Pound Sterling / Euro Week Ahead Forecast: Looks to Hold 1.18 as BoE-ECB Divergence Dominates

- Written by: James Skinner

- GBP/EUR supported at 1.1797, 1.1749, 1.1715

- Could look to cement hold on 1.1800 this week

- BoE speech & UK budget the highlights for GBP

- ECB decision looming & could support GBP/EUR

Image © Adobe Images

- GBP/EUR reference rates at publication:

- Spot: 1.1820

- High street bank rates (indicative band): 1.1500-1.1589

- Payment specialist rates (indicative band): 1.1714-1.1760

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound-to-Euro exchange rate could cement its grip on the 1.18 handle this week if October’s European Central Bank (ECB) decision underlines a yawning divergence between it and the Bank of England (BoE), although Sterling must first navigate the UK’s autumn budget.

Pound Sterling was trading near to 1.18 against the Euro on Monday after slipping from one year highs of 1.1874 during Friday trading that brought with it a mixed bag of UK economic figures, commentary from the BoE’s chief economist, both of which may have encouraged pr-weekend profit-taking.

Official figures revealed a surprise fall in UK retail sales for September only for IHS Markit surveys to then suggest the economy regained momentum in October, while Bank of England Chief Economist Huw Pill provided clarity on the Bank's interest rate outlook during an interview with the FT on Thursday October 21.

"The big picture is, I think, there are reasons that we don't need the emergency settings of policy that we saw after the intensification of the pandemic," Pill said in remarks.

Pill’s remarks challenged a market assumption that Bank Rate could rise to 1% in 2022 but also at the same time appeared to confirm there is a decision to begin reversing the interest rate cuts of March 2020 some time in late 2021 or in early 2022.

The shifting BoE interest rate outlook has proven uplifting of the Pound-to-Euro rate and could burnish Sterling’s appeal further this week if the ECB doubles down Thursday on its earlier guidance that Eurozone interest rates are likely to remain unchanged for quite some time to come.

Above: Pound-to-Euro exchange rate at daily intervals with spread or gap between 2-year and 10-year government bond yields for UK and Germany.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Before then however, the Pound must first navigate a Monday speech from BoE Monetary Policy Committee member Silvana Tenreyro and Wednesday’s autumn budget in what are both neutral-to-negative risks for the currency.

“Aside from what we think will be a fairly tight Budget and Spending Review on Wednesday, it will be interesting to see if any other MPC members drop in their two cents on the outlook for interest rates before the week-long purdah period begins ahead of the policy meeting on 4th November. As it stands, Silvana Tenreyro is the only member scheduled,” says Paul Dales, chief UK economist at Capital Economics.

Little excitement is expected by economists, or for Sterling, when HM Treasury sets out its intentions on borrowing, spending and taxes this Wednesday after the government made clear how it intends to tighten the purse strings over the coming years with September’s health and social care levy.

But MPC member Tenreyro’s speech will likely be listened to closely by Sterling at 14:00 Monday when she covers the timely topics of international trade, global supply chains, and monetary policy at an online event hosted by the Center for Economic and Policy Research.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

As one of the more ‘dovish’ voices on the BoE’s nine seat rate setting committee it’s possible the market would expect Tenreyro to set out the case for the BoE to leave Bank Rate and its other monetary policy tools at their current calibration during the months ahead, which would leave the Pound most sensitive to any indications of a shift in stance toward support for any gradual withdrawal of crisis period stimulus.

"A 15bp hike now looks fully discounted for the November 4th BoE meeting. While the BoE may try to rein in some of the more aggressive tightening being priced (e.g. a Bank Rate at 1.25% by end-2022), we suspect the first in what should be a series of hikes (amidst CPI heading to 4-5% next six months) will keep GBP bid on dips,” says Francesco Pesole, an FX strategist at ING.

The Pound-to-Euro rate has held the 1.18 handle since breaking above the level in mid-October, which extended a fortnight long rally that took place amid the market’s reappraisal of the BoE interest rate outlook, which has culminated in aggressive expectations for Bank Rate to rise to 1% next year.

"This was extremely negative price action," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, referring to EUR/GBP’s break below the 0.8471 area and GBP/EUR’s move above 1.1804.

Above: Commerzbank slide with EUR/GBP technical analysis.

"The lack of follow through on the downside does concern us, but we continue to hold below the 55-day ma so remain negative for now," Jones and colleagues said in a Friday research briefing, referring to EUR/GBP.

Jones and the Commerzbank team said last week that Sterling’s break above 1.18 could ultimately see it targeting 1.2137 over the coming months and that an upside bias should persist so long as the Pound-to-Euro rate remains above its 55-day moving-average at 1.1715.

In the meantime, there are Fibonacci retracements of October’s recovery rally at 1.1797 and 1.1749 that could each potentially provide support to the Pound-Euro rate in the event of any weakness over the coming days.

Above: Pound-to-Euro exchange rate at daily intervals with major moving-averages and Fibonacci retracements of October rally indicating possible areas of technical support for Sterling.

Whether the Pound-to-Euro rate is able to hold the 1.18 handle into next weekend may depend more than anything on the market’s response to Thursday’s 12:45 European Central Bank monetary policy decision and 13:30 press conference.

This year’s sharp increases in inflation rates have been widely described by central bankers as temporary or some derivation thereof although this hasn’t stopped investors from betting that many central banks will be likely to lift interest rates by the end of next year, and they haven’t spared the ECB.

Friday’s market pricing envisaged a 2022 rate rise from the ECB as likely when the bank’s policy guidance and inflation forecasts all but rule out a change in its interest rate before 2024.

Given it’s long struggle against inflation pressures that have been too limited in the Eurozone, it’s possible the ECB would want to double down behind its September policy guidance on Thursday in what would potentially be a headwind for the Euro.

“Ultimately, showing deference to its forward guidance and policy sequencing preferences should be enough to keep the EUR on its backfoot. That is, both the PEPP and the APP must end before the ECB were to think of hikes,” says Mazen Issa, a senior FX strategist at TD Securities.

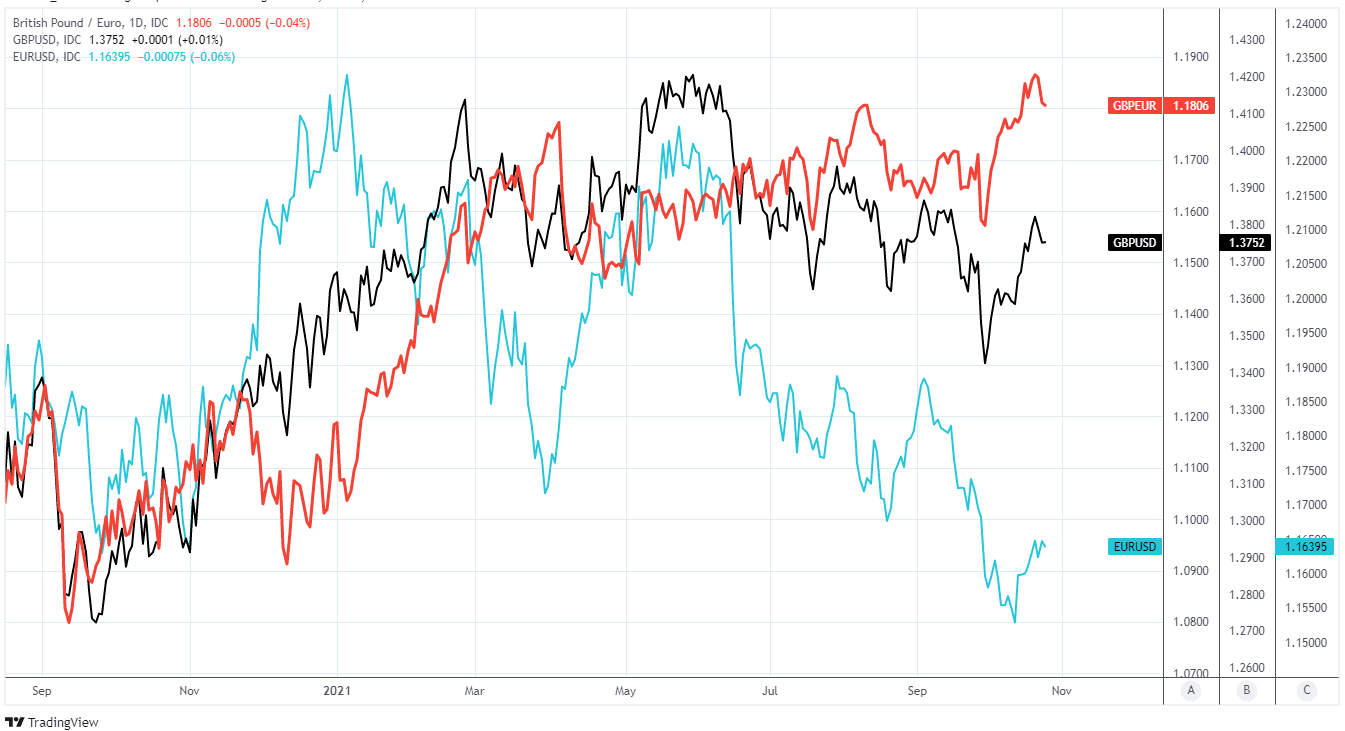

Issa and the TD Securities team warned on Friday there’s a risk of the Euro-Dollar rate being pushed back beneath 1.16 this week as a result of ECB policy and other market factors, which would be supportive of the Pound-Euro rate if the main Sterling pair GBP/USD is in the meantime able to avoid a significant setback, as GBP/EUR always closely reflects the relative performance of GBP/USD and EUR/USD.

Above: Pound-to-Euro exchange rate at daily intervals with major moving-averages and Fibonacci retracements of October rally indicating possible areas of technical support for Sterling.