EU Vaccine Export Ban a Non-Event for Pound-to-Euro Exchange Rate says Leading FX Analyst

- GBP said to have fallen on EU vaccine export threat

- But UK more exposed to India supply disruptions

- India confirms no more exports likely for foreseeable future

