Pound Sterling: PMI Data Settles Nerves Following Retail Sales and GfK Shockers

- Written by: Gary Howes

- PMI data shows economy grew strongly in Oct.

- But retail sales for Sept. fall more than expected

- GBP volatile, but within tight ranges

- Consumer confidence falls to lockdown lows

- ING says GBP bullish trend to stay intact

- BoE's Pill points to Nov. rate hike

Image © Adobe Images

Market Rates at Publication:

GBP/USD: 1.3792

GBP/EUR: 1.1855

Preliminary PMI data for October came in stronger than expected, settling market nerves following a disappointing retail sales reading released earlier in the day and a slump in the GfK Consumer Confidence survey.

The British Pound was facing headwinds ahead of the weekend - dropping against most of its peers - as markets digested news that retail sales fell more than expected in September, but the PMI numbers will help shore up sentiment.

But losses were reversed after the Markit/CIPS Manufacturing PMI for October read at 57.7, up on the consensus expectation for 55.8 and the previous month's 57.1.

The Services PMI read at 58, well ahead of the 54.5 forecast by the market and the previous month's 55.4.

The Composite PMI - which calibrates the services and manufacturing readings to account for their respective shares of the economy - came in at 56.8, which is ahead of the consensus forecast of 54 and the previous month's 54.9.

"We’re seeing the pound strengthen following the data release as the growth in these numbers is definitely being accompanied by higher cost pressures and that will add to the case for higher interest rates," says Mike Owens, Global Sales Trader at Saxo Markets.

Chris Williamson, Chief Business Economist at IHS Markit says the flash PMI data is above the pre-pandemic survey average of 54.0 and indicative of roughly 0.7% quarter-on-quarter GDP growth.

Markit reported that private sector growth had risen to a three-month high amidst a robust and accelerated increase in activity.

Survey respondents widely reported buoyant business and consumer spending due to the roll back of pandemic restrictions. Service providers led the recovery, Markit said.

It was reported employment numbers continued to rise sharply in response to improving customer demand and strong confidence towards the business outlook.

This will ease concerns that the ending of the furlough scheme in September had swamped the market with unemployed job seekers.

Indeed, headwinds come in the form of accelerating cost pressures and ongoing staff shortages.

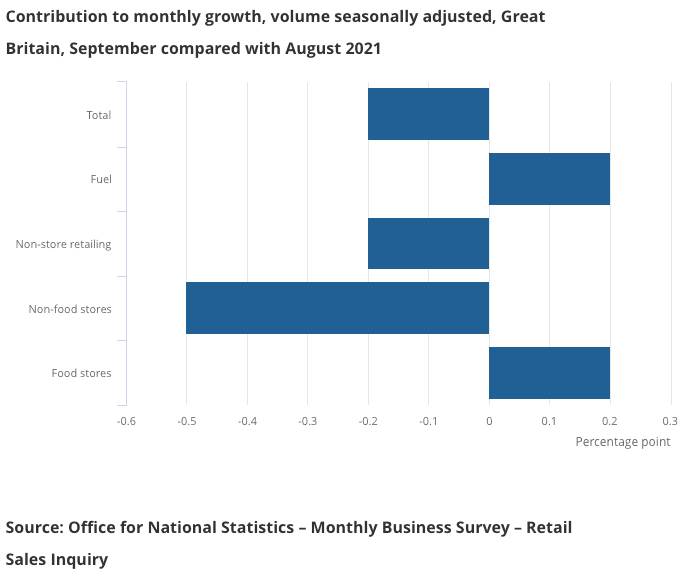

The Pound had faced its own headwinds agead of the weekend after the ONS revealed UK retail sales fell sharply in September, suggesting an economic slowdown might be worse than many economists had expected.

Retail sales for September fell 2.6% year-on-year, which is deeper than the 1.7% decline the market was looking for and the -0.9% figure reported for August.

"Consumers spending their weekends queuing for petrol further curbed sales in September after what was already a poor end to the summer," says Aled Patchett, head of retail and consumer goods at Lloyds Bank.

Sterling has seen some increased volatility, although ranges remain tight: the Pound to Euro exchange rate went from 1.1870 to a low of 1.1828 following the retail sales, before recovering to 1.1850 in the wake of the PMI numbers.

The Pound to Dollar exchange rate went from 1.38 to a low of 1.3770 before recovering to 1.38.

"Even as we enter the traditionally buoyant golden quarter – normally the busiest period for retailers in the run up to Christmas – a number of challenges threaten to undermine confidence. Chief among these are the current high gas prices which create a challenge on two fronts by increasing operating costs and reducing the spending power of consumers," says Patchett.

The Pound has found support of late by growing expectations for a Bank of England interest rate rise, with the market now fully invested in a 15 basis point hike on November 04 with further hikes in 2022 set to take the Bank Rate to 1.0% by the end of the year.

Downside risks to Sterling could emerge if these expectations soften.

"The MPC will not hike in November. This has been repeatedly ruled out and would be an unreasonable risk, in our view," says Fabrice Montagné, an economist at Barclays.

Economists have said the Bank risks committing a policy mistake if it were to cut rates as the economy was slowing, as the retail sales figures suggest.

"Labour market and population data are due to be published just after the November meeting but in time for the December meeting," says Montagné.

But even if the data proves weak, Montagné says a rate hike is still likely as the Bank of England is said to be more driven by "risks rather than headline data".

"Hence, we can assume that the BoE is set to hike regardless of data in the early stages of its cycle. Therefore, even though we continue to believe that risks are excessively tilted to the soft side, our current call will be driven by MPC statements," says Montagné.

The retail sales figures comes on the same day the GfK Consumer Confidence survey reveals consumer confidence "takes a turn for the worse in October".

The figure read at -17, its lowest since February.

"The sharpest concern is how consumers see the future economy with this collapsing ten points this month just as it did in September," says Joe Staton, Client Strategy Director GfK.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Falling consumer confidence could prove a significant headwind to the UK economy given the substantial role played by the consumer in what is overwhelmingly a services economy.

"Against a backdrop of cheerless domestic news – fuel and food shortages, surging inflation squeezing household budgets, the likelihood of interest rate rises impacting the cost of borrowing, and climbing Covid rates – it is not surprising that consumers are feeling down-in-the mouth about the chilly winter months ahead," says Staton.

Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank says near-term risks to the Pound are building.

"On a broad, trade-weighted basis GBP is now at the highest levels seen since the Brexit vote in June 2016. Driving this has undoubtedly been the story that the BoE falls into the camp of central banks prepared to react to the inflation shock," says Turner.

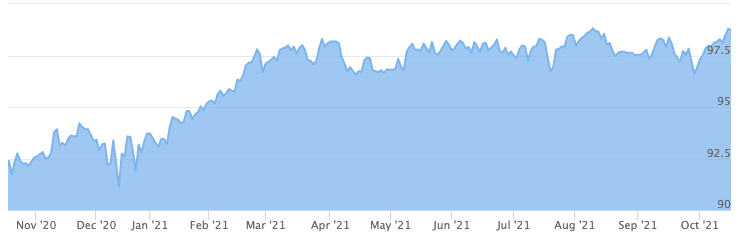

Above: The GBP trade weighted exchange rate from the Bank of England. Image (C) Pound Sterling Live.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

He says "a re-pricing of the BoE cycle on the back of a very split vote to hike on 4th November or on some form of rate protest in the BoE’s three year CPI profile (2024 forecast below 2%) could trigger a knee-jerk sell-off in the pound."

However, Turner says any negative impacts to Sterling from the decisions taken on November 04 are unlikely to be long lasting.

"We doubt this will turn the near term bullish trend for GBP. The fact that the BoE has set its tightening stall out (like fellow G10 central bankers in Norway and New Zealand) suggests it is very hard to play the top in UK rates and the pound," he says.

Turner finds currencies tend to perform well at the start of tightening cycles.

"Unless the BoE can convince markets of some kind of ‘one and done’ or ‘two and done’ when it comes to tightening, we think GBP finds support on any BoE-day disappointment," he says.

The Bank of England's new Chief Economist has warned inflation is set to smash their existing forecasts and that the prospect of a November interest rate rise was therefore under "live" consideration.

In an interview with the FT, Huw Pill said inflation is likely to rise "close to or even slightly above 5%”.

When prodded about the prospect of a November rate hike, Pill said it "is finely balanced", "I think November is live."

"The big picture is, I think, there are reasons that we don’t need the emergency settings of policy that we saw after the intensification of the pandemic, he added. "The settings [of monetary policy] that we now have are supportive settings. The need for support has diminished, as this [policy] bridge [to the other side of the pandemic] has been built and largely traversed."

In August the Bank upgraded the peak in UK inflation to 4.0%, but the scale of the cost pressures impacting the economy have taken economists by surprise.