Pound Sterling in Business Confidence Boost, Euro Eyes German Inflation Numbers

- Written by: Gary Howes

- GBP looks to end April on front foot

- GBP underpinned by UK business confidence pick-up

- Eurozone GDP shows soft growth in Q1

- EUR could be expensive near current levels says Crédit Agricole

Image © Adobe Images

Pound Sterling was on course to end April on a strong note as it rose across the board, aided in part by news UK business confidence rose to a one-year high amidst improved optimism about the economic outlook.

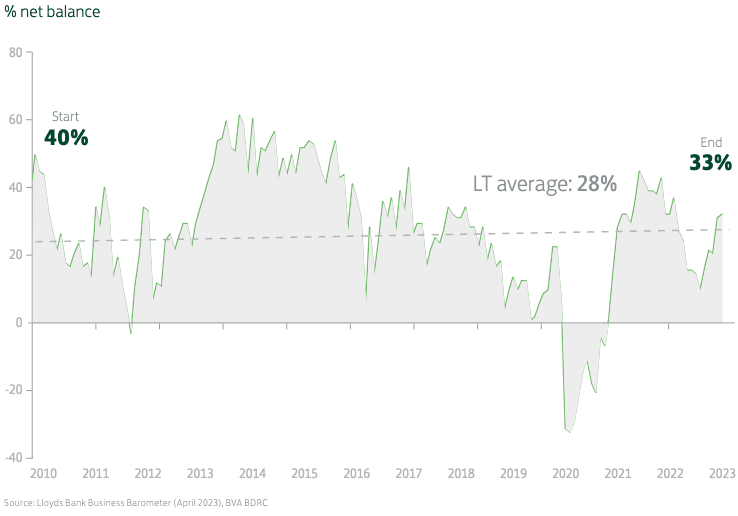

According to the Lloyds Bank Business Barometer UK business confidence rose to 33% - its highest in 11 months - and remains above the long-term average of 28%. The data is the latest to suggest the UK economy is performing better than economists had anticipated, ensuring improved sentiment towards the Pound.

Inflationary pressures were apparent as wage expectations ticked higher as hiring intentions improved for the fifth month in a row.

Indeed, the share of firms planning to raise their prices remains elevated, reports Lloyds.

The data suggests UK inflation will remain sticky over the coming months and will potentially disappoint the Bank of England which has long forecasted a sharp fall in inflationary pressures in 2023.

The data is therefore consistent with a need for further rate hikes, which can support UK bond yields and Pound Sterling exchange rates.

The Pound to Euro exchange rate rose to a high of 1.1386, its highest level since mid-April. The Pound to Dollar exchange rate meanwhile rose to 1.2544, a mere pip below the multi-month high.

Above: "Confidence above the long-term average" - Lloyds Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Euro was softer after it was reported the Eurozone economy eked out growth in the first quarter of the year but looking at the details reveals Germany is proving a drag as peripheral nations such as Spain and Italy see robust growth.

Eurozone GDP rose 1.3% year-on-year in the first quarter said Eurostat, which was slightly less than the consensus was looking for at 1.4%. It also marks a slowdown from Q4 2022's 1.8% jump.

Germany disappointed with a 0.0% q-q figure, with the consensus looking for growth of 0.3%, Q4 2022 GDP was meanwhile revised lower to -0.5% q-q, after a preliminary first estimate of 0%.

German states are meanwhile reporting inflation data, with North Rhine-Westphalia figures printing at 6.8% in March, suggesting the national figure was likely to print in line with forecasts for a 7.3% year-on-year increase. The national inflation figure is due at 13:00 BST, which could offer some market volatility, and comes just days ahead of the European Central Bank's (ECB) May 04 interest rate decision.

The Euro remains one of the better-performing currencies for April as investors bet the ECB will raise interest rates by more than the Bank of England, U.S. Federal Reserve and all its G10 peers over the coming months as it battles elevated inflation levels in the Eurozone.

"Markets seem to favour the euro among other currencies in instances when the dollar falls on the back of Fed dovish repricing and US banking concerns. Our perception is that investors favour currencies that can offer both an ongoing domestic tightening cycle and still some room for a hawkish surprise at the coming meetings," says Francesco Pesole, FX Strategist at ING Bank.

Image © Alfred Yaghobzadeh, European Commission Audiovisual Services

The Pound to Euro exchange rate will choppy around 1.13 amidst regular bouts of demand for the single currency with the focus falling on the ECB's May 04 decision.

Money market pricing shows investors are geared for a 30 basis point hike, which effectively means the market is unsure as to whether the ECB will go with a 25 or 50bp move.

A 25bp move could disappoint against 'hawkish' expectations and would therefore potentially result in Euro weakness, allowing the Pound to recover ground in early May.

But a 50bp hike combined with guidance that further hikes are incoming could prompt a more determined break below 1.13. "It feels as if the euro is the market's preferred currency," says Antje Praefcke, FX Analyst at Commerzbank. "The ECB seems simply perceived as more restrictive at present thanks to the many comments from hawks on the board."

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

"The fact CHF and EUR lead the pack instead suggests that old-school central bank relative hawkishness concerns are the real drivers within the G10 space," says Shahab Jalinoos, head of FX research and strategy at Credit Suisse.

To be sure, GBP/EUR is not experiencing runaway declines, largely because the Bank of England is expected to raise interest rates on two more occasions in 2023 with no interest rate cuts expected until 2024 is well underway. (The Fed is expected to start cutting in the second half of the year).

Analysis from French investment bank Crédit Agricole meanwhile finds the Euro is now richly valued with "a lot of positives in the price ahead of the ECB".

Positioning data reveals the Euro is also the "biggest long" in G10 FX markets. "The EUR is looking expensive vs the USD and GBP according to our fair value models," says Valentin Marinov, head of FX research at Crédit Agricole.

He says next week’s ECB meeting might therefore do little to advance the Euro from current levels.

"FX investors could conclude that many ECB-related positives are already in the price of the EUR. We further believe that the ECB-Fed policy divergence priced in by rates markets at present is quite excessive and expect it to correct lower in coming months," says Marinov.

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |