Pound Sterling Off Lows Against Euro, Increasing Confidence for June 21 'Freedom Day'

- Written by: Gary Howes

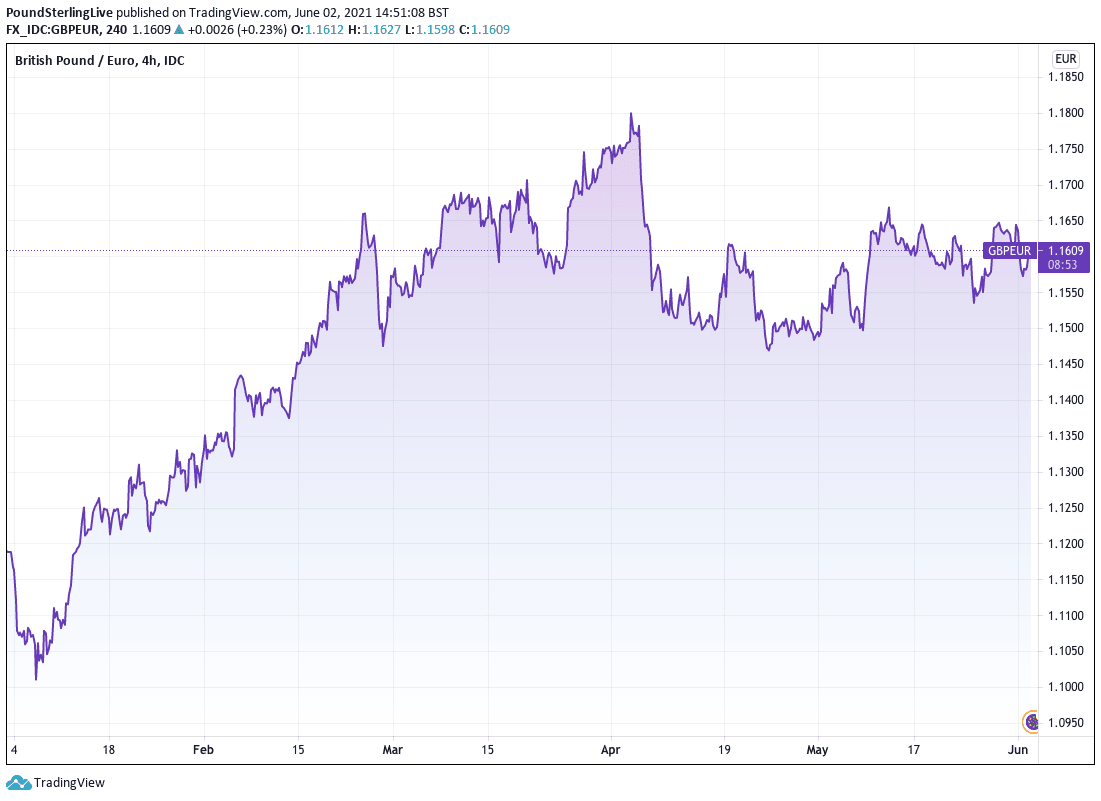

- GBP/EUR back above 1.16

- Govt. hints June 21 unlock still on

- Even if delayed, GBP will be OK say analysts

Above: Prime Minister Boris Johnson meets members of staff and patients during a visit to Colchester Hospital. Picture by Simon Dawson / No 10 Downing Street.

- Market rates at publication: GBP/EUR: 1.1604 | GBP/USD: 1.4155

- Bank transfer rates: 1.1380 | 1.3860

- Specialist transfer rates: 1.1523 | 1.4057

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound was again seen advancing against the Euro amidst fresh signals from Government that all Covid-19 restrictions will be lifted on June 21 as originally planned and some analysts said even if there were to be delay to the final lifting of restrictions it would be of little lasting consequence to the currency.

The Pound lost value at the start of the month which some analysts said could be a result of growing concerns that the June 21 'freedom day' would be delayed, thereby denting sentiment towards the UK economy and its currency.

"Concerns about the spread of the Indian Covid variant and the risks to the 21st June full reopening plans have yet again weighed on GBP," says Petr Krpata, Chief EMEA FX and IR Strategist at ING Bank.

Weakness in the Pound is however relatively muted and against a good portion of currencies the trend remains constructive.

Above: Bouts of weakness in Pound-Euro tend to be short-lived in the current regime.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound-to-Euro exchange rate moved back above 1.16 in mid-week trade, a level it holds on Thursday, but as the above shows price action remains restricted to a range that has been in place since March.

How the Pound trades going forward could depend on the strength of the economic rebound that comes from unlocking, with any disappointing news on delays to unlocking, the vaccines and data likely to put the UK currency on the back foot.

Although concerns about the final relaxation of restrictions have risen of late, the government maintains a cautiously optimistic tone noting that the vaccines are keeping people out of hospitals while analysts say that any delay is unlikely to derail the economic recovery anyway.

Prime Minister Boris Johnson said midweek that "we’ve just got to wait a little bit longer" to work out the effect of the Indian variant.

