GBP/EUR Week Ahead Forecast: Bottom and Happier Equilibrium Nearby

- Written by: James Skinner

- GBP/EUR risks further losses short-term

- But bottom now likely no lower than 1.07

- After EUR/USD dips further below parity

- Losses indicate emerging risk premium

- Reflecting inflation, perceived credit risks

- After UK Gov bets big on growth budget

- Chance of early BoE meeting & rate rise

Image © David Holt, Accessed: Flikr, Licensing Conditions: Creative Commons

The Pound to Euro rate has sustained heavy losses in recent trade but could fall further this week in search of a new equilibrium from which Sterling assets are able to offer the UK's would-be economic sponsors a sufficient risk-adjusted return, although the author suspects that it's unlikely to fall any further than 1.07.

Sterling sustained heavy losses against the Euro on Friday and came under further significant pressure from the Asia open on Sunday evening in an apparent follow-through response to a government budget and economic plan that almost certainly means an exceptionally large increase in UK government debt supply hitting the market.

GBP/EUR broke below 1.10 with gusto in overnight trade after falling from levels above 1.14 just last Friday morning, although if the author reads the recent price action and current market environment correctly, then Sterling could be likely to bottom anywhere above 1.07 during the opening half of this week.

"With the new fiscal package of tax cuts, gilt yields are hitting new highs and the cable [GBP/USD] is selling off. This is because more demand will depress real rates [inflation-adjusted yields] in the UK, if not accompanied by productivity gains," says Chester Ntonifor, chief FX strategist at BCA Research.

"We are maintaining our long EUR/GBP trade. On cable [GBP/USD], downside remains but we will be buyers at 1.05," Ntonifor said on Friday.

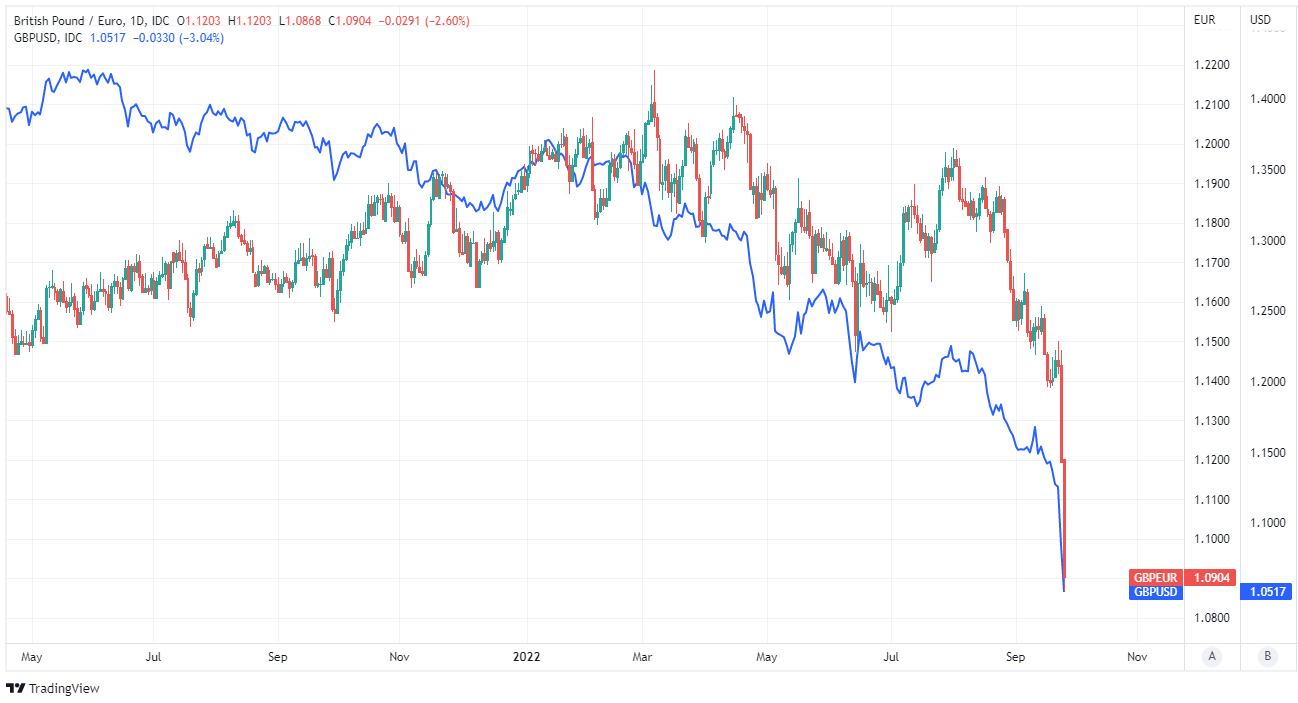

Above: Pound to Euro rate shown at daily intervals alongside GBP/USD. Click image for closer inspection.

Above: Pound to Euro rate shown at daily intervals alongside GBP/USD. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The market's reaction is not difficult to rationalise or understand given that significant extra supply of UK government bonds is coming to market at a point when high levels of inflation are already weighing heavily on bond prices and there has been a widespread perception around the market that UK interest rates are not high enough.

"The severity of the rise in gilt yields last week likely will be unnerving the Treasury. At their current level, yields imply that debt interest payments in 2023/24 will total about £94B, almost double the £50B forecast by the OBR in March," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

Friday's budget has lifted the government's Net Financing Requirement (NFR) by an estimated £72.4 billion, to £234BN, for 2022 and that extra supply of bonds will be hitting the market at a point when the Bank of England (BoE) is also about to become an active seller of UK government bonds.

This was perhaps always likely to see investors seeking enhanced returns by demanding lower Sterling exchange rates and lower asset prices in order to play ball, which is what appears to be happening.

That is in some ways, and to some extent, exactly what the free-floating Sterling exchange rate was designed to do way back in the 1970s.

Above: Pound to Euro rate shown at weekly intervals alongside GBP/USD. Click image for closer inspection.

"We think sterling will bear the brunt of the economic adjustment to the terms of trade shock the UK is going through: we forecast it to reach 1.05 against the dollar," says Jonas Goltermann, a markets economist at Capital Economics.

Some commentators will almost inevitably paint this as a crisis for Sterling but, in theory, if the market is anything like what it's cracked up to be then there ought to be levels somewhere at which the Pound and related assets become cheap enough to begin selling themselves.

These new 'equilibrium' levels and that market outcome may even be pretty close now and increasingly likely with Sterling having fallen briefly beneath 1.05 against the Dollar, leaving GBP/USD trading at a substantial -21% discount to its 2022 starting levels.

"Though the market reaction has been negative, we think it's unlikely that the government's approach will cause sterling to collapse or create problems in selling gilts," writes Andrew Goodwin, chief UK economist at Oxford Economics, in a Friday research briefing.

"But the absence of a credible long-term economic and fiscal strategy does leave UK assets vulnerable, with sterling the most obvious release valve. Despite the likelihood of more aggressive monetary tightening, we expect sterling to continue to drift lower to around $1.05 in the short-term," he added.

Above: Pound to Euro rate shown at weekly intervals alongside GBP/USD and EUR/USD. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

For GBP/EUR, however, a lot also depends on the single currency after losses were limited last Friday when the latter pushed further below parity against the Dollar and in part because any EUR/USD rebound this week would be likely to act as an additional burden for Sterling.

Such a rebound could see GBP/EUR falling toward 1.07 at times, although it's hard to fathom how the Pound would end up trading lower than there.

Nonetheless, the budget and depreciation of the Pound are likely to have significant implications for the Bank of England's inflation outlook and interest policy, which are likely to be back in focus for the market this week.

The BoE raised Bank Rate by half a percentage point to 2.25% just last week but warned that it could "respond forcefully" to anything that threatens to lift inflation further and this is one of things that the large fiscal giveaways contained in last Friday's budget will be likely to do.

It's for this reason that policymakers at the BoE could be likely to respond by lifting Bank Rate aggressively following their next meeting in November and there may even be a risk of that meeting being brought forward as soon as this week or next in light of the market's response to the budget.