Euro Outlook: Lagarde Rejects 2022 Rate Hike

- Written by: Gary Howes

Above: Christine Lagarde. Image by Dominique HOMMEL. © European Union 2019 - Source: EP

Euro exchange rates were softer in midweek trade and faced a challenging outlook after the head of the European Central Bank (ECB) sent markets a clear message that they were wrong to expect interest rate rises as soon as 2022.

ECB President Christine Lagarde said on Wednesday that it was "very unlikely" the ECB would raise rates in 2022.

"In our forward guidance on interest rates, we have clearly articulated the three conditions that need to be satisfied before rates will start to rise," Lagarde said in an appearance in Lisbon. "Despite the current inflation surge, the outlook for inflation over the medium term remains subdued, and thus these three conditions are very unlikely to be satisfied next year."

Money markets have for some weeks shown investors to be priced for a 2022 rate hike at the ECB in light of exceptional inflation, which has reached a 13-year high.

- GBP/EUR reference rates at publication:

Spot: 1.1796 - High street bank rates (indicative band): 1.1483-1.1466

- Payment specialist rates (indicative band): 1.1690-1.1796

- Find out more about specialist rates, here

- Or, set up an exchange rate alert, here

But for the ECB's policy makers inflation is expected to remain temporary in nature and therefore pricing for a 2024 rate hike remains more appropriate in their view.

If the Euro has found support against the likes of the Pound, Dollar and other major currencies on rate hike expectations shifting forward, then it stands it will come under pressure when these expectations reverse.

The GBP to EUR exchange rate rallied on Wednesday to 1.18 having fallen to 1.1750 earlier in the day, although there will be a degree of investor positioning ahead of the Bank of England policy decision due Thursday behind moves in the Pound.

The Euro would nevertheless almost certainly be better supported were expectations for rate hikes at the ECB to move forward in a convincing and determined manner.

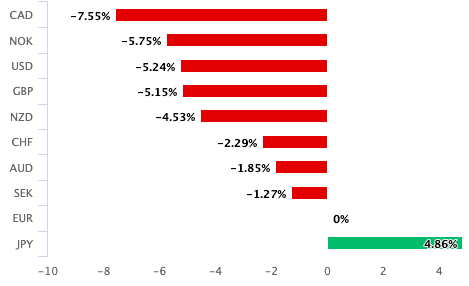

Above: The Euro is one of 2021's laggards, courtesy of a legacy of subdued ECB rate expectations.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

But it seems the central bank remains heavily invested in ensuring expectations remain as tame as possible to ensure the cost of finance in the bloc does not rise and squeeze out the economic recovery.

"An undue tightening of financing conditions is not desirable at a time when purchasing power is already being squeezed by higher energy and fuel bills, and it would represent an unwarranted headwind for the recovery," Lagarde said.

The justification for keeping rates unchanged rests with a view that the current spike in inflation will prove temporary in nature, suggesting it is inappropriate to respond with higher rates.

"Despite the current inflation surge, the outlook for inflation over the medium term remains subdued," said Lagarde.

"Our assessment is that the current inflationary surge is mainly due to factors of a transitory nature, although these factors could show a higher degree of persistence than initially estimated, so that we expect to continue to see relatively high rates of inflation in the coming months," said Pablo Hernández de Cos, Bank of Spain Governor and ECB board member.