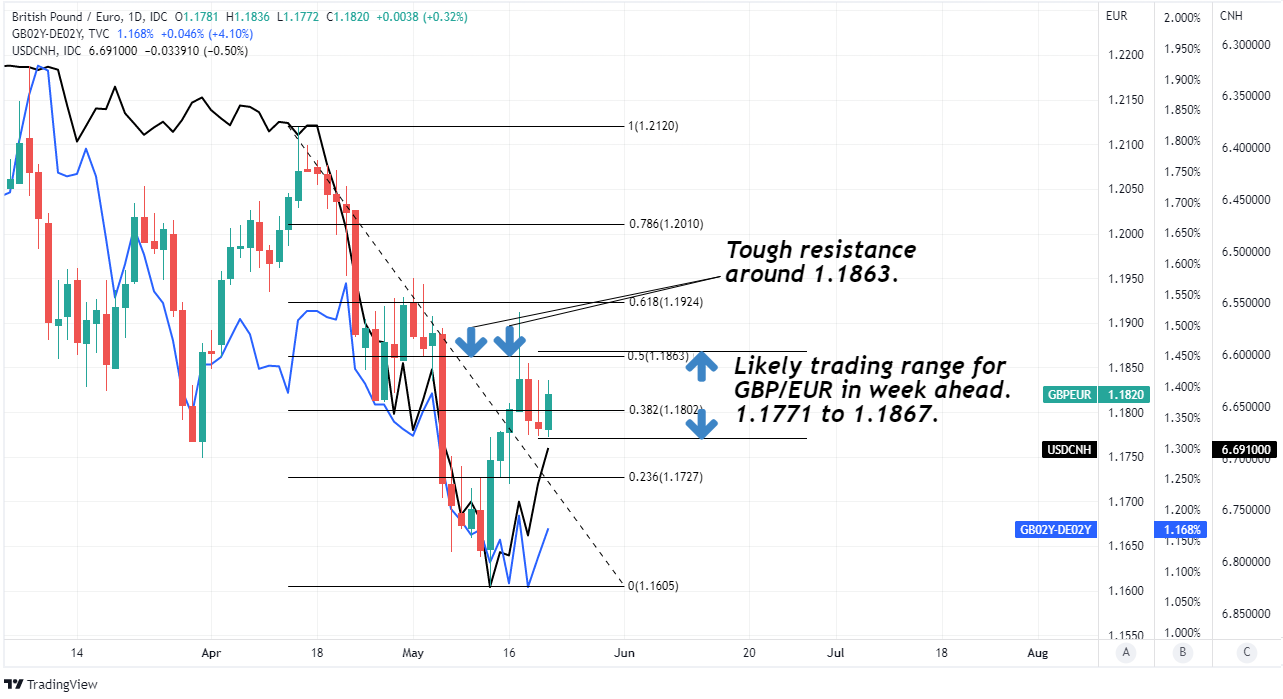

GBP/EUR Week Ahead Forecast: 1.1771 to 1.1867 Range Ahead

- Written by: James Skinner

- GBP/EUR supported near 1.1771 short-term

- May struggle with resistance around 1.1860

- Loose 1.1771-1.1867 range likely up ahead

- Recent UK data balm for BoE policy outlook

- China story & RMB rebound also supportive

- BoE speech, PMI surveys, RMB all in focus

Image © Adobe Images

The Pound to Euro rate has lifted off early May lows but could be likely to consolidate its recent gains within roughly a 1.1771 to 1.1867 range over the coming days due in part to the prospect of a further rebound by China's Renminbi, which would have positive implications for Sterling and the Euro.

Pound Sterling traded briefly above the 1.19 handle against the Euro last week after a volley of Office for National Statistics figures furthered a supportive turn in UK government bond yields.

These figures included first quarter employment data as well as inflation and retail sales numbers for April, which suggested that wages pay packets grew strongly as household spending continued apace even with inflation having topped 9% last month.

The market appeared to interpret this as meaning there’s a risk of the Bank of England (BoE) revising its inflation forecasts higher and continuing to lift Bank Rate during the months ahead, which would explain the supportive turn higher in the spread - or gap - between UK and German government bond yields.

