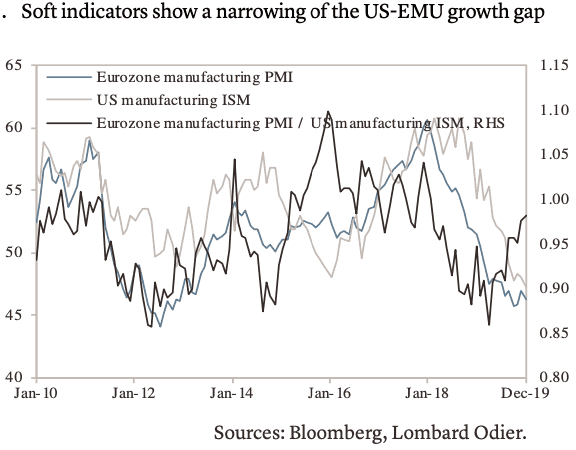

An improvement in the performance of the Eurozone economy in 2020 appears to be a central expectation that underpins forecasts for a stronger EUR/USD over coming months, with a pickup in economic activity likely to shrink the economic outperformance the U.S. has held over the Eurozone since 2018.

"The growth differential between the U.S. and Euro area is likely to narrow," says Vasileios Gkionakis, Head of FX Strategy at Lombard Odier. "It is not so much a story of euro-area growth rebounding strongly... but rather one of U.S. growth slowing."

The U.S. growth rates is forecast by Lombard Odier to cool from 2.3% year-on-year to 1.8% in 2020.

"We hold on to our constructive EUR view and maintain our forecast for EUR/USD at 1.15 by the end of this year," says Gkionakis. "This view is largely based on a bearish Dollar stance and an ongoing pick-up in European equity inflows."

The Euro may have been saved from a deeper sell-off higher Tuesday after the January ZEW survey out of Germany showed corporate confidence recovering notably in the wake of this month's 'phase one deal' to suspend the trade war between the U.S. and China.

Germany’s ZEW institute said Tuesday that analysts became more optimistic in their assessment of their current economic situation as well as the outlook in January, before announcing matching improvements for the Eurozone.

“The continued strong increase of the ZEW Indicator of Economic Sentiment is mainly due to the recent settlement of the trade dispute between the USA and China. This gives rise to the hope that the trade dispute’s negative effects on the German economy will be less pronounced than previously thought," says Achim Wambach, president of the ZEW Institute.

The Eurozone experienced a broad-based increase in industrial production at the end of 2019, data that points to a slightly brighter end to last year after a slowdown that had lasted about 12 months. Industrial output expanded 0.2% in December from the previous month, following two months of contraction, according to numbers out of Eurostat last week.

The slowdown in Eurozone growth was lead by Germany, where growth has slowed to its lowest level since the financial crisis according to Germany's Bundesbank.

"We now think pessimism regarding the Eurozone outlook may be overdone especially if Brexit is resolved and the ECB itself appears to be signalling little appetite to ease monetary policy further with fiscal stimulus seen as the next pillar of support," says an analyst briefing from Citi.

Citi's FX analysts are forecasting a rebound in the Euro in 2020, largely on the basis that the Eurozone's growth rates will pick up, and close the U.S. outperformance gap. However, a broader underperformance by the U.S Dollar will also help the pair higher:

"Although ECB actions are nonetheless designed with a weaker EUR in mind, U.S. President Trump and his Administration are actively trying to cap $ upside both via firing warnings to the ECB and jawboning the Fed for further cuts. The Fed is adding Dollar liquidity. This is Dollar negative and EUR/USD volatility has been falling. We expect narrower U.S.-EA growth differentials in 2020 and 2021. EUR may rebound."

Citi, the world's largest dealer of foreign exchange, say they are forecasting the Euro-to-Dollar exchange rate to be at 1.16 in the next six to twelve-months.

Georgette Boele, FX Strategist with ABN AMRO, is forecasting some EUR/USD upside in 2020, despite an expected lacklustre performance from the Eurozone economy.

ABN AMRO economists expect the eurozone economy to remain weak in the coming quarters and they have pencilled in a rate cut (in Q1) and more quantitative easing by the European Central Bank.

"Does this mean that the euro will weaken further? We don’t think so," says Boele. "We think that most eurozone economic weakness is reflected in the euro and some stabilisation will likely

be euro positive."

A Weaker Dollar in 2020

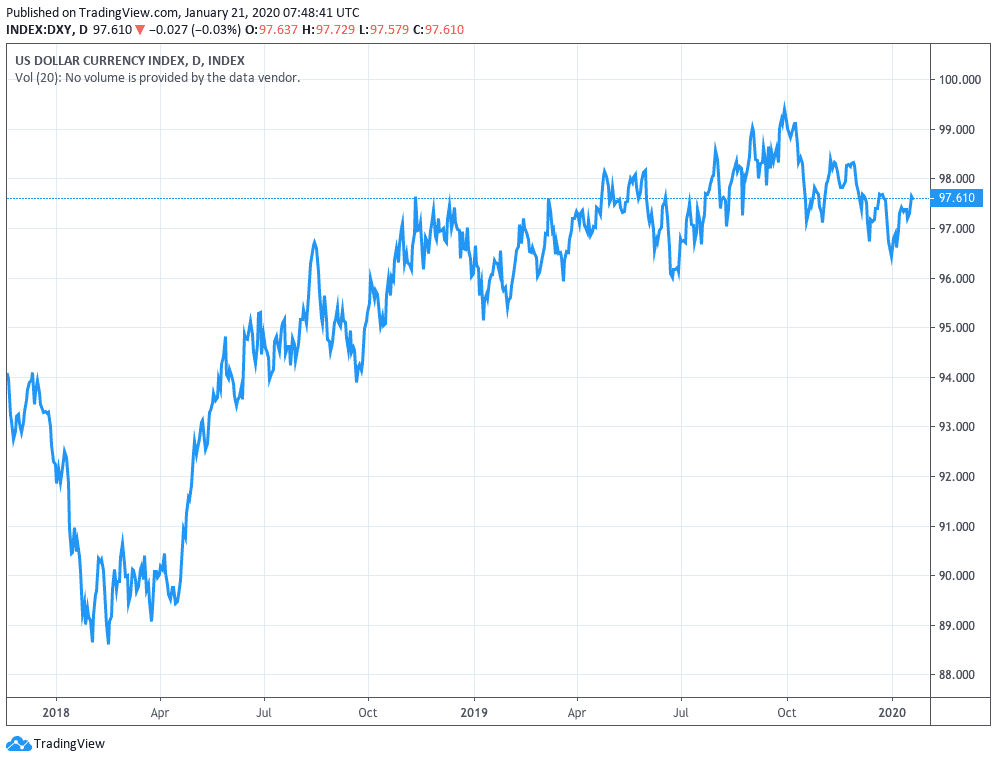

Central to ABN AMRO's forecast for a stronger EUR/USD is a broad based weakening of the Dollar.

We think that the Dollar is on a path of long-term weakness and there are several reasons for this," says Georgette Boele, Senior FX Strategist at ABN AMRO.

Reason 1: Boele says the fundamental drivers for the US dollar have already been on a path of deterioration.

"For example, current account and fiscal deficit have widened. They have not weighed on the US dollar yet, but at some point, in time they will, especially if the cyclical picture is also deteriorating," says the analyst.

Reason 2: ABN AMRO's U.S. economist expects the U.S. economy to weaken in the coming months while strategists also expect one more rate cut in Q1 2020. "This should hurt the Dollar," says Boele.

Reason 3: ABN AMRO expects no sharp risk-off sentiment in currency markets, a condition that would typically weigh on the safe-haven Dollar.

The market has apparently grown used to President Donald Trump's management style, in particular his approach to foreign relations via Twitter. "The market impact of these tweets and comments will probably be lower," says Boele.

Above: The Dollar index - a broad measurement of overall USD performance - has been trending higher since 2018.

In addition, analysts expect a trade truce between the U.S. and China and a very low probability of a no-deal Brexit.

"There is reduced need for safe-haven demand for the dollar, the Japanese yen and the Swiss franc," says Boele.

Reason 4: The Dollar's strength or weakness must also be viewed as being a relative state to that of other currencies: in short, if other currencies are to strengthen, the Dollar could fall back.

ABN AMRO expects a stabilisation or some improvement in the outlook for other currencies such as the Euro, Sterling, Scandi’s and Dollar-block currencies.

"These currencies are undervalued on the metrics of purchasing power parity, while the US dollar is overvalued. In addition, investors are currently net-long the dollar and net-short most of these currencies. If our scenario plays out the dollar also becomes less attractive," says Boele.

The Euro-to-Dollar exchange rate is forecast to maintain an upward trend in 2020, rising from 1.14 at the end of the 1st quarter to end the year at 1.16.

"We expect Dollar strength to fade in the near-term, because of cyclical weakness and lower safe-haven demand. Further out a deterioration in longer-term fundamentals and somewhat more constructive outlook in other currencies will result in a weaker U.S. Dollar," says Boele.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. They offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement