The EUR/USD Rate: Analysts Clash Over Outlook amid Uncertainty over Whether a "Bottom" Has Been Set

- Written by: James Skinner

© Rawpixel.com, Adobe Stock

- Analyst opinons differ over if new bottom marked in EURUSD.

- Some already buying as others eye a summer trip down to 1.10.

- Growth differentials key driver, most like EUR higher through 2020.

The Euro was treading water against a steady Dollar Thursday but the outlook has clouded of late and is dividing analysts in their forecasts, many of whom are attempting to gauge whether a new "bottom" has been set that could now act as support for exchange rate.

Europe's single currency found support for a brief recovery this week as investors continued to take profits on U.S. Dollar bets in the wake of last Friday's blowout GDP data and ahead of this Wednesday's Federal Reserve interest rate statement, although the greenback has since firmed and pushed the Euro-to-Dollar rate lower again.

But that's just the latest decline for the exchange rate as the Dollar was bid higher throughout April and the Euro has been under the cosh due to concerns about the health of the continental economy, leading the EUR/USD to hit a fresh 22-month low just last week.

Analysts are now debating whether that low marks a major "bottom" that will act as a support level for the exchange rate from here onward or if there are still further losses to come throughout the summer monhts. Opinions vary wildly about the short-term outlook although there's a solid consensus suggesting a recovery beckons thereafter.

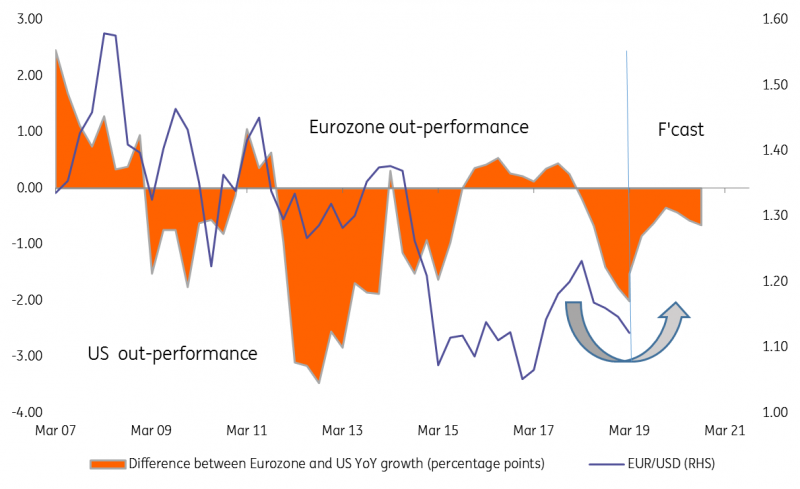

"If we compare the pace of y/y growth, Eurozone’s 1.2% is significantly lower than 3.2% reported in the US last week. Even when the positive contribution of net exports and inventories is excluded, 1.5% y/y GDP growth in the US is still markedly higher than in the Eurozone. It is therefore too early to mark an important year-to-date low in EUR/USD just yet," says Jane Foley, a senior FX strategist at Rabobank.

Foley forecasts the Euro will fall even further over the coming months, to 1.10 on a six-month horizon, before embarking on a gradual recovery through 2020. She forecasts the U.S. economy will not only have lost momentum by that time but will also have entered a mild recession.

Above: Euro-to-Dollar rate shown at daily intervals.

The Euro, down -2.2% thus far this year, has suffered in 2019 due to a faltering economy that's been trailing behind its U.S rival ever since early 2018 when the U.S. economy was juiced by once-in-a-generation tax reforms and growth on the old continent was soon to be crimped by a slowing Chinese behemoth that was wounded in a tariff fight with the U.S.

Last year's ongoing slowdown put a torpaedo through the consensus idea that a recovering economy would soon allow the European Central Bank (ECB) to do away with its crisis-era monetary policy around the same time the Federal Reserve rate hiking cycle was maturing. That was supposed to turn the global tide of capital flows in favour of the Euro rather than a high-yielding U.S. Dollar.

The underperformance of the Euro has seen analysts increasingly forced to mark down earlier bullish Euro-to-Dollar forecasts for year-end 2019 but that's not stopped others from dipping their toes into the waters of the single currency after last week's sell-off.

Kit Juckes, chief FX strategist at Societe Generale, told clients to buy the Euro last week around 1.1160 although he didn't say exactly how far the Euro might rise. But he wasn't the first bidder drawn from the woodwork as Nordea Markets had already advocated buying around 1.13 previously and targeting 1.1650 but the bank was stopped-out of its trade in last week's sell-off.

