GBP/EUR Rate Might Struggle to Regain its 2024 Highs

- Written by: Gary Howes

Above: Bank of England Governor Bailey believes rates can be cut and inflation will still fall to target. File image. credit: Bank of England.

The Pound to Euro exchange rate is a 'sell' recommendation with some strategists and will unlikely regain its 2024 highs as the Bank of England sharpens the knife for a June interest rate cut.

Investors see the odds of a June cut at just over 50%, meaning it is still not fully expected. This leaves scope for further adjustment in the coming weeks, which will weaken the Pound Sterling.

By contrast, the market is fully priced for the European Central Bank to cut in June, ensuring the Euro is relatively insulated from the eventual move. This leaves the Pound as the moving piece in the GBP/EUR outlook puzzle.

"We are recommending a new long EUR/GBP trade idea to reflect our view that risks are tilted to the downside for the GBP in the near-term," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank. "We continue to see room for the UK rate market to price in more than two rate cuts from the BoE this year."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Last week's Bank of England policy update delivered a dovish policy signal as Dave Ramsden joined Swati Dhingra in arguing for an immediate 25 basis point cut.

"Ramsden has a history of leading the way in voting for a change in policy as he was one of the two dissenters who started voting for a hike in November 2021," says Halpenny.

Huw Pill, a key player on the MPC, signalled on Tuesday he might be ready to join Ramsden in voting for a cut at the next meeting. Pill told an ICEAW conference that an interest rate cut this summer was likely and that the Bank could cut rates before inflation had fallen comfortably back to the 2.0% target.

"It's important to recognise we can cut bank rate, while still leaving some restriction in the system," he said. This indicates the Bank believes the data does not necessarily have to be unambiguously supportive of rate cuts in order to trigger a first move.

The Bank last week downgraded its inflation forecasts and sees headline inflation comfortably below 2.0% in the medium term based on an assumption that it will cut rates twice before year-end. This means it believes it can cut twice without compromising inflation's descent to below the 2.0% target.

"We still expect an earlier BoE rate cut in June than the market is expecting for a cut in August or September," says Halpenny.

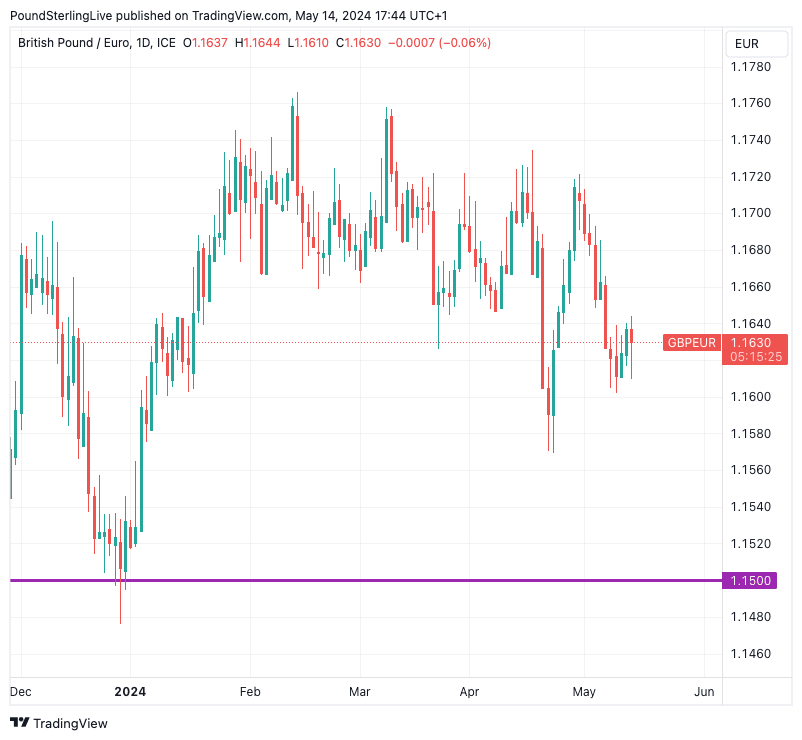

MUFG targets a move in Euro-Pound to 0.87, which gives a Pound-Euro target of 1.15.

Above: GBP/EUR daily. Track GBP/EUR with your own custom rate alerts. Set Up Here

Another downside risk for the Pound would involve the market upping the total number of cuts it expects from the Bank over 2024 (currently two are expected) and 2025. The more a central bank cuts relative to others, the more its currency will be penalised.

"The Bank will first cut rates at the next meeting in June and that, due to inflation falling to only 1.0% later this year, the Bank will reduce rates to 3.00% next year rather than to 3.75-4.00% as currently expected by investors," says Paul Dales, Chief UK Economist at Capital Economics.

Governor Andrew Bailey told reporters last week that UK interest rates would need to be cut by more than the two 25bps cuts the market currently expects.

"A fall in headline inflation to below 2% in the spring, a further deterioration of the labour market and subdued GDP growth is likely to see the MPC cut fairly quickly once it starts," says Daniel Vernazza, Chief International Economist at UniCredit.

Above: The Bank of England's forecasts show it believes it can cut rates and still achieve its 2.0% inflation target.

However, economists at ING Bank say they still prefer August as a starting date for the Bank's rate cutting cycle, with economist James Smith saying last week's Bank of England meeting was no smoking gun for a June cut. He concedes a "distinctly more optimistic flair" regarding the inflation outlook means a June cut is still a possibility.

The Bank reiterated in its policy guidance that it will continue to monitor the data before considering a rate cut, and there are no less than two inflation releases before the late-June decision. It would likely take two consecutive upside surprises to push the first cut until August.

An upside surprise in next week's inflation data - particularly the services CPI print - could see recent June rate cut bets unwind somewhat, allowing Pound-Euro to recover back into the middle of the 2024 range which is closer to 1.17.