GBP/EUR Forecast to Breach 1.53 by Goldman Sachs

Leading investment bank Goldman Sachs has told clients they are forecasting the pound sterling to euro exchange rate to breach 1.50 in 2016.

This places Goldman Sachs as the most bullish forecasters in sterling / euro according to our tables.

This article is published as the pound to euro exchange rate conversion takes a bit of a dip into month-end, the pair is quoted at 1.4107, a good percentage point lower than seen at last night’s close.

We suspect that the euro exchange rate complex may be enjoying a month-end rally. Month-end flows play a big part in currency moves, particularly with volumes as low as they presently are.

“Month-end investor needs are expected to prove more meaningful to a market still evidently subject to thin summer trading conditions,” says a client note from Lloyds Bank.

We don’t see the decline in the British pound being indicative that any major trends have reversed.

Note that all currency quotes in this piece reference the spot markets, your bank will charge a discretionary spread when delivering FX. An independent provider will however seek to get you closer to the market, in some instances this can result in the delivery of up to 5% more FX.

Pound Sterling Forecast to Outperform the Euro

The pound sterling has enjoyed a steady rate of ascent against the euro through the course of 2015 having rallied from a low of 1.2698 to a high just above 1.44 in July.

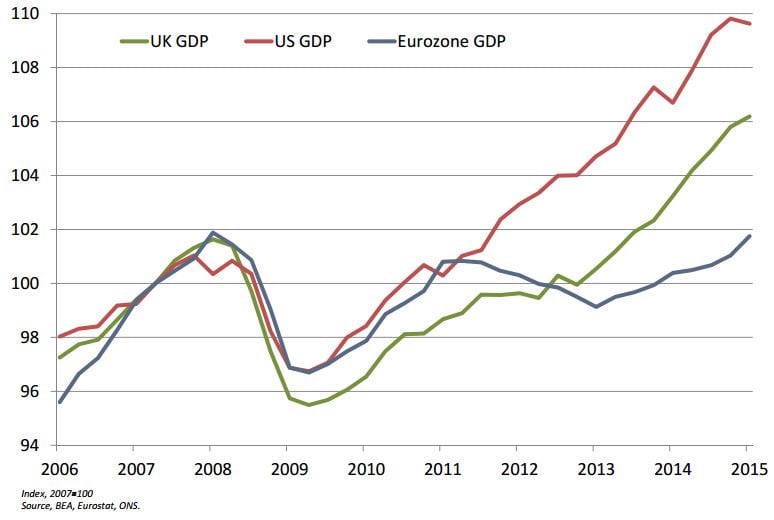

Indeed, there is no reason why we can’t draw the trend-line back to 2013 when currency markets finally bought the message that the UK economy was finally gaining the advantage over its Eurozone peer.

“We believe EUR/GBP’s relatively steady decline reflects the ongoing outperformance of UK activity, firming price pressures in the form of wage growth which is trumping low inflation prints, and incremental hawkishness in central bank communication,” says George Cole at Goldman Sachs.

Goldman Sachs confirm EUR/GBP has been one of the most consistent downward trends since the start of the year.

It is pointed out that while euro-dollar has fallen further over the last 12 months, sterling has strengthened more vs the euro than the dollar since January.

At the same time, the pullback seen in EUR/GBP in March/May 2015 was less severe than in EUR/USD.

“As we have argued, against the backdrop of ECB QE, Sterling should continue to benefit as the Bank of England moves towards exit from its post crisis policy accommodation on the back of a strong economy and tightening labour market,” says Cole.

It is interesting to note that the investment bank does not see a major negative effect on the pound sterling coming via government spending cuts, something other researchers have previously expressed concern over.

Lloyds Bank has been particularly vocal on this point.

“We think the current account deficit overstates the risk to GBP, and the impact from renewed fiscal tightening included in the July government budget will only have modest impacts on the BoE’s growth projections,” says Cole.

Goldman Sachs continue to expect upward pressure on frontend rates further out the forward curve, leading to further currency appreciation vs EUR.

“We see EUR/GBP at 0.65 in 12 months,” says Cole.

In pound to euro terms this equates to a rate of 1.5384.

Rising interest rates in the United States is also expected to play a pro-GBP role – “in the case that the Fed hikes first, broadbased USD strength should help alleviate pressure on GBP in tradeweighted terms, making it easier for the Bank of England to tighten policy, for the UK curve to reprice higher, and for GBP to strengthen against the EUR.”

Near-Term Outlook: PMI’s Dominate Data Calendar, Super-Thursday at Bank of England

Turning to the week ahead for the pound sterling, the release of manufacturing, construction and services PMI data will be watched closely by policy makers for signs that the UK economic recovery continued in July.

The market is leaning towards a small improvement in the UK manufacturing PMI, but the data is pointing to a weaker print.

“We see the UK manufacturing PMI falling from 51.4 to 50.9, as broadly softer regional surveys and the cumulative effects of GBP strength continue to weigh on sentiment,” says Richard Kelly at TD Securities in London.

This would initially support the current market consensus for a 0.5pp decline in the services PMI suggests Kelly.

The big event to watch however will be Super-Thursday at the Bank of England where the August policy decision, the minutes of that meeting and the Quarterly Inflation Report are release. For an in-depth look at this please see here.