JP Morgan Bet on a Euro Rally v the Pound

Pound Sterling is seen buying €1.1730 at present - a decent rate when compared to the exchange rate's performance thus far in 2017. But, the outlook bodes for further weakness we are told.

Analysts at the world’s largest investment bank have confirmed they are sticking with a trade designed to profit on an expected decline in the British Pound against the Euro from current levels.

A call by strategists at JP Morgan for the Pound to fall against the Euro comes at a time when other institutions have announced they are shifting their strategic stance from bearish to neutral on Sterling.

The call also comes at a time of renewed vigour for Sterling.

The Pound to Euro exchange rate leapt higher last week after Prime Minister Theresa May surprised markets by calling for early elections on June 8th, a step that was subsequently voted for by MPs.

At the time of writing the exchange rate is at 1.1730 having been as low as 1.1380 in mid-March. While the market is below recent highs seen towards 1.20 thanks to the French elections, the pair is still relatively well-priced by 2017 standards.

Politics appear to be playing a part in the UK currency's strong performance.

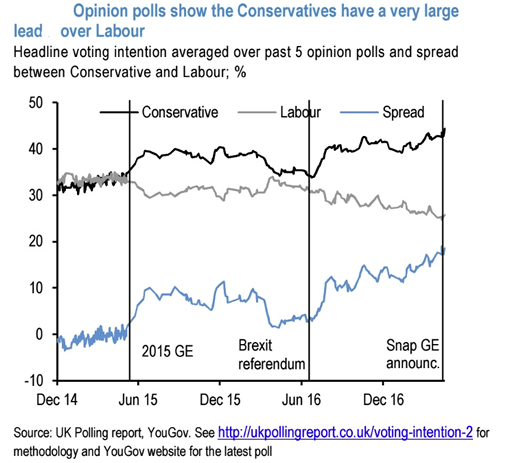

Of relevance to markets have been recent polls which show the Conservative party well ahead of the Labour party, which could translate into a majority of 100-110 seats for the Conservatives, up from 12 currently.

Indeed, a poll from IPSOS Mori released mid-week shows May being more popular with voters than either Margaret Thatcher or Tony Blair. It suggests leadership will be a key determinant of the upcoming vote result. The Ipsos MORI poll also suggests the Conservative party will will with a landslide 144-seat majority.

This could provide Sterling with further room to advance. GBP outperformed its rivals following the news and is one of the best-performing currency in G10 this month.

The Pound strengthened by as much as 2% in trade-weighted terms following May’s call and the TWI found itself just a whisker away from its post-Brexit high.

“Market focus has been on recent polls which if realised, would provide a strong mandate for the Government’s Brexit approach and would also remove any risks that hard-line Eurosceptic Conservative MPs could unduly influence May’s Brexit negotiations going forward, thus reducing the tail risk of a very hard Brexit,” says Meera Chandan at JPMorgan.

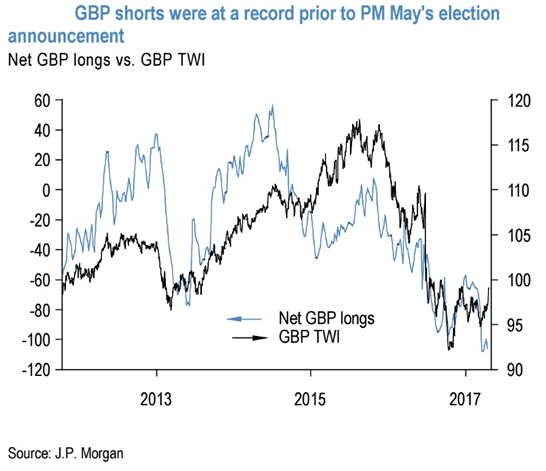

That the news came at a time that GBP shorts were a near record only helped to exacerbate the market move that saw Sterling outperform.

“Looking ahead, while recent political developments on balance are positive, we are still moderately bearish on GBP over the medium-term,” says Chandan. “Even though tail risks have diminished, risks to growth still remain."

How to Bet Against the Pound

Despite the recent strong performance of the Pound JP Morgan don't expect it to last, particularly against the Euro.

Analysts argue the historical relationship between price and positioning indicates that bulk of the GBP shorts initiated this year have been unwound, leaving positioning somewhat cleaner and therefore the ability of Sterling to fall once more becomes possible.

To take advantage of any Pound weakness and Euro strength, JP Morgan have suggested speculators put on a trade to take advantage of any downside.

“Hold a 2-month 0.8820-0.9050 EUR/GBP call spread,” says Chandan.

Now, we are not going to explain the dynamics of this trade in this article, but those interested in the technicalities of options trading can investigate here.

What we can say is that it is a bet that the EUR/GBP exchange rate will rise, i.e. the Pound will fall against the Euro.

“Relevant for the trade structure in question, the EUR call/ GBP put spread recommended is nearly worth zero so has limited additional downside and could also benefit from a modest bounce in EUR if our base case in the French elections is realised,” says Chandan.

Upgraded Forecasts, But Pound Still Needs to Go Lower

In mid-April JP Morgan announced they were upgrading their forecasts for Sterling but maintained the view that the Pound would still fall.

Analyst Paul Meggyesi said he still expects a weaker GBP over time as the UK economy underperforms and real yields decline to nearly -3%.

Real yields referred to here is the money paid to investors of UK government bonds - the difference paid on UK bonds and the bonds in other countries has a significant impact on currency valuations.

But, JP Morgan see upside risks to their forecasts for the Pound an have lifted their headline GBP/USD forecast a percent in recognition that the economy might not slow as much as they had initially feared.

“We have to take some reassurance, as will investors, that an early vote increases the scope for a transitional period that delays and slows the economic impact of Brexit and thus wait for more clarity on the longer term growth ramifications to re-assess,” says Chandan.

But, the Pound is still likely to fall back from current levels.

“Our base case continues to be that of a ‘hard’ Brexit (defined as a loss of single market access with prioritisation of immigration) and the near-term outlook for growth is unchanged with further slowing expected,” says Chandan.

Analysts at JP Morgan doubt whether the Pound to Dollar exchange rate will sustain moves below 1.20.

The forecast for EUR/GBP was this month cut from 0.88 to 0.87 (mid-year) and from 0.92 to 0.91 (end-year).

This equates to a Pound to Euro exchange rate upgrade from 1.1364 to 1.1494 for mid-year and 1.0869 to 1.0989 for the end-of-year.

Also upgrading their GBP forecast profile this week are Deutsche Bank who pursue an argument surprisingly similar to that of JP Morgan.

Deutsche Bank’s new Sterling forecast reflects a more optimistic view of the Brexit endgame, but not of Sterling fundamentals.

“We have revised the GBP/USD cycle end-point eight big figures higher from its previous low of 1.06. This returns it to levels after the Brexit vote, but before PM May’s ‘hard Brexit’ Birmingham Party Conference Speech, consistent with a reduction of crash risk,” says Deutsche Bank analyst Oliver Harvey.

Forecasts for EUR/GBP is kept unchanged from present levels until 2019, reflecting our view of broadly balanced risks for the UK and the Euro Area over the next two years.

EUR/GBP is seen at 0.83 right through 2017 - 2018 which is a Pound to Euro exchange rate at 1.2048.

So a little more upside for those hoping for a stronger Pound.