"The Fed is patient, the Fed is on hold and what happens next depends on what the economy does. The same is true for EUR/USD," Juckes writes, in a fresh note to clients Thursday. "If I plot the market pricing of US/Eurozone rate differentials a year forwards, against EUR/USD, all I see is a complete breakdown in the relationship."

Above: Euro and EUR-U.S. two-year forward rate differential (red). Source: Societe Generale.

"EUR/USD, and indeed FX in general, is far more about relative growth prospects at the moment, than it is about the outlook for monetary policy. On that score the reaction to the Eurozone GDP data still suggests to me that there is a little too much pessimism about growth, which is holding back the euro. However, the outlook certainly isn't bright enough to justify a big move to the upside, either," Juckes adds.

Eurozone GDP growth came in at 0.4% for the opening quarter, up from 0.2% previously and ahead of the consensus for growth of only 0.3%. This ensured the annualised rate of economic growth held steady at 1.2% when it had been expected to decline.

The data followed a March upturn in the Chinese industrial sector that led some economists to anticipate that a European recovery could soon follow along behind it.

However, a detailed breakdown of the different contributions to GDP growth will not be available until late in May, which means the jury is still out on whether the boost was entirely a domestic phenomenon or something more than that.

The answer to the above question matters greatly for determining the trajectory and timing of changes in interest rates on both sides of the Atlantic, particularly as U.S. GDP data for the first quarter was far stronger than many economists had dared to imagine.

"The recent fall below 1.12 has prompted quite a few analysts to cut their EUR/USD forecasts. We had already penned a move to 1.10 in our profile for 2Q19, but, like others, acknowledge that the case for a rebound later this year has become a little harder," says Chris Turner, head of FX strategy at ING Group. "We still think EUR/USD will put in a significant low this year."

Above: Euro-U.S. economic growth differential and correlation with EURUSD.

Turner says the growth imbalance between the Eurozone and the U.S. economies will soon turn in favour of the old continent but he also forecasts that it could be some time before the Euro is able to benefit from that because of the impact that a high 2.5% Federal Reserve interest rate is having on the behaviour of investors.

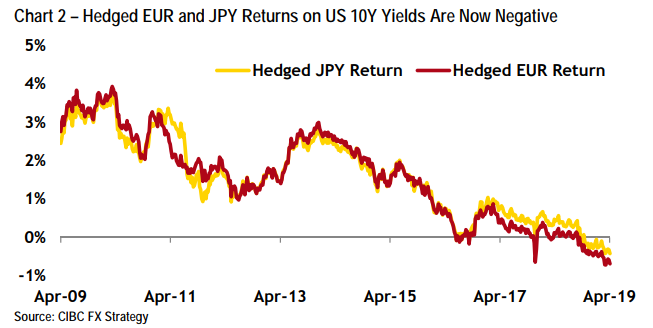

"We happen to think that interest rates at the short end of the curve are really important for FX markets right now. These have created exceptionally high USD hedging costs (now 3% for EUR and JPY-based investors) and these rates may only start to ease when it becomes clear the Fed is ready to ease – thus this may not be a story until 2020," Turner writes this week.

The Federal Reserve interest rate is the highest in the G10 universe by a country mile, which has seen fund managers in Europe and Japan who're buying U.S. assets increasingly doing so without protecting themselves from downward swings in the value of the U.S. Dollar.

This is because in order for investors to protect their portfolios against a lower greenback they must bet against it themselves, which almost always involves swapping for another lower yielding currency, which is an expensive thing for investors to do.

Selling the Dollar at the same time as investing in a U.S. asset would enable the fund manager to profit from currency losses on the exchange rate, which would then offset the reduction in value incurred by the portfolio asset when the original investment capital is translated back into Euros or Yen.

Analysts at CIBC Capital Markets say selling the Dollar will convert what are positive annual returns before hedging, into modest annual losses after hedging.

Above: CIBC Capital Markets graph showing hedging costs for Japanese and Eurozone investors.

"Right now, the implied cost of a 3m forward hedge for a Japanese investor (annualized) is roughly 2.90%. That means for an investor in Japan, you could earn 2.50% in US 10-year yields unhedged or -0.40% if you hedge. In the Eurozone, the return after hedging works out to -0.61%. This is the first time that hedging costs have been this expensive relative to US 10-year yields in over a decade," says Bipan Rai, head of FX strategy at CIBC.

Somebody buying the Pound-to-Dollar rate, so betting on an increase, would have to pay something like the difference between the BoE base rate and the Fed's rate. That's 1.75% annualised.

Likewise, hedging against a rise in the Euro-to-Dollar rate costs more than 3% given the European Central Bank's record low interest rates and negative German bond yields.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement