Euro-Dollar Rate Softens after Growth and Inflation Data Argue for ECB Action

- Written by: James Skinner

Image © Adobe Images

- EUR slips after inflation surprises on downside, growth fall.

- GDP growth halved again in Q2 and core inflation fell in July.

- Growth pulse is weakening and inflation was already too weak.

- Data argues for ECB action as Fed gets ready to cut U.S. rates.

The Euro was on its back foot again Wednesday as markets responded to the latest growth and inflation figures from the Eurozone, which have all-but confirmed the European Central Bank (ECB) will need to cut interest rates and restart its quantitative easing (QE) program over the coming months.

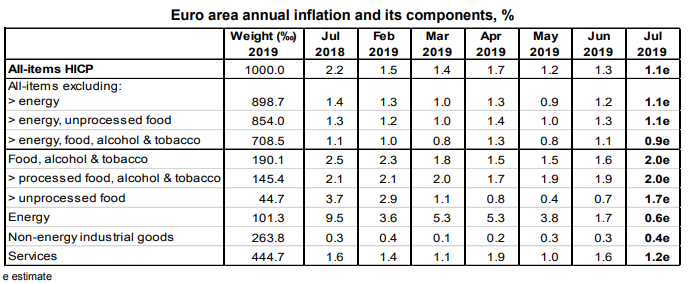

Eurozone inflation fell from 1.2% to only 1.1% in July when financial markets had looked for it to decline to 1%, which should have been a welcome surprise for the single currency. However, the more important core inflation rate surprised on the downside when it fell from 1.1% to just 0.9%.

Consensus had been for the latter to decline only to 1%. Core inflation is seen as a truer reflection of domestic price trends because it ignores commodity-price-sensitive energy and food while also excluding alcolol and tobacco goods. Prices of the latter are influenced by government taxes.

Furthermore, the rate of economic growth halved in the second quarter, according to Eurostat data. GDP growth was just 0.2% last quarter, down from 0.4% at the beginning of the year and leaving the annualised rate of expansion far below the ECB and European Commision's forecasts.

"Clearly, the economy is expanding at a slow cruising speed that seems too low for inflation to increase quickly towards the ECB target. And that gives the Bank more ammunition to act in the autumn," says Bert Colijn, an economist at ING.

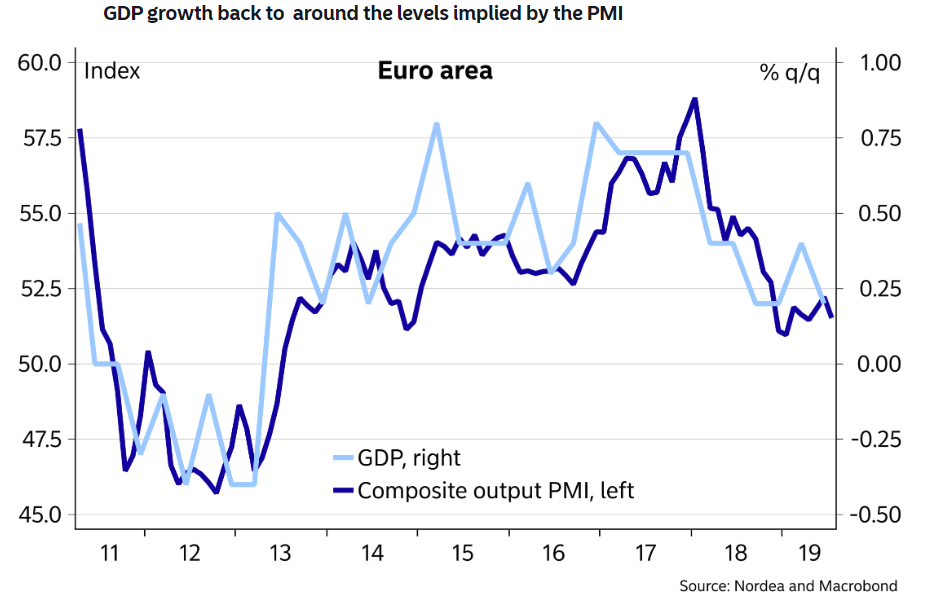

Above: Eurozone GDP growth correlation with IHS Markit manufacturing PMI.

