GBP/EUR Week Ahead Forecast: Looking for a Fightback

- Written by: Gary Howes

- UK wage data due Tuesday

- Inflation release on Wed. is week's highlight

- Retail sales to close off the week

Image © Adobe Images

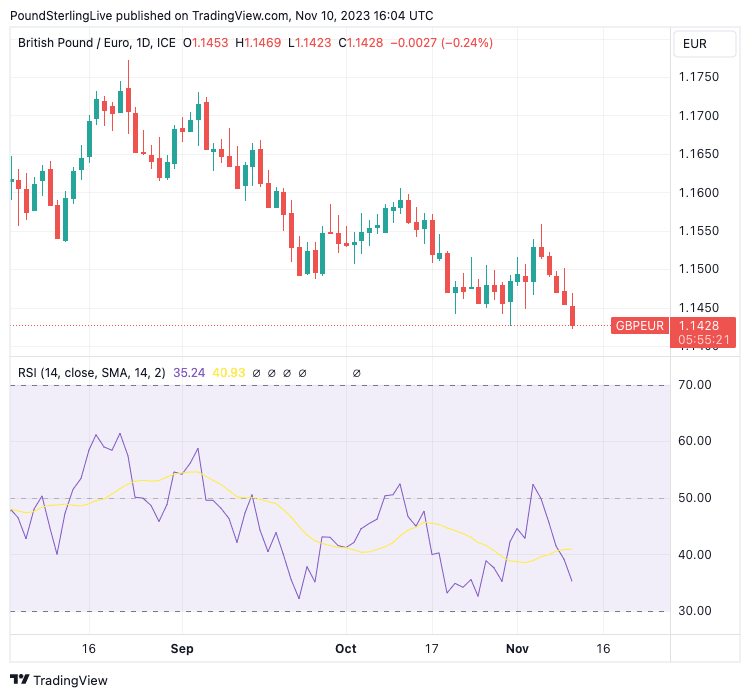

The Pound to Euro exchange rate remains locked in a multi-week downtrend that must be respected; however, signs of emergent oversold conditions could combine with any positive UK data surprises to help a recovery over the coming days.

Our previous week ahead forecast reported an improved outlook for Pound Sterling, thanks to the improvement in market sentiment and the solid 0.40% advance in GBPEUR on Friday, November 03, that materially improved the technical setup.

The call looked good when the pair went as high as 1.1540 on Monday. But this was a false dawn if ever I have seen one: bulls were spanked over the coming days as we saw a rare run of five daily losses.

The exchange rate closed at a 25-week low, leaving momentum indicators suppressed and advocating for further losses and we would be inclined to respect the downtrend that is in place.

But the pair's Relative Strength Index (RSI) is approaching oversold levels at 30 (see the lower pane in the bottom chart). Recent history shows this pair tends to get uncomfortable at such levels, and given the relatively benign macro backdrop for this pair, a correction in the RSI is called for.

Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

Therefore, a chance of a snap back over the coming days is possible, and we would favour a move back to 1.1475, which has been the pair's centre of gravity since mid-October when the sell-off from the August highs faded.

It is also worth noting that the GBP-EUR decline has overshot the fall in the UK-German two-year spread differential, which would also call for some caution in chasing this pair lower.

For now, however, we would view any strength in the exchange rate as being short-lived, so near-term Euro buyers should be quick to jump on any gains.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"EURGBP's high close on the week should solidify the break out from the recent trading range and target additional gains in the weeks ahead towards 0.89," says Shaun Osborne, Chief Currency Strategist at Scotiabank.

Flipping this analysis onto a Pound into Euro perspective, losses towards 1.1236 are expected by the Scotiabank analyst "in the weeks ahead".

This week is busy with earnings, inflation and retail sales data on tap for the Pound.

Earnings are due at 07:00 GMT on Tuesday, with the consensus looking for a reading of 8.3% in September. Should the outcome be above this, the Pound could find some support.

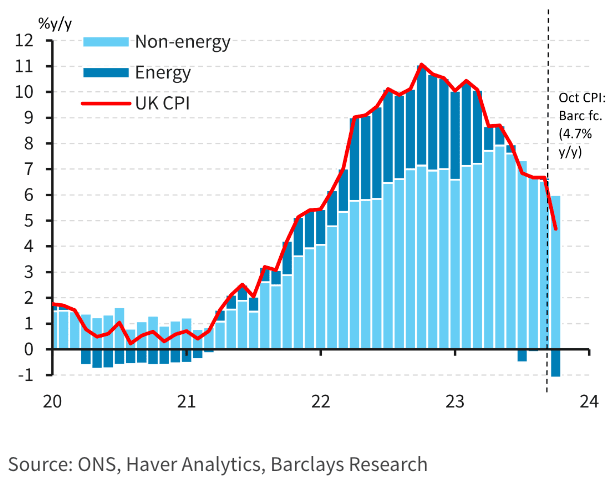

The week's highlight is Wednesday's inflation report, due at 07:00, with the market preparing for a sizeable drop to 4.5% year-on-year from 6.7%. Should the outcome be above this figure, the Pound could be supported, although we would expect any strength to be limited.

However, should inflation undershoot, the market would likely boost bets for rate cuts in 2024, resulting in further weakness in the Pound.

"The fall in household energy bills, coupled with base effects, is set to drive a sharp decline in headline inflation in October, though we also expect moderation in core inflation with both core goods and services easing," says Abbas Khan, an economist at Barclays.

Above: "Falling energy contribution the primary driver of the fall in headline CPI in October; but non-energy components to ease too" - Barclays.

"A drop in the Ofgem Price Cap alongside slowing food and core goods momentum should result in headline CPI dropping by close to 200bps," says Sanjay Raja, Senior Economist at Deutsche Bank.

Deutsche Bank's own Price Survey Tracker points to another 150bps fall in headline inflation by springtime, and the bank forecasts continue to show headline CPI printing closer to 3% y/y by April 2024.

Certainly, lower inflation will boost consumer buying power and sentiment, which is supportive of the economy and the outlook. But it remains debatable whether currency markets are willing to price an improved macroeconomic story into the Pound.

More likely, any boost to market expectations for Bank of England rate cuts stemming from below-consensus inflation numbers will likely weigh on the UK currency.

"For now, we continue to see some downside risks to the Bank of England's CPI projections, which we think should open the door for modest rate cuts by spring time next year," says Raja.

Above: What the Bank of England is forecasting. Image courtesy of Deutsche Bank.

Retail sales are anticipated to have fallen 1.0% in the year to October and 0.9% in the month.

Should the outcome be above these estimates, the Pound could rise, although gains would likely be limited. Instead, risks are tilted to the downside in the event the outcome is below estimate.

"Retail sales were surprisingly soft in September, dropping 0.9% m/m. But we think this is largely noise and expect a decent rebound in October. September's sharp falls in sales in the non-food and non-store categories look particularly odd, and we expect these sectors to have largely made up those losses in October," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

In the Eurozone, the focus turns to the release of third-quarter GDP, due for release at 10:00 GMT on Tuesday. The market is looking for a reading of 0.1% year-on-year for the third quarter, down from 0.5% previously.

"The market focus with regards to Europe is likely to be on the upcoming GDP releases. High-frequency data suggest the risks for the preliminary GDP figures for 3Q—advance figures earlier pointed to –0.1% q/q—could come in weak. The release is likely to reveal that the industrial sector, in particular, continues to struggle," says Dominic Schnider, strategist at UBS.

"As for the currency, we think the data will limit euro strength in the very near term," he adds.

German ZEW economic sentiment surveys are in focus at the same time, with the market looking for the current conditions to read at -75 in November, a slight improvement on October, and the sentiment survey to read at 2.5, up from -1.1.

Such an improvement in sentiment could confirm the theory that the nadir in negative sentiment has been passed, a belief that has boosted the Euro over recent weeks.

European Central Bank (ECB) President Christine Lagarde is in focus on Friday as she is due to speak at 08:30 GMT.

"We expect ECB speakers to continue to push back against market rate cut expectations and reaffirm their commitment to get inflation under control. The EUR could benefit to the extent that the comments encourage rate investors to pare back rate cut bets," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Last week, we saw the Pound struggle after the Bank of England's Huw Pill validated market expectations for UK rate cuts from about mid-year, while the Dollar rallied after Federal Reserve Governor Jerome Powell fiercely fought back against any talk of rate cuts.

Central bank speak matters, and the Euro could move higher or lower depending on whether Lagarde does a Pill or Powell.