EUR/USD Rate Week Ahead Forecast: Charts Marginally Bearish but we Anticipate Some Resillience

Image (C) Adobe Images

- Marginal bias for more downside

- Downtrend could extend to 1.1400

- Inflation data is key for USD, for EUR it is minutes of ECB's last policy meeting

The Euro-to-Dollar exchange rate fell 0.66% last week from 1.1600 to 1.1523 on a close-to-close basis, as Italian budget deficit fears and weak German economic data weighed on the Euro.

The Dollar had a week of two halves, rising initially as traders priced in higher interest rates in the U.S. - which are a big draw for international capital flows - but then losing ground at the end of the week following mixed employment data.

From a technical standpoint, the charts could be interpreted as marginally bearish, but not confidently so.

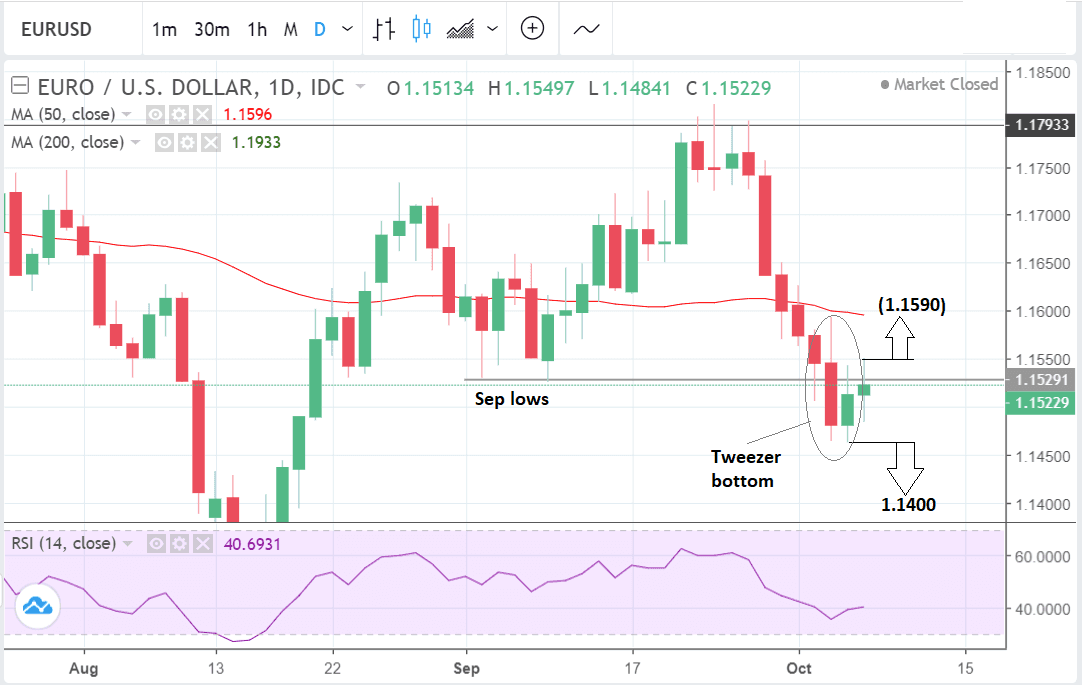

The daily chart below is showing the pair has been falling steeply since the September 24 highs but that over the last two days it has started to recover.

It is still too early in the recovery's infancy to argue it represents a change in trend, especially because the two up days were not very strong. This means the short-term downtrend from the 24 September highs is still probably intact and we forecast a break below the 1.1465 lows would confirm an extension down to the next downside target at 1.1400.

The weak rise in RSI, which is a momentum indicator, also makes it less likely the recovery is the start of a bullish reversal.

There is some evidence to suggest the trend may be about to turn higher, however, which should caution traders from becoming overly bearish.

The first is the bullish tweezer bottom reversal pattern at the October 3 and 4 lows. A tweezer bottom is a bullish Japanese candlestick reversal pattern formed when two candles have lows which are of a very similar level, such as happened on October 3 and 4. This creates the 'tweezer' look of the pattern's name. the fact it was followed by a bullish green up day on Friday is further confirmation of a bullish reversal in the short-term trend.

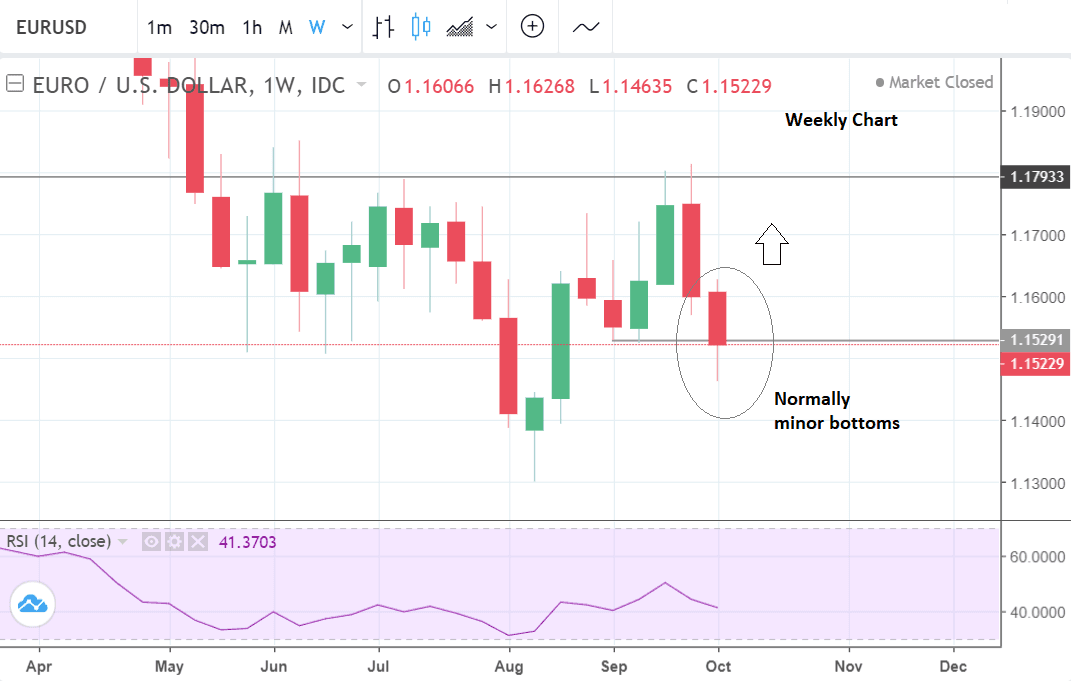

The weekly chart above it showing a bullish sign in the shape of last weeks candle with its 'lollypop' look due to the disproportionately long distance between the close and the low. These candles are normally found at minor bottoms and trough lows and lend evidence to the argument the trend may be about to reverse.

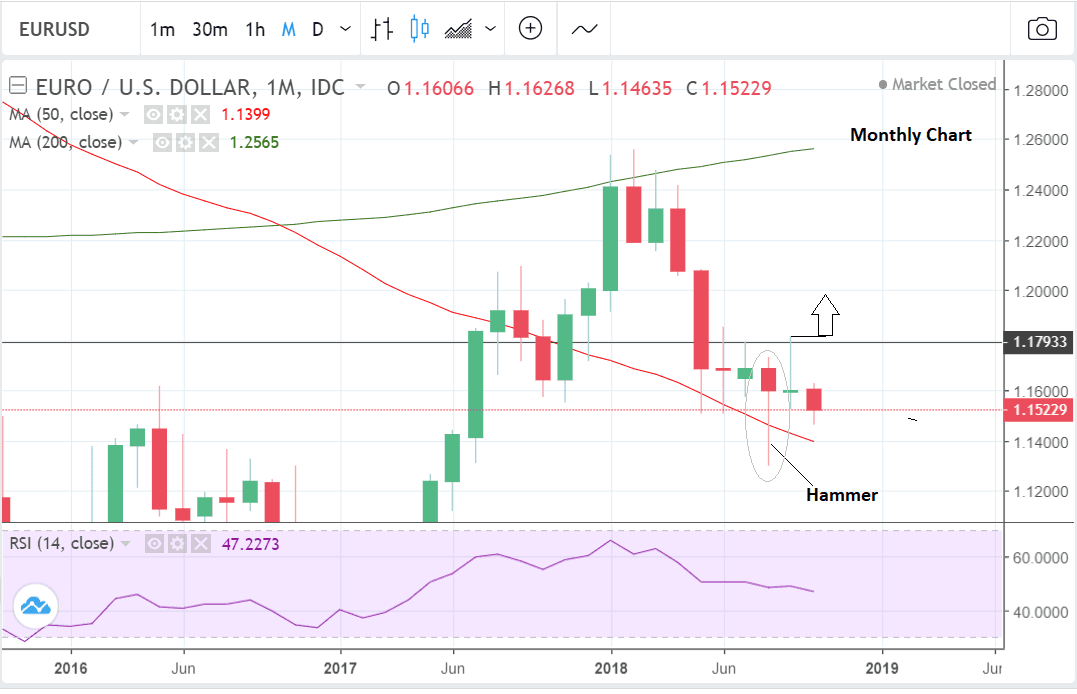

The monthly chart above is also signalling a potential reversal of the broader trend after the sell-off in August touched and then reversed at the 50-month MA. August ended up forming a hammer candlestick pattern which is a bullish reversal sign. The September rise which followed added confirmation, especially after it took out the July highs.

Although the market suddenly weakened at the end of September, the makings of a longer-term reversal are present, and only require a re-break above the 1.1815 August highs for confirmation of the start of a new longer-term uptrend.

As such, whilst the daily chart continues to show the short-term downtrend remains in force there are also signs a reversal could be on the horizon which should temper bearish enthusiasm, and if the pair were to recover to above the 1.1550 highs it would confirm to us a transition of the short-term trend and more upside to a target at 1.1590 and the 50-day MA.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The U.S. Dollar: What to Watch this Week

The main release for the U.S. Dollar in the week ahead is inflation data as measured by CPI.

Headline CPI is forecast to show a 0.2% rise in September from 0.2% previously.

Core CPI is expected to rise by 0.2% from 0.1% previously. Both are scheduled to be released at 13.30 B.S.T on Thursday, October 11.

On a yearly basis, this translates into a forecast of a 2.8% increase in headline CPI and 2.5% for Core CPI.

In the previous month of August core inflation increased a modest 0.1% but followed a strong reading in July.

Core goods prices fell for the first time in three months, as apparel prices fell 1.6%, reflecting renewed downward pressure on core goods prices owed to recent dollar appreciation.

Core services inflation softened during the month to 0.2%. Physician services and hospital prices edged down.

Analysts maintain a view that inflation should continue to steadily trend upward, however, there is little indication that inflation will accelerate and force the Federal Reserve to raise rates sharply.

Another key inflation-related release for the U.S. Dollar in the coming week is PPI or producer prices data out on Wednesday at 13.30, which is forecast to show a rise of 0.2% month-on-month compared to September.

Michigan Consumer sentiment for September is expected to inch 4 basis points higher to 100.05 when it is released at 15.00 on Friday.

Several Federal Reserve speakers are also set to speak in the week ahead. These include Williams at 14.15 on Wednesday and Bostic at 23.00 on the same day.

Investors may scrutinise what they say for signs of convergence with chairman Powell's recent comments about rates probably surpassing the neutral rate in the future. If they back him up it will support the Dollar higher; if they raise doubts it could weigh on USD.

The neutral rate is a hypothetical level interest rates need to be at to balance the economy. On average officials think it lies at 3.0%. Powell's comments suggest US interest rates could eventually rise above 3.0% from their current 2.25% and were bullish for the Dollar.

The Euro: What to Watch

The main release for the Euro in the week ahead is likely to be the European Central Bank's account of its September 13 monetary policy meeting. Investors will be checking the report for signs of confidence in the economy from the governing council.

Mario Draghi said inflation was relatively vigorous in the Eurozone in his recent testimony to parliament but since then the Euro has lost ground on Italy concerns, question marks over German growth and its financial sector and a strong Dollar.

Simmering Italian budget concerns may also be a risk factor in the coming week although the next crunch data is further off on October 15, the deadline for Italy to present its revised budget to the EU again.

The main hard data release for the Eurozone is industrial production data in August, which has been soft recently but is expected to recover by 0.4% month-on-month in August.

"Manufacturing has been something of a soft spot for the Eurozone, with survey data subdued and July industrial production falling -0.8% month-over-month. Within the details, production of consumer goods dropped noticeably along with production of intermediate goods. There were, however, monthly increases in the production of capital goods (0.8%) and energy (0.7%)," says Wells Fargo, who add they are forecasting a rebound of 0.3% in August, with gains 'broad-based' and overall economic growth in the Euro-area in Q3 "steady" rather than "strong".

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here