Eurozone Inflation Data is Robust but pays no Dividend to the Euro

Euro exchange rates declined in value at the turn of the month after the release of steady, but unspectacular, inflation data kept alive the prospect of the European Central Bank having to keep stimulus efforts active.

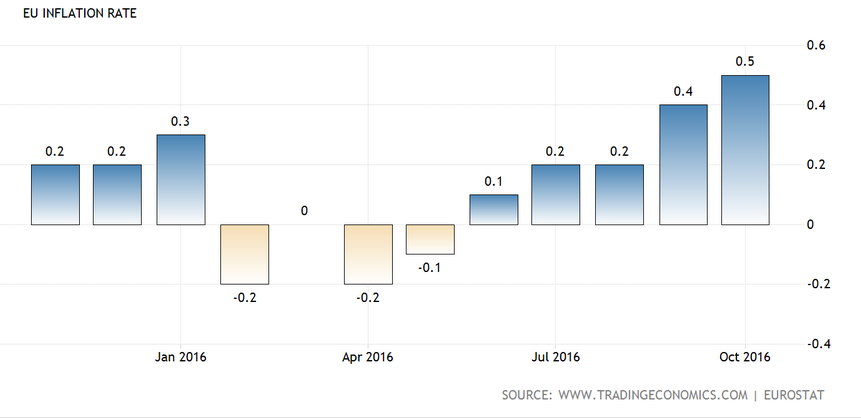

Eurozone CPI data showed a 0.5% rise year-on-year, in October, on Monday, reaching a two and a half year high in the process.

The result was in line with analysts’ expectations and higher than the 0.4% of the previous month of September.

Core CPI rose by 0.8% which was also in line with estimates and the same as the previous result.

Despite showing notable gains markets viewed the numbers as ‘soft’ overall, and sold the Euro in the ten minutes which followed the publication of the data.

Nordea Bank’s Holder Sandte said the results were, if anything, being below-par:

“Headline inflation rose to 0.52 % y/y in October, a bit less than expected.

“Core prices barely increased over the month so that inflation excluding energy fell to 0.69% y/y.

“Excluding food, energy, alcohol and tobacco, prices rose by 0.76% y/y, down from 0.83% in September,” he said.

The data did not change his view that the ECB would continue to expand its monetary stimulus programme in December, a move which would widely be seen as a weakening factor for the Euro, as it would keep interest rates depressed.

“All in all soft numbers, confirming the ECB’s worry that there is no convincing rise in core inflation – and there might even be downward pressure. As we see it, the ECB cannot just sit and watch and let the asset purchases end in March next year.,” says Sandte.

Focus on Core CPI

Prior to the release of the data, Helaba Economics’ Ralf Umlauf said the Core Inflation rate, which strips out volatile elements such as Food, Fuel and Tobacco, would be the most important result from the point of view of the ECB:

“Central bankers have recently started to intensify their focus on core inflation – which is usual in the US.

“When the flash estimate of euro area consumer prices comes out today, market participants will be watching the corresponding release of core inflation all the more closely,” he said.

Sandte, however, was not particularly upbeat about the prospects for Core prices, saying, “Core inflation is firmly anchored below 1% in our view.”

The inflation and growth data was evidence the “moderate recovery” in the Eurozone was extending, according to Unicredit Economist Marco Valli.

“The data confirm that the pace of recovery remains moderate, but rather resilient to shocks – this was the first quarter to fully include possible spillover from the Brexit,” he said.

Like Nordea’s Sandte, however, he saw no possibility of the ECB deciding to halt their stimulus drive as a result of the data:

“All this supports our forecast for QE extension at the current pace when the ECB meets on 8 December,” he concluded.

The Euro Index sold off marginally following the release of the data, falling from 88.67 to 88.62 at the time of writing.