Pound / Euro Week Ahead Forecast: 1.1940-1.2041 Eyed

- Written by: James Skinner

- GBP/EUR set to remain buoyant above 1.19

- Rough 1.1940-to-1.2041 range likely ahead

- UK economic data, Ukraine migraine support

- BoE testimony, UK PMIs, geopolitics in focus

Image © Adobe Images

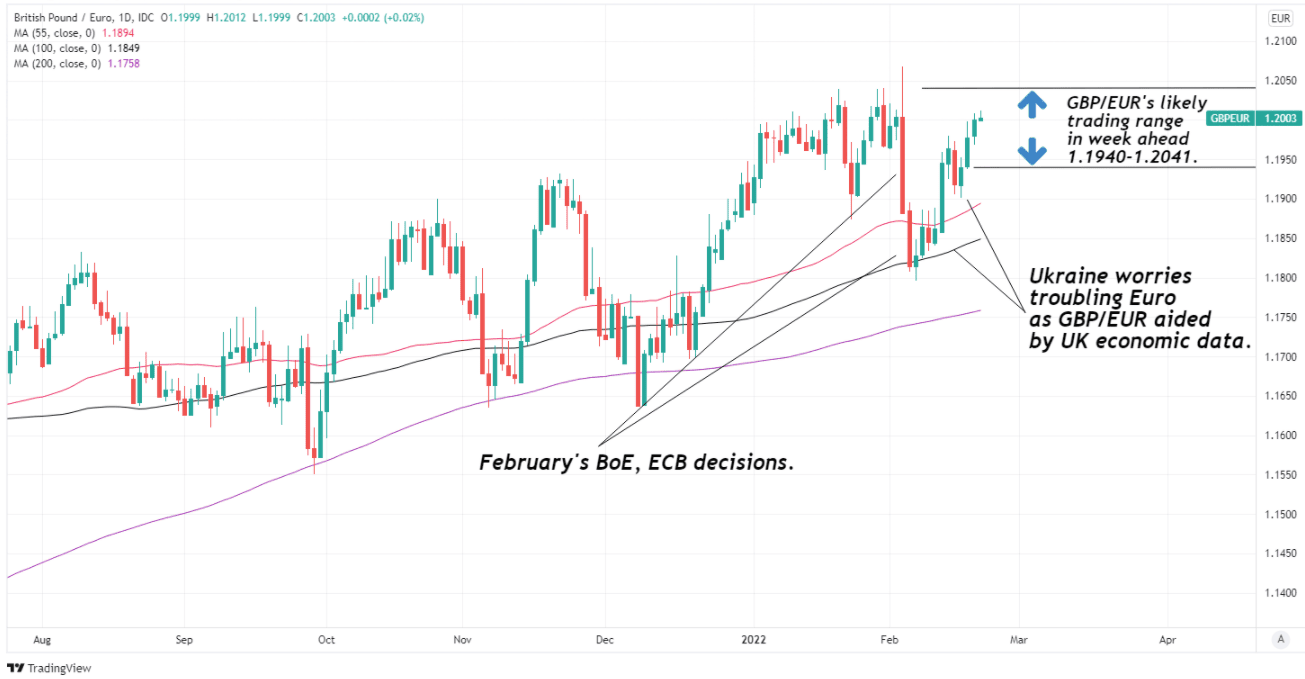

The Pound to Euro exchange rate ended last week near to February highs after market concerns about developments in Ukraine weighed heavily on the European single currency, and it could be likely to remain choppy within a rough 1.1940 to 1.2041 range over the coming days.

Pound Sterling entered the new week changing hands near 1.20 against the Euro after the single currency fell broadly on Friday in response to the renewed and escalating risk of a conflict in Eastern Ukraine, which saw GBP/EUR trading close to the middle of this week’s likely range on Monday.

“Like the storm-hit UK, global markets are facing strong winds as the geopolitical situation in Ukraine remains volatile. Sticking to our metaphor, we may not see any smooth "landing" in diplomatic talks next week, and markets may start settling in with the prospect of prolonged geopolitical risks, helping USD, JPY and CHF,” says Francesco Pesole, a strategist at ING.

Friday’s evacuation of inhabitants from the breakaway provinces in Eastern Ukraine, to Russia, made unavoidably clear the escalating risk of conflict following a week in which markets were unnerved by the increasing frequency of ceasefire violations for which both sides are pointing fingers.

Shared borders and economic interlinkages are leading candidates for explaining why mainland European currencies have been the most sensitive to the ebb and flow of perceived conflict risks, which have helped keep Sterling buoyant in recent trade and could potentially remain supportive this week.

Above: GBP/EUR at daily intervals with selected moving-averages and annotation for recent events. Click image for closer inspection.

- Reference rates at publication:

GBP to EUR: 1.1984 - High street bank rates (indicative): 1.1665 - 1.1750

- Payment specialist rates (indicative): 1.1876- 1.1924

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

“In our view, the resulting impact of sanctions (with the risk of military conflict) may lead to a surge in oil prices (food prices), sell-off in risk markets, flattening of the US yield curve, and an ensuing bid in the USD (EUR weakness; broad EM FX weakness). This is in combination with a still likely path of rate hikes from the US Fed (even if the risk is some pricing-out of hikes),” says Jordan Rochester, a strategist at Nomura.

“Of the three major central banks, we believe the ECB is most likely to respond with the most caution on tightening policy, followed by the BoE. Given the lower trade links, we’d argue the US FOMC would be the least affected by Ukraine/Russia tensions in its policy deliberations,” Rochester and colleague George Buckley said in a research briefing last week.

While risks emanating from Ukraine have been front and centre for many in the currency market, UK economic data has also been an important influence for Sterling and will again be in the mix this week too.

The first appointment in the UK calendar this week is the release of IHS Markit surveys of key economic sectors on Monday at 09:30 although the highlight is Wednesday afternoon’s parliamentary appearances by Bank of England (BoE) Governor Andrew Bailey and colleagues.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Domestic factors are offering some shield to GBP, which is pricing in very little geopolitical risk. While we expect the pound to face less downside risks compared to the euro in the week ahead, USD strength could push Cable back to test 1.3500,” ING’s Pesole said on Friday.

Recent upside surprises in official estimates for retail sales, inflation, employment and GDP data have all cast the UK economy in a resilient light for the December and January periods during which the Omicron strain of coronavirus would temporarily derail the recovery.

This, its possible implications for interest rate policy at the BoE and the week ahead’s likely price action in the influential EUR/USD exchange rate could each help to ensure that any corrective declines in the Pound to Euro rate peter out between 1.1940 and 1.1960 over the coming days

Sterling would likely remain buoyant this week if Pesole and the ING team are right in looking for the Euro-Dollar rate to remain under pressure, although their envisaged decline in GBP/USD would also be likely to keep GBP/EUR from lifting much above 1.20.

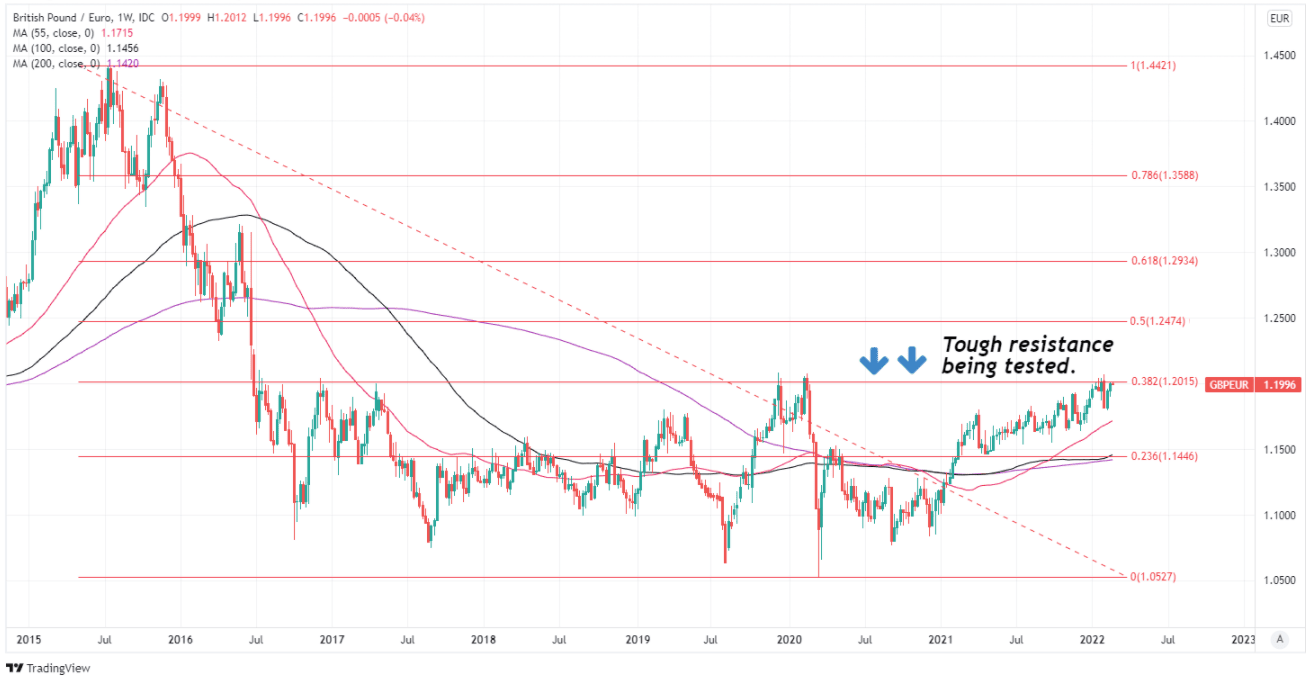

Above: GBP/EUR at weekly intervals with selected moving-averages and Fibonacci retracements of 2015 decline highlighting likely areas of medium and long-term technical resistance. Click image for closer inspection.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Much about the outlook does still depend, however, on the market’s interpretation of BoE policymakers’ testimonies to the House of Commons’ Treasury Select Committee on Wednesday when they’re scheduled to answer questions about the February Monetary Policy Report and UK inflation.

“Better UK Retail Sales (Y/Y ex auto fuel 1.7% vs 1.1% exp) follows on from the strong CPI and better employment data all pushing in the direction of a 50bp hike in March and keeping GBP in the ascendancy, helped by a very low level of positioning,” says Jonathan Pierce, a trader at Credit Suisse.

“Unfortunately we didn’t get the correction lower I hoped would enable better entry points and I don’t feel inclined to chase from here,” Pierce wrote in a Friday commentary from the trading desk in London.

Office for National Statistics figures suggested inflation rose from 5.4% to 5.5% last month, which took annual price growth closer to the 7.1% peak anticipated by the BoE for the second quarter but also marked the smallest increase in inflation seen since April 2021.

This was an early and prospective indication that the organic buildup of price pressures may be beginning to ebb, which is something that would potentially lead the BoE to eventually contemplate pausing its cycle of interest rate rises in order to observe the intervening developments.

Suggestions of that kind would be a downside risk for the Pound in the weeks and months ahead.