But he added, "I can see nothing in the data at the moment that means we can’t go ahead with step four, the opening on 21 June. But we’ve got to be so cautious because there’s no question the ONS data on infection rates is showing an increase."

Calls for restrictions to be lifted on time from members of Johnson's Conservative Party grew on Tuesday when the UK recorded zero Covid deaths for the first time since the pandemic started.

Education Secretary Gavin Williamson said on Wednesday that "there is a sense that there has been really amazing and promising progress that has been made."

"The roll-out of the vaccine is having an impact on everyone’s lives," he told LBC Radio.

"It’s too early to suggest that the 21 June ending of restrictions will be delayed. Hence selling GBP on a rising case numbers seems overdone," says Jeremy Stretch, Head of G10 FX Strategy at CIBC Capital Markets.

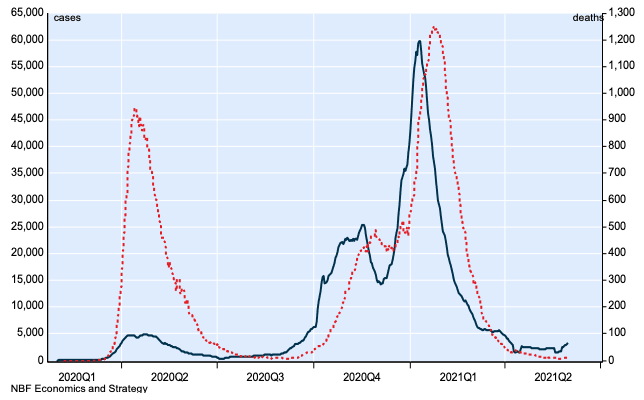

Image courtesy of NBF Economics

The Pound-to-Euro exchange rate advanced towards the top of a recent short-term range above 1.16 and for now price action appears to be relatively contained and markets potentially awaiting a fresh catalyst to drive a more concerted directional move.

Nevertheless, ING's Krpata tells clients in a daily currency market briefing that GBP/EUR is now below short-term fair value following "the recent Sterling decline".

While Covid-19 cases are rising across the UK the numbers arriving in hospital and subsequently dying are not causing concern to government, suggesting that vaccines have broken the link between infections and deaths.

Therefore, any need for restrictions to "protect the NHS" - the mantra of government during the pandemic - is brought into question.

"The vaccines are having an impact in terms of actually reducing transmission, reducing the number of people in hospital and it is these factors that are going to guide the decision," said Williamson.

UK media have given prominent coverage to scientists and medical advisors who have urged the Government to consider delaying the final easing of lockdown on June 21, saying the more transmissible Indian variant could push up hospitalisations and deaths as a new wave takes hold.

A decision is expected by June 14 and the Pound could prove reactive to both the ensuing debate and ultimate decision.

But Pound Sterling Live reported on May 18 that a delay to the full reopening of the country would not necessarily deliver a substantive blow to the Pound and this is an observation being widely communicated by professionals in the analyst community.

This is because economists believe the reopening of shops, restaurants and bars - which has already taken place - will have had the bigger marginal impact on economic activity than the final lifting of restrictions on social gatherings and distancing rules set for June 21.

"In reality the last stage is probably the least impactful for change in mobility," says a note out from Morgan Stanley's research team.

"The 21 June unlock is a largely symbolic date for reopening - and a big one for sports fans and party goers," says Jordan Rochester, Global FX Strategist at Nomura.

"We remain long GBP vs USD," says Rochester.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

On the matter of the Pound vs. Euro, Nomura judge that recent range-bound price action is likely to now turn higher once again.

If June 21 is delayed Rochester would expect Sterling to selloff, "but only briefly and provide an opportunity to add to longs".

Marek Raczko, an economist at Barclays told clients in a regular weekly foreign exchange strategy briefing that his team maintain a supportive view on Pound Sterling, given the gradual recovery and normalisation of economic behaviour spread over many months.

He does however say much of this news is already baked into the Pound's current levels, "given current GBP levels and lack of market relevant data this week, we expect GBP to move sideways in the near term."

We reported on Tuesday that Jeremy Boulton, a Reuters market analyst, has however given an outright bullish assessment of the Pound's prospects.

"GBP/USD, which broke above two major levels in May, should reach 1.5000 as a result but from there may struggle," says Bolton.

A break higher in GBP/USD could well unlock the door to further gains in other Sterling pairs, for example the GBP/AUD and GBP/CAD which have been been unable to break fresh multi-month highs of late.

"GBP/USD ended May at a close of 1.4215, the highest finish since Britain voted to leave the European Union. GBP/USD closed over the 100-MMA for the first time since June 2014 and above 1.4171 which is 76.4% drop from the pre-referendum peak," says Boulton.

"This suggests GBP/USD will retrace the drop from 1.5022 traded just before news the UK had voted to exit the EU," he adds.

But from this level the Pound is expected to struggle by Boulton as it faces significant headwinds from huge changes in expectations and hedging resulting from Brexit.