Euro Pumped & Dumped as Ukraine War Forces a More 'Hawkish' ECB

- Written by: Gary Howes

- EUR up as ECB signals earlier end to quantitative easing

- But falls during press conference

- ECB acknowledges falling growth, rising inflation

Above: File image of ECB President Christine Lagarde. Image: Andreas Reeg/ECB.

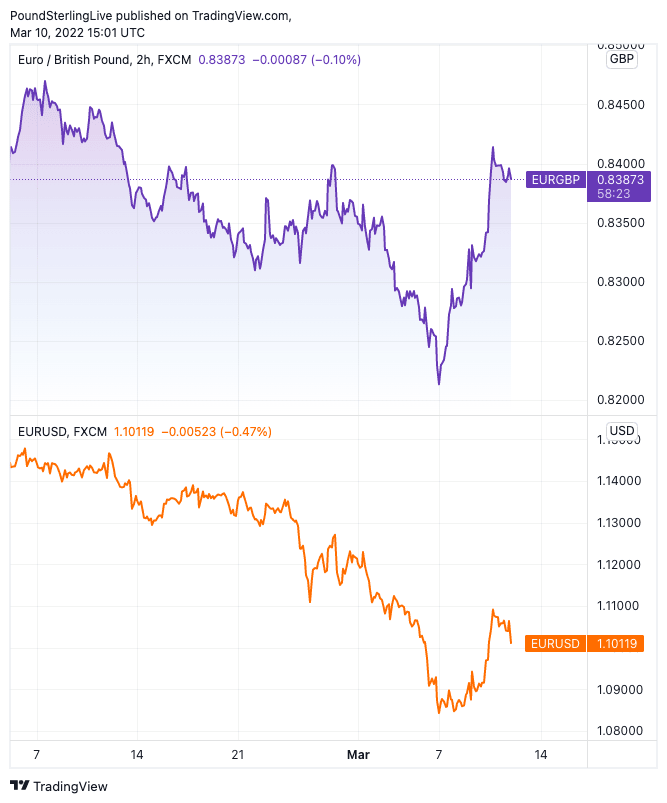

The Euro pushed higher against the Dollar and Pound Sterling to then perform a full reversal in the wake of the European Central Bank's March policy update.

The ECB helped the Euro higher after it said it was ready to end its quantitative easing programme in the third quarter of 2022 in what amounts to a more 'hawkish' signal from the central bank.

It said in its March policy update it will conclude net purchases under the APP in the third quarter, "if the incoming data support the expectation that the medium-term inflation outlook will not weaken even after the end of our net asset purchases".

Previously the ECB guided a closure to quantitative easing (the APP) in the final quarter.

"This opens the door to rate hikes in 4Q22," says Viraj Patel, a strategist at Vanda Research.

Markets were wary the ECB would strike a more cautious tone at the March meeting given the significant geopolitical deterioration regarding Ukraine and Russia which threatens to negatively impact Eurozone growth rates over coming months.

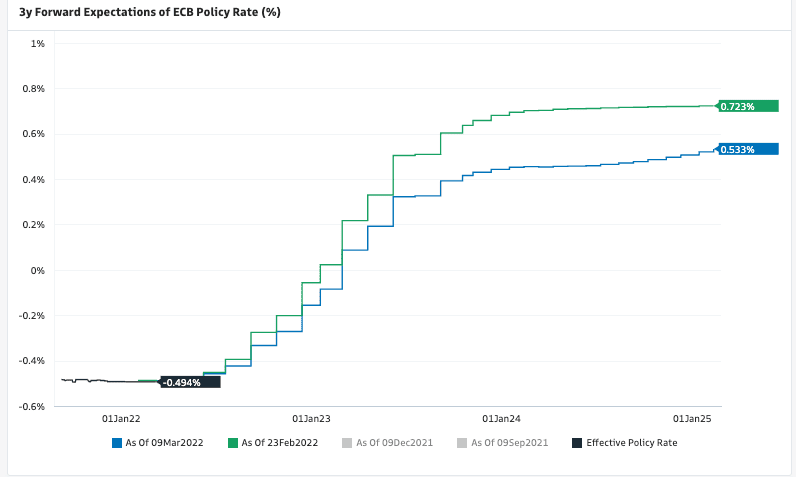

As such the market had lowered its expectations for 2022 and 2023 rate hikes at the ECB, adding downside pressure to the Euro.

But the ECB appears concerned that inflation is at risk of anchoring above its long-term target of 2.0% for an extended period of time and feels it must pursue tighter policy, offering the single currency some upside.

Gains were soon however reversed as markets began to factor in an ugly profile for the Eurozone: surging inflation and declining growth rates, all of which spells the potential for a stagflationary environment.

The ECB now sees 2022 inflation at 5.1% against a previous forecast of 3.2% and inflation for 2023 is forecast at 2.1% against a previous forecast of 1.8%. Due to recent developments the ECB now sees 2022 GDP growth at 3.7% against 4.2% previously and 2023 GDP growth is now seen at 2.8% against previous forecasts for 2.9%.

Above: EUR/GBP (top) and EUR/USD (bottom).

"The ECB must know the war in Ukraine could further impact supply-side constraints and hit consumer and investor sentiment further - if a de-escalation comes through much later than markets expect," says Ima Sammani, FX Market Analyst at Monex Europe.

"In such a scenario, the ECB will stand ready to revise asset purchases in both size and duration, according to Lagarde - but there is a risk that at that point, it will be a case of putting the genie back into the bottle. And that is exactly the risk markets started to factor in throughout the press conference. Over the course of the hour-long communiqué, EURUSD pared back all of its post-statement gains to trade back at fresh session lows," she adds.

The ECB emphasised in its statement "any adjustments to the key ECB interest rates will take place some time after the end of the Governing Council’s net purchases under the APP and will be gradual."

Harvey says what was initially a 'hawkish' event for the Euro had distinctive 'dovish' undertones, as emphasised by President Christine Lagarde when she made it clear the ECB was not accelerating normalisation, and markets shouldn’t interpret it as if it was.

She noted that the ending of net purchases via APP is conditional, and that optionality and flexibility are key going forward.

The Governing Council has therefore given itself the opportunity to hold a longer period of wait-and-see before starting to lift rates.

"This gave today’s hawkish surprise dovish undertones," says Harvey.

Going forward through 2023 there is ample scope that the ECB opts to keep interest rates unchanged for longer than markets currently anticipate, which could yet disappoint Euro bulls.

The Euro to Pound Sterling exchange rate rose a third of a percent to 0.8423 in the wake of the decision, putting the Pound to Euro rate at 1.1872. But the reversal in sentiment soon saw the EUR/GBP fall back to 0.8385 and GBP/EUR go to 1.1933. (Get a money transfer quote here).

The pair had been as high as 1.22 at the start of the week.

The Euro to Dollar exchange rate was up 0.20% at 1.1100 following the initial announcement but reversed to record a 0.50% decline on the day at 1.1015 following the press conference.

Above: The amount of rate hikes expected from the ECB by the market has fallen since the eve of Russia's invasion of Ukraine.

- Reference rates at publication:

GBP to EUR: 1.1926 - High street bank rates (indicative): 1.1609 - 1.1692

- Payment specialist rates (indicative): 1.1820 - 1.1866

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

The ECB said net asset purchases under its APP quantitative easing programme will now be brought down to €20BN per month in June rather than in October, as previously signalled.

The decision to ultimately withdraw further monetary support comes despite the ECB "taking into account the uncertain environment... the Russian invasion of Ukraine is a watershed for Europe."

But ultimately the Governing Council is concerned that inflation risks have been tilted to the upside by Russia's invasion of Ukraine and the associated sanctions placed on the country by the international community.

"The Governing Council will take whatever action is needed to fulfil the ECB’s mandate to pursue price stability and to safeguard financial stability.twill take whatever action is needed to fulfil the ECB’s mandate to pursue price stability and to safeguard financial stability," said the statement.

Carsten Brzeski, Global Head of Macro at ING Bank N.V. says compared with the latest adjustments to its monetary policy tools in December, this is a slightly more hawkish outcome.

"The war in Ukraine has strongly increased the risk of stagflation in the eurozone. Extremely high energy and commodity prices, potential energy supply disruptions, weaker trade, new supply chain disruptions and a high degree of uncertainty for both companies and consumers have changed the eurozone’s economic prospects in only a few days," says Brzeski.

Heading into the March meeting the market was looking for 33 basis points of hikes in 2022.

"A first rate hike before the end of the year is still possible," says Brzeski.

But if the ECB hikes by increments of 10 basis points - as it cut by ten basis points when the Deposit Rate fell below zero - this implies up to three hikes in 2022.

The market might therefore be expecting more hikes out of the ECB than are likely, which could prove to be a headwind for the Euro in the future if the market starts to rerate.