GBP/EUR Week Ahead Forecast: We're 60/40

- Written by: Gary Howes

Image © Adobe Images

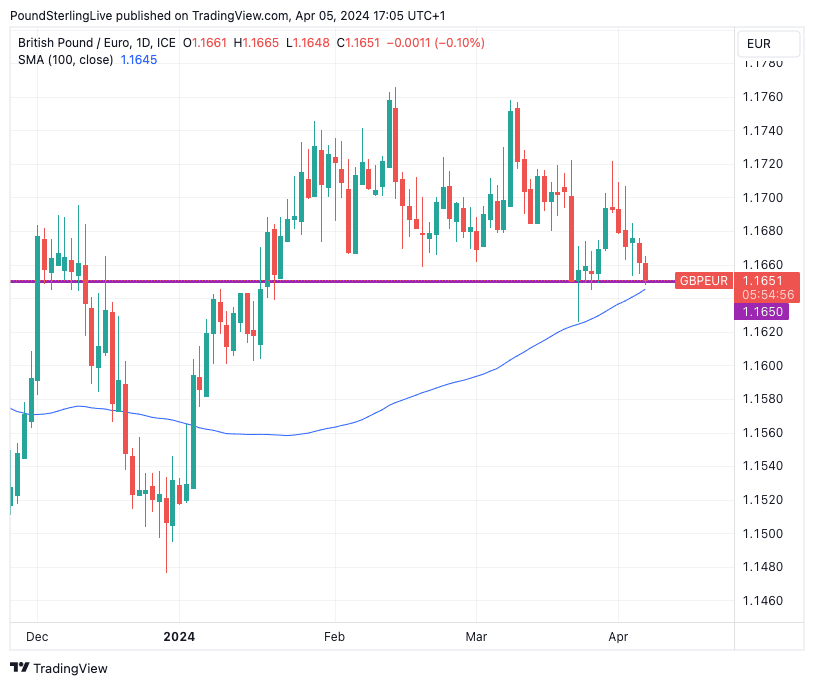

We expect Pound Sterling to recover against the Euro this week, but our confidence in a rebound is lower than at the same point just one week ago.

The Pound to Euro exchange rate has certainly acquired a heavy feel recently having fallen to the bottom of the range it has inhabited for the past two months.

Our immediate query is whether we are about to see a break of the range (finally!) or a mean reversion back into the range.

Of course, those wanting a stronger Pound will be dismayed to see that talk of an exit from the sticky quagmire that has dominated proceedings for much of 2024 might be to the downside.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

That said, these market participants can take some comfort from two factors:

1) there is some decent support in the immediate vicinity, and participants might not want to push into clear air just days ahead of the European Central Bank's April meeting.

2) this has been a dependable mean-reverting exchange rate for most of 2024.

The technical support comes in the form of the lower boundary of the range at approximately 1.1650 and the nearby 100-day moving average (1.1645). Both could disarm the sellers ahead of the European Central Bank (ECB) meeting on Thursday.

Track GBP/EUR with your own custom rate alerts. Set Up Here

Regarding mean-reversion, the average level of the past 50 days (the approximate length the sideways range has been intact) has been 1.17, and a return to this point is our favoured scenario at this juncture. We don't see the clear-cut evidence of a divergence in the fundamental setup between the Eurozone and UK being in place to trigger a meaningful break.

That said, confidence in this mean-reversion behaviour is certainly lower (this time a week ago we would have been 80/20, today we are 60/40) for the simple fact there is greater scope for the market to reprice Bank of England rate cut expectations than there is for a repricing in European Central Bank expectations.

Simply put, the market has greater scope to raise the odds of a June rate cut from the Bank of England, while it is already fully priced for the European Central Bank to do so. But the Bank of England story will only come into play next week when the big-hitting data drops.

This week's ECB meeting is the calendar highlight for Pound-Euro, and for the exchange rate to move to 1.17 and above we might need to see the ECB say the kind of things that encourage the market to bet on further rate cuts in the months following a June kick-off.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

This could be a tall ask for those hoping for a weaker Euro: the scenario we anticipate sees ECB President Lagarde gently verifying market consensus for a June rate cut while warning further cuts are entirely data dependent.

This should generate enough doubt to keep the Euro sellers at bay and potentially push Pound-Euro lower.

There is some interest on the GBP side in the form of Friday's ONS release of February GDP figures.

After recording 0.2% month-on-month growth in January 2024, the market expects the UK economy expanded 0.1% in February.

The rule of thumb is that an undershoot in the figures would weigh on the Pound as this would encourage markets to bet on a more aggressive rate cutting path from the Bank of England.

"We think the UK economy remains on track for a fairly resilient first quarter of modest growth, shaking off the recession seen at the end of 2023. Although a little disappointing, the absence of growth within the services sector that we forecast in February coincides with our view that the lack of stronger growth is not necessarily a bad thing for the BoE in the last throes of its battle with high inflation," says Gabriella Willis, UK economist at Santander CIB.

She explains the Bank might view modest growth as perfect in the sense it will allow it to proceed with its first interest rate cut mid-year.

"We suspect that slow growth in the UK economy will give the BoE enough confidence that the UK is on track for a soft landing, 'disinflating' without a much weaker economy," says Willis.

The GDP numbers are therefore not a major concern for the Bank, instead it will be the following week's inflation and labour market statistics that will have the greater market-moving potential.

If the Pound-Euro can defend the 1.1650 line in the sand, a rally back towards 1.17 over the remainder of the month will be on the cards if inflation and/or job numbers beat expectations.