British Pound to Languish Below 1.10 vs. Euro as Recession Beckons in 2021 say Scandanavian Economists

Above: Economists in Oslo say the Pound and Dollar are facing a long period of underperformance ahead of a U.S. recession. © Andy Emel, Adobe Stock

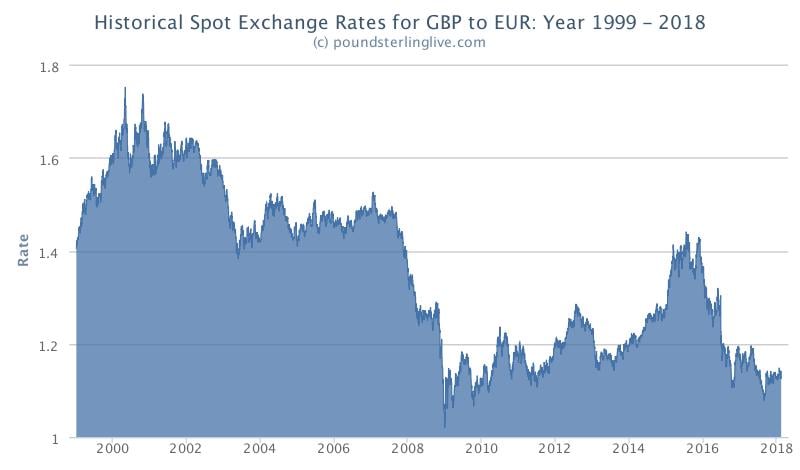

Once the Pound would buy more than 1.20 Euro's, but the new normal could now be for the exchange rate is to occupy levels below 1.11.

These are the findings of an hard-hitting assessment of the British Pound's future relationship with the Euro from a group of Scandanavian economists who suggest the Pound is unlikely to make any significant headway over coming months, and years.

In fact, economists at DNB Markets - the Oslo-based banking giant - have looked forward right through to 2021 where they expect the UK currency to only buy 1.05 Euros.

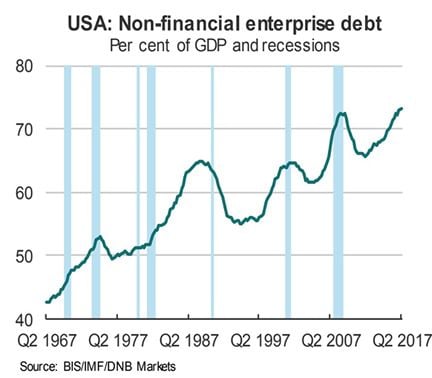

2021 also coincides with another striking event we are told - the onset of recession in the United States where a growing corporate debt burden finally overcomes economic growth.

And as we know from past experience, contagion from the world's largest economy is typically the norm which puts the U.K. and Europe at risk of a severe slowdown. The last global recession that kicked off in 2008 saw Sterling fall to even lower levels against the Euro than it did in the wake of the E.U. referendum which reminds us of just how powerful such an event can be for the British currency.

The U.K. economy and the rest of the world have now enjoyed a long period of expansion, even if the U.K. has seen growth moderate in 2017. The current US-lead economic upturn has now lasted a long time and is only beaten in duration by two expansions in the post-war era, one in the 1960s and one in the 1990s.

The latter lasted exactly ten years and is the longest ever registered.

DNB Markets believe the current upturn could last even longer, but there is considerable uncertainty about when the next recession will materialise, what will trigger it and, not least, how serious it will be.

DNB Markets are however of the belief that the U.S. will lead the world into a recession within their forecast period, which is up to 2021. The cause will be down to the high corporate debt.

"We believe the triggering factor will be that the debt burden becomes too heavy for the business sector. Even if the Fed increases interest rates only gradually, at some point rates will be high enough to have a tightening effect," says DNB Markets economist Knut A. Magnussen.

"In light of the high debt level in the business sector, we predict that the recession will primarily be driven by a steep decline in corporate investments," says Magnussen.

And What Does this Mean for the Pound?

If the U.S. goes into recession in 2021, the rest of the world is expected to catch a cold.

"The ripple effects will spread to other countries and pull global economic growth down by one percentage point to 2.5 per cent in 2021," says Kjersti Haugland, an economist with DNB Markets.

This is bad news for the UK economy which is already seen underperforming the global economy.

"The U.K. stands out from the rest, with prospects of below-normal growth and rising unemployment in coming years. Uncertainty about the rules and treaties that will apply after the E.U. exit becomes effective on 29 March 2019, will weigh down domestic demand," says Haugland.

Indeed, DNB Markets forecast UK growth to read at 1.3% in 2019, 1.3% in 2019, 1.5% in 2020 and 0.4% in 2021 when the recession is forecast to take hold in the U.S..

This will be well below the 1.0% that the Eurozone is forecast to experience at the same time and confirms that a relative underperformance against the Eurozone economy will pose downside pressure on GBP/EUR.

US growth is forecast to suffer a -0.6% decline in 2021.

Such economic underperformance is then computed into DNB Market's foreign exchange forecast models.

"In the foreign exchange market, we expect the USD and GBP to keep slipping," says Hauglan.

The Euro, on the other hand, is seen enjoying further gains and DNB Markets predict that EURUSD will rise to around 1.30 within the next three years.

DNB Markets meanwhile forecast the Euro-to-Pound exchange rate to trade at 0.91 by August 2017, 0.92 by February 2019, 0.93 by February 2020, 0.95 by February 2021 and 0.95 by February 2020.

This gives a Pound-to-Euro exchange rate forecast of 1.10, 1.09, 1.08 and 1.05 respectively.

This is certainly one of the more bearish forecasts for Sterling and comes at a time when other analysts are actually raising their forecasts for the currency in view of a smoother Brexit process.

However, no other economists we follow have dealt with what must be the elephant in the room - the onset of the next big slowdown which - unless you are Gordon Brown who once famously said the period of boom-and-bust was over - must at some point be prepared for.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.