ABN AMRO Drop their Pound / Euro Forecast of 1.30

- Written by: Gary Howes

Image © Adobe Images

A recent shift in policy at the European Central Bank will save the Euro from a deep decline against the British Pound, says a leading foreign exchange analyst.

Georgette Boele, Senior FX Strategist at ABN AMRO, had forecast a significantly weaker Euro relative to the Pound by the end of 2022 and through 2023, on an assumption the Bank of England would hike much faster than the ECB.

But, fast forward to the early February and assumptions about the Euro have been shaken by a policy shift at the ECB.

The ECB ultimately called time on its Negative Interest Rate Policy (NIRP) - in place since 2014 - when on February 03 it validated market expectations for rate hikes to commence before the end of 2022.

Euro exchange rates rose accordingly.

Concerning the outlook for the Euro and Pound from here, what matters is how the ECB and Bank of England deliver on policy expectations.

"Currently, rate hike expectations dominate FX markets, and we expect this to continue for some time," says Boele.

- Reference rates at publication:

GBP to EUR: 1.1880 - High street bank rates (indicative): 1.1564 - 1.1647

- Payment specialist rates (indicative: 1.1773 - 1.1820

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

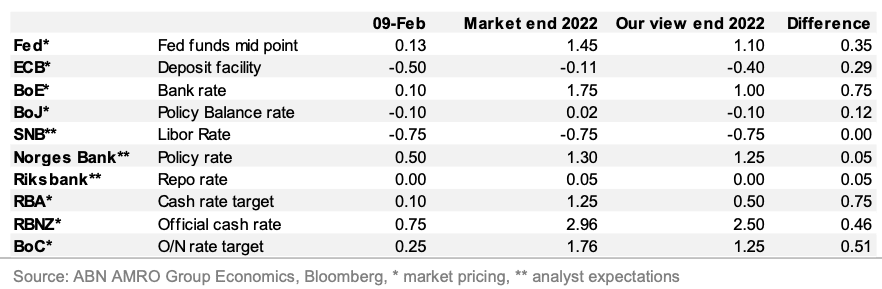

Financial markets now expect four rate hikes by the ECB, in steps of 10 basis points.

By contrast the market is expecting a further 125 basis points of rises from the BoE.

On balance, this is supportive of the Pound to Euro exchange rate outlook.

But both the ECB and BoE are expected by ABN AMRO to disappoint against market expectations, and this is what matters for currency markets.

The disappointment from the BoE will be greater as Bank Rate is expected by ABN AMRO to only rise to 1.00% by year-end.

This represents a potential 75 basis points of market repricing that would weigh on Pound exchange rates. By contrast the market would only be disappointed to the tune of 29 basis points on the ECB's policy path.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We have adjusted our FX forecasts to reflect the differences in market pricing compared to own views. As a result, we have for example upgraded our EUR/GBP forecasts, meaning we no longer have aggressive weakness in EUR/GBP," says Boele.

ABN AMRO forecasts the Euro to Pound Sterling exchange rate to end 2022 at 0.85 and end 2023 at 0.84.

Previously the bank held forecasts of 0.79 and 0.77 respectively.

Therefore, the GBP/EUR exchange rate forecasts are lowered from 1.2658 for end-2022 to 1.1765. The end-2023 forecast is lowered from 1.2987 to 1.19.

Above: ABN AMRO's central bank forecasts vs. what the market is expecting.