Pound / Euro Week Ahead Forecast: Could Test 1.22 on 'Hawkish' BoE

- Written by: James Skinner

- GBP/EUR supported near 1.1950

- Holding near 1.20 as BoE looms

- Could test 1.22 on ‘hawkish’ BoE

- Natwest & BMO eye 1.25 in 2022

- ECB policy also key for GBP/EUR

Image © Adobe Images

The Pound to Euro rate has been quick to draw dip-buyers in periodic bouts of weakness and could be likely to attempt a breakout to new two-year highs if the recent divergence between Bank of England (BoE) and European Central Bank (ECB) monetary policies continues this week.

Sterling recovered above 1.20 by Friday’s close to end the week little changed against the European single currency after last Monday’s corrective decline beneath 1.19 was met by a bid from the market that was sustained throughout the period.

Robust demand for Sterling leaves the Pound to Euro rate near its highest since February 2020 ahead of this Thursday’s all-important BoE and ECB policy decisions, which are likely to be decisive in determining if it can break higher in the direction of the 1.22 handle or if it remains contained near to 1.20.

“We expect to see the first back-to-back rate hike since 2004, with the Bank Rate raised to 0.5%. We're also expecting the MPC to confirm the start of (passive) quantitative tightening (QT) with reinvestments dropping out of the Bank's balance sheet from next week onwards. This will be the first time ever that the Bank has embarked in QT,” says Sanjay Raja, an economist at Deutsche Bank.

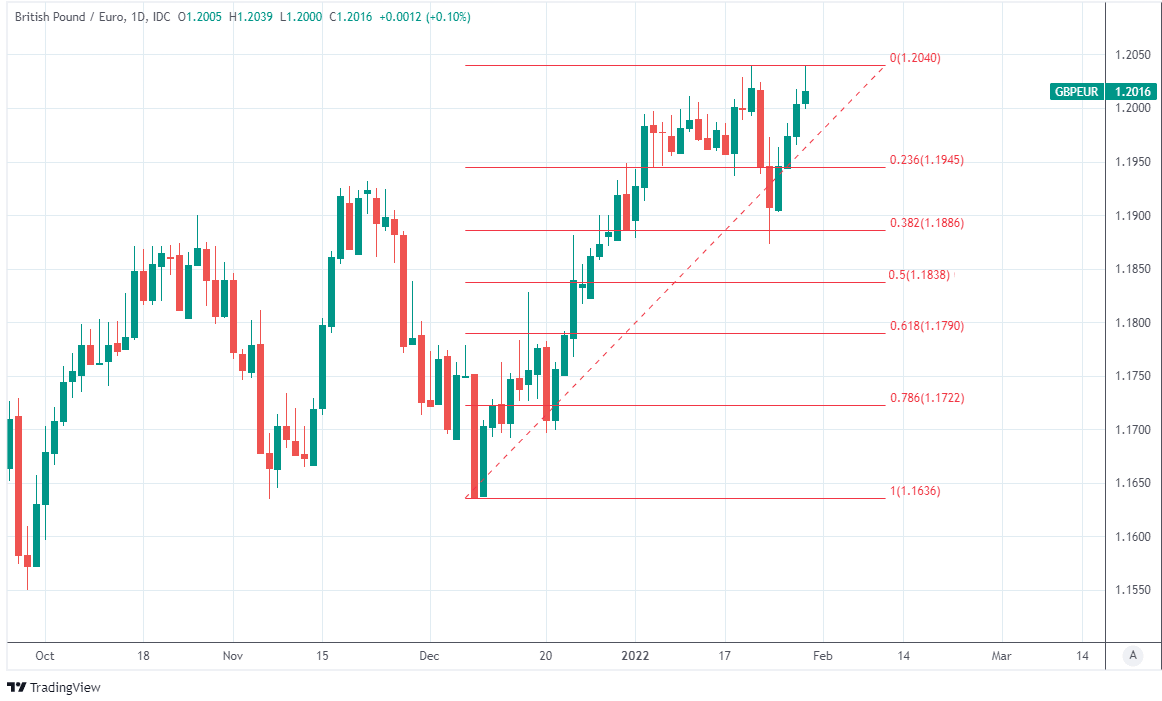

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of December rally indicating possible technical support areas for Sterling.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We expect another 25bps tightening in August, followed by two more hikes next year to take the terminal rate up to 1.25%. The risk: given the uncertainty around the inflation path and the potential pass-through into wages, more will be needed and perhaps at a faster pace, potentially even exceeding our estimate of the neutral rate (1.25%),” Raja explained in a Friday research briefing.

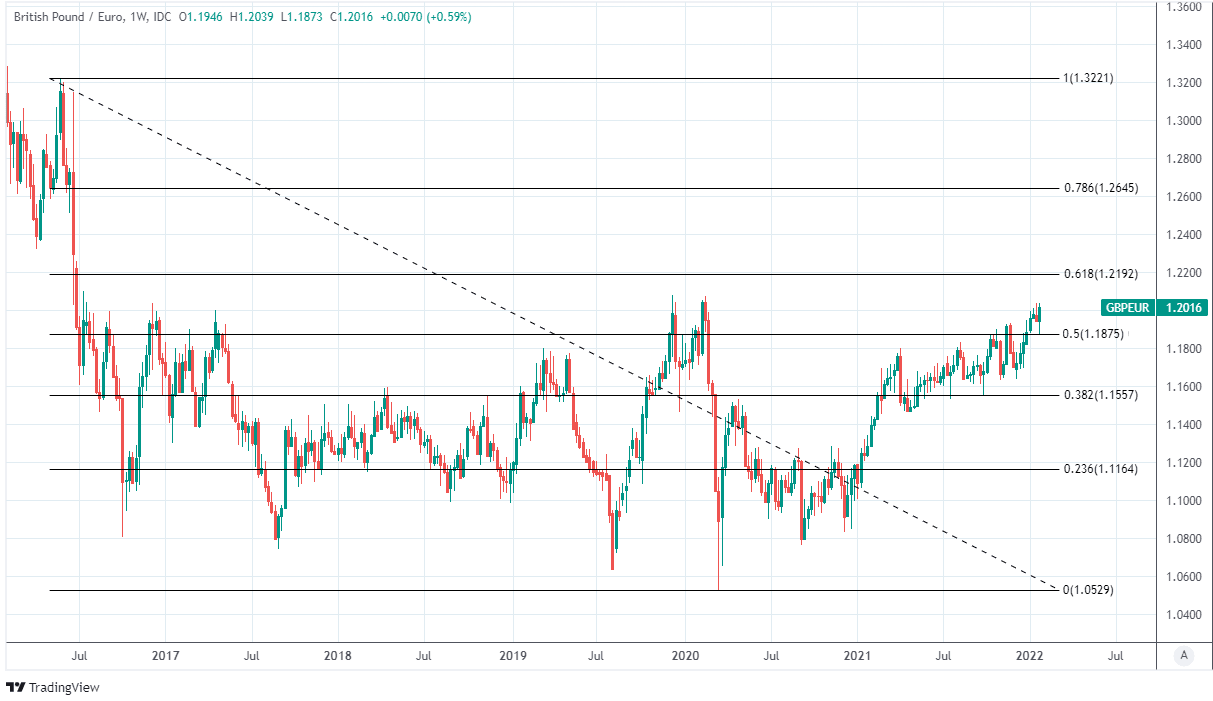

A Pound to Euro break higher this week could see Sterling trading up to levels not seen since the immediate aftermath of the Brexit referendum in 2016 but would likely require a ‘hawkish’ response from the BoE to the ongoing acceleration of UK inflation and a continued show of patience from the ECB on Thursday.

UK inflation reached a multi-decade high of 5.4% in December and with forward (future) energy prices rising sharply in the interim the likelihood is that BoE policymakers revise forecasts higher this week in anticipation of a further protracted period in which price growth continues at rates far above the two percent target.

“We have not heard much from BoE policymakers since December’s meeting, although external MPC member Catherine Mann recently pointed to the importance of leaning against rising price expectations. A recent Citi/YouGov survey has revealed that the public’s expectations for inflation in a year’s time jumped to a record high,” says Han-Ju Ho, a senior economist at Lloyds Commercial Banking.

Above: Swap rate differentials point EUR/GBP toward 0.80 and GBP/EUR toward 1.25. Source: BMO Capital Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Some other economists have argued that recent and ongoing increases in the cost of living could leave the BoE reluctant to be hasty in reversing the interest rate cuts it announced in support of the economy at the onset of the coronavirus crisis, which took Bank Rate down from 0.75% to 0.10%.

There are multiple reasons for why such a line of thinking is very likely to be flawed, however, and prominent among them is the latest Office for National Statistics data confirming that a robust labour market has gotten wage packets rising with inflation in a manner that would typically stoke additional price pressures further down the line.

While those factors alone could ensure inflation continues to overshoot the 2% target for some time, it matters that the current low level of Bank Rate is also further stimulating inflation because this would, to some extent, put the BoE in the frame for overshooting the target in highly unlikely event that it hesitates to withdraw its stimulus.

“Admittedly, the EUR-GBP 2Y and 5Y swap rate differentials have recently been moving in a less favorable direction for the GBP, but there is probably room for those rate differentials to provide additional support to the GBP if the MPC expresses a willingness to normalize policy at a rapid clip. The OIS curve currently implies a 1.0% Bank Rate by the June meeting, and nearly a further quarter point hike by August — but we're not sure the FX market is quite there yet,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

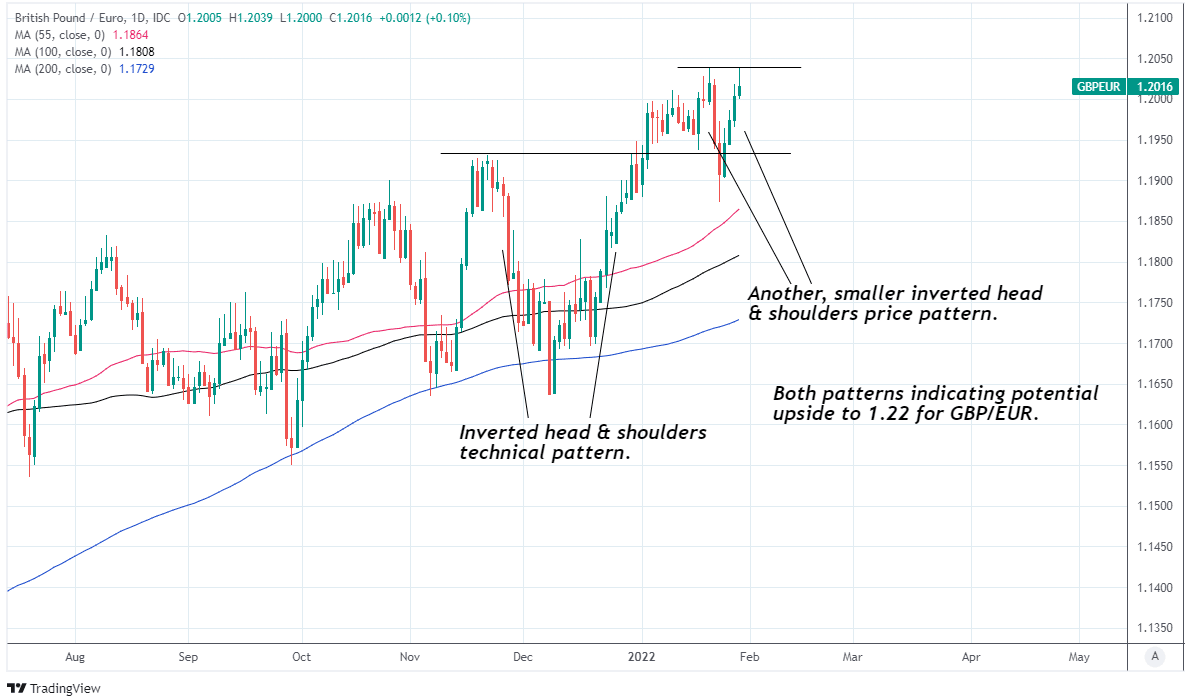

Above: Pound to Euro rate shown at daily intervals and annotated for recently bullish technical developments.

Thursday’s policy decision is due out at 12:00 and for the Pound to Euro rate it takes place against an increasingly bullish backdrop on the charts, which currently includes two inverted head-and-shoulders technical patterns that each indicate scope for Sterling to take a run at near-six year highs around 1.22.

This could, however, be a somewhat conservative indication of the upside potential for Sterling if recent analysis from BMO Capital Markets and Natwest Markets is anything to go by because their work suggests there could be scope for the Pound to Euro exchange rate to rise to around 1.25 over the coming months.

“We expect the BoE policy outlook to veer closer to the Fed vis-à-vis the ECB. Relative labour markets and immigration policy differences between the two suggest inflation can be more lasting in the UK,” says Paul Robson, European head of G10 FX strategy at Natwest Markets.

“A growing policy divergence narrative in the UK may be contributing to a loosening (though not a full disconnect) of GBP’s positive correlation with wider risk. So we keep to our view that EUR/GBP can drop to 0.80 [GBP/EUR rise to 1.25]. We may eventually reach a point later this year when BoE looks more fully priced and ECB “catch-up” risk becomes more relevant, but we don’t think that’s today’s narrative,” Robson and colleagues also said.

Above: Pound to Euro rate shown at weekly intervals with Fibonacci retracements of referendum-induced decline indicating likely areas of technical resistance to a recovery by Sterling.