GBP/EUR Week Ahead Forecast: UK Budget, Wages and ECB Decision Eyed

- Written by: James Skinner, Contributions from Gary Howes

- GBP/EUR volatility possible in wide March range

- As UK budget & wage data decides BoE outlook

- ECB decision & forecasts pose risk to GBP/EUR

Image © Adobe Images

The Pound to Euro exchange rate has lacked any strong directional impulse in recent trade but could be volatile within its March range this week thanks to a busy calendar that includes UK jobs and wage data, the Spring Budget and the European Central Bank's interest rate decision and policy update.

Sterling was a middle-of-the-road performer among major currencies for the week to Monday after ceding ground slightly to an outperforming Euro even after a better-than-expected set of January GDP figures from the UK on Friday.

"January (+0.5%) masks a story of divergent fortunes across sectors with broad-based resilient services activity, but continued weakness in manufacturing and construction activity, likely reflecting the impact of monetary tightening in rate-sensitive sectors," says Abbas Khan, an economist at Barclays.

"We think that the Chancellor will refrain from material, permanent fiscal easing next week when he delivers his Spring Budget, and instead will make use of the better near-term picture to deliver modest and largely temporary easing," Khan and colleagues write in a Monday research briefing.

January saw a year-end fall in output substantially reversed and partially vindicated a recent improvement in market sentiment about the outlook for the UK economy but much about the performance of Sterling this week will be determined by the content of Wednesday's budget.

Above: Pound to Euro rate shown at 2-hour intervals with selected moving averages. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

With the economy more resilient than anticipated, the Chancellor is in a better-than-expected position for Wednesday's annual fiscal update but he is also constrained by lingering risks of inflation and Office for Budget Responsibility pessimism about the long-term prospects of the economy.

"We think Hunt will use some of this improvement to continue the long-running freeze on fuel duty for another year, scrap plans to reduce the generosity of the Energy Price Guarantee in April, and perhaps give one off-bonuses to public sector workers," writes Andrew Goodwin, chief UK economist at Oxford Economics, in a Friday research briefing.

"But politics points towards delaying any significant 'giveaways' until closer to the next general election," he adds.

While Wednesday's budget is the highlight of the week for Sterling, it is preceded by the release of employment and wage data for January, which is likely to be influential of next Thursday's Bank of England (BoE) interest rate decision and the outlook thereafter.

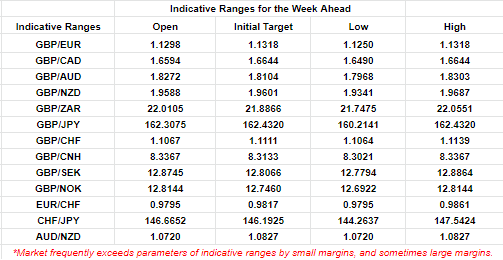

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"We look for a 30K three-month-on-three-month rise in unemployment in January. This probably would not lead to a rise in the unemployment rate from December's 3.7%, but would suggest it is on track to increase," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

"Meanwhile, we think the headline rate of year-over-year growth in wages excluding bonuses fell to 6.6%, from 6.7% in December. Finally, we look for a modest 30K month-to-month increase in the PAYE measure of employees in February," Tombs writes in a Monday briefing.

The market consensus looks for average earnings, with bonuses, to have increased 5.7% in the year to January and for employment to have risen 40K in the three months to January.

Additionally, the Pound to Euro rate is also likely to be highly sensitive on Thursday to the content and implications of the latest European Central Bank (ECB) inflation forecasts and any guidance given about the outlook for interest rates on the continent.

This is after Eurostat figures indicated that inflation has been stubborn in remaining little changed for February when the more important core inflation rate surprised on the upside by rising from 5.3% to 5.6% in defiance of ECB expectations for moderation over January and February.

"Another 50bp increase, which would increase the deposit facility rate to 3%, has been widely telegraphed. Meanwhile, the debate among rate-setters on the policy outlook beyond March looks set to intensify," says Hann-Ju Ho, an economist at Lloyds Commercial Banking.

Above: Pound to Euro rate shown at daily intervals with selected moving averages. Click image for closer inspection. (To optimise the timing of international payments you could consider setting a free FX rate alert here.)