“Textbooks suggest that the prospect of a more aggressive interest rate cycle from the BoE is a positive near term factor for the pound. However, insofar as this would increase the likelihood of a hard landing for the UK, upside potential for GBP on more rate rises could turn out to be limited,” says Jane Foley, head of FX strategy at Rabobank, writing in a Friday research briefing.

Above: Pound to Euro rate at daily intervals with Fibonacci retracements of April decline indicating likely areas of technical resistance for Sterling. Shown alongside inverted or upside down Dollar-Renminbi rate and the spread - or gap - between 02-year UK and German government bond yields (blue line). Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound remained buoyant last week despite European Central Bank (ECB) policymakers also indicating they are increasingly minded to lift Eurozone interest rates in the near future, which has lifted Eurozone bond yields sharply but not by enough to dampen market appetite for Sterling.

“We would not get carried away with the sterling recovery, however. Sterling is showing a high correlation with risk assets – trading as a growth currency – and the outlook for risk assets will remain challenging for the next three to six months probably,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING. (Set your FX rate alert here).

Sterling could benefit further this week and as soon as Monday if comments from Bank of England Governor Andrew Bailey support the idea that the BoE is likely to continue lifting interest rates in the months ahead.

He’s set to participate in a panel discussion titled "Monetary policy, policy interaction and inflation in a post-pandemic world with severe geopolitical tensions" at the Oesterreichische [Austrian] National Bank Annual Economic Conference at 17:15 on Monday.

This is the highlight of the week ahead for Sterling, although both it and the Euro may also be responsive to the IHS Markit PMI surveys due out on Tuesday as well as to the trajectory of the Chinese Renminbi.

Above: Pound to Euro rate at weekly intervals with 55-week moving-average and Fibonacci retracements of September 2020’s extended recovery from coronavirus-induced lows indicating likely areas of medium-term technical supports Sterling and resistance for the Euro. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“Some support measures for the Chinese economy and some stability in the Chinese renminbi have helped usher in a period of consolidation in FX markets. This may well last into next week, although we would consider this a pause not a reversal in the dollar's bull trend,” ING’s Turner cautioned on Friday.

China's Renminbi pared back some of its recent heavy losses in a meaningful fashion last week and could be set to extend that rebound in the days ahead.

This is after Shanghai - China's largest city and the world's most important seaport - began a phased reopening from 'lockdown' and following cuts to mortgage-linked interest rates from the Peoples’ Bank of China last week.

“The property sector accounts for 30% of the Chinese economy – so yes, this is a big deal and much needed given sagging private sector demand, falling prices and developer defaults. The 1-year LPR was likely left unchanged to not stoke further price pressures, but that’s the next domino to fall if things get worse,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

Lower mortgage borrowing costs are supportive of the under pressure Chinese economy, while Shanghai’s reopening is potentially a form of balm for supply chains in the manufacturing sector, which may eventually dampen prices of internationally traded goods and help reduce global inflation pressures.

Above: Pound to Dollar rate at daily intervals with Fibonacci retracements of February decline and various extensions thereof indicating likely technical resistances for Sterling. Shown alongside inverted or upside down Dollar-Renminbi exchange rate and spread - or gap - between 02-year UK and U.S. government bond yields. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Factory production fell 2.9% YoY in April as Shanghai lockdown led to supply chain disruption in the Yangtze River Delta that accounts for one-fourth of China's GDP," says Nathan Chow, an economist at DBS Group Research.

A further recovery by the Renminbi might be less supportive of GBP/EUR than it would be for GBP/USD, however, given that the Eurozone has a more sizable economic linkage with China that could partially offset Sterling's generally higher 'beta' or senstivity to changes in market risk appetite.

For illustrative purposes, the author’s own calculations suggest that if the Renminbi was to retrace a full third of the losses sustained since April 05 at any point, then Sterling and the Euro would reverse around half of their own respective declines from that period.

That would see USD/CNH easing lower to 6.67 as GBP/USD and EUR/USD reverse higher toward 1.2662 and 1.0670 respectively, while the author's own model suggests any such outcome this week would result in a rough 1.1771 to 1.1867 trading range for GBP/EUR over the coming days.

Many might perceive this to be "short-covering" in Sterling, although that could have more to do with the market's tendency to underestimate or overlook the extent to which Renminbi movements can impact other currencies around the world and across the market.