"If growth continued at the 0.2% pace in the second half of the year, roughly in line with the recent composite output PMI, GDP would grow by a bit more than 1% in 2019 as a whole," says Jan von Gerich at Nordea Markets. "Given the absence of an uptrend in core inflation, weak GDP growth and the growth risks firmly pointing to the downside, the ECB looks likely to announce an entire package of stimulus measures at the September meeting."

The annual growth rate was 1.1% when the second-quarter is compared with the same period one year ago, although if maintained over the course of a year, Wednesday's growth rate would see the economy expand by less than 1%.

European Commission officials forecast 2019 GDP growth of 1.3%, while the ECB is looking for just 1.2%. Both numbers are a long way below the 1.8% seen in 2018 and are lightyears off the 2.3% expansion clocked up back in 2017.

This is important for markets because falling demand in an economy typically means less consumer price inflation further down the line and the Euro area's inflation pulse was already far too weak for the ECB's liking. The bank is obliged to ensure inflation averages a level that's "close to but below 2%".

"ECB policymakers already seem to have made up their mind to loosen policy. We had assumed that they would cut interest rates in September and wait a little longer before re-launching QE. But the continued weakness of the economic data increases the chance of more significant stimulus being announced in September," says Jack Allen-Reynolds at Capital Economics.

Above: Eurozone inflation rates and contributions to inflation. Source: Eurostat.

Wednesday's inflation figures leave the consumer price index substantially below the 1.8% level that prevailed in January 2018 and the core inflation rate lower than the 1% level prevailing at the same time.

Core inflation was only 0.3% higher in July than it was in January 2015, when the ECB first said it would cut its interest rate below zero and begin buying European bonds en masse in an effort to reflate the economy.

The main inflation rate is up from -0.6% in January 2015, although that has more to do with changes in oil prices.

ECB President Mario Draghi said last week the bank still sees signs of strength in the economy, but he also admitted the growth outlook is getting "worse and worse". He singled out manufacturing and those countries where manufacturing is important for growth as suffering the greatest.

"The raft of weak economic data published this morning strengthens the case for the ECB to announce a package of stimulus measures at its next meeting in September," Allen-Reynolds writes, in a note to clients. "While economic weakness had previously been concentrated in Germany and Italy, the national data available so far show that the slowdown in Q2 was broad based, with growth softening in France, Spain, Austria and Belgium."

Above: Euro-to-Dollar rate shown at 15-minute intervals.

The ECB said last week that it's tasked staff with devising a "tiered system for reserve remuneration" and considering "options for the size and composition" of a new quantitative easing program. References to a "tiered" system suggest the ECB is on the verge of cutting its deposit rate further below zero because policymakers have previously floated the idea as a means of protecting already-weak profitability at commercial banks from negative rate charges on reserves.

Changes in interest rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

"Water levels in the Rhine and its tributaries are receding once more. Low water levels in the Rhine held back German industrial production and risks doing so again this year, perhaps unless ECB manages to fill the rivers with liquid(ity) from the Eurosystem. This represents another downside risk for the Euro-area," says Andreas Steno Larsen, a strategist at Nordea Markets. "If EURUSD rallies on a dovish Fed message this week (we think it will), it could make sense to build new EURUSD tactical shorts."

Wednesday's data comes just hours ahead of the July Federal Reserve interest rate decision, which is expected to see U.S. rates cut for the first time since the immediate aftermath of the financial crisis. However, the mounting prospect of offsetting rate cuts and quantitative easing from the ECB could well prevent the Euro from recovering ground previously lost to the Dollar because of rising rates that have made the U.S. bond market much more attractive to investors than the Eurozone alternative.

Above: Euro-to-Dollar rate shown at daily intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement