GBP/EUR Exchange Rate Recovery Could Reach 1.1560

- Written by: Gary Howes

- EUR struggles on news Germany in recession

- UK long-term yields fall following inflation data

- But yield curve inversion can support GBP says ING

Above: Chancellor Hunt will find the cost of borrowing dearer as investors reject the UK's long-term bonds, however, ING says this can help support GBP/EUR. Image: HM Treasury, Gov.uk

Pound Sterling remains supported against the Euro following news that Germany has entered recession while analysts say the market's recent move to price in further Bank of England interest rate hikes can continue to support the UK currency.

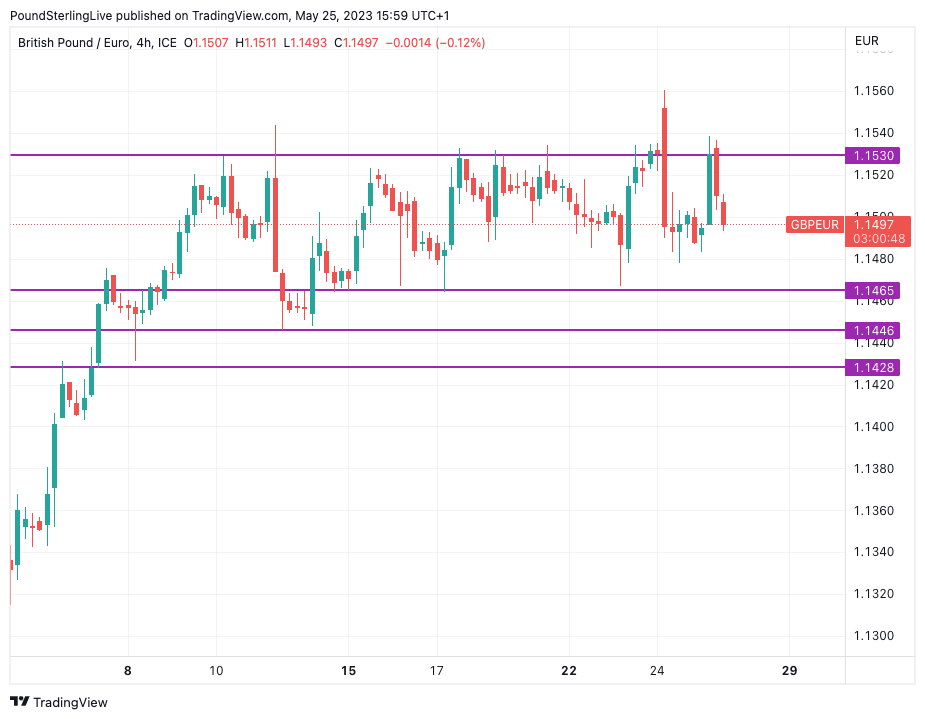

The Pound to Euro exchange rate (GBPEUR) looks firm above 1.1475-1.15 after fears about the health of the Eurozone's largest economy were realised as Germany revised its Q1 2023 GDP downward to -0.3% quarter-on-quarter, officially entering a technical recession after contracting in the final quarter of 2022.

Weak household consumption, squeezed by higher inflation, and lower government spending as COVID-19 schemes rolled off have contributed to this downturn.

HSBC economists suggest there is little evidence of a quick recovery from recession, with weaker sentiment surveys and struggling manufacturing data supporting this view.

Joe Manimbo, Senior FX Analyst at Convera says the Euro has fallen back after fears about the health of the Eurozone's largest economy were realised. "Data, meanwhile, continues to paint a worrisome picture of second-quarter growth which may expose the euro to increased downside risk over the near term," he says.

Nevertheless, the news from Germany was not enough to propel GBPEUR beyond 1.1530 on any meaningful basis and the pair looks set to struggle to gather much upside traction in the near term.

Those looking to buy euros might therefore continue to struggle to attain 1.15 with their currency payment provider should GBPEUR remain capped at 1.1530 and it would likely take a stable move into 1.1540-1.1550 for such a rate to become available with the more competitive providers.

The charts do however suggest the pair remains relatively well supported with local buying interest forming at 1.1465 for much of May and for now, therefore, it appears there is little appetite for the pair to extend lower.

Above: GBPEUR at four-hour intervals.

There were however concerns expressed by some analysts that the Pound was increasingly vulnerable to a deeper fall following the release of above-consensus inflation figures this week, but with markets settling we see the currency remains relatively well supported, for now at least.

The inflation data surprised markets by coming in above expectations, prompting a revision of the expected peak in the Bank of England's base rate.

Markets now see up to 90 basis points of hikes, with one of the UK's largest lenders saying Bank Rate looks set to end the cycle at "at least" 5.0%.

Asmara Jamaleh, an economist at Intesa Sanpaolo, suggests that the potential rate hike "should aid in a subsequent recovery of the Pound".

Expectations for interest rate hikes in the near term, followed by rate cuts over the medium-to-long term means short-dated UK bonds are yielding significantly more than long-dated bonds.

This is creating an inversion of the UK sovereign bond (gilt) curve.

Legal & General Investment Management - the UK's largest investment manager - said it is staying away from long-term investments in gilts after Gilt prices slumped following the inflation data release.

But Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank, says this inversion of the yield curve is significant in that it can support the Pound against the Euro.

"Our debt strategists think the Gilt curve should invert further. While this is not welcome news for UK growth prospects, in the past we have found inverted yield curves positive for currencies," says Turner.

ING had previously held a summer target for EUR/GBP near 0.8800, but Turner says this may now be challenging to achieve, with a bias now leaning towards a retest of the 0.8650 area.

From a Pound-Euro perspective, the previous target of 1.1360 has given way to a higher target of 1.1560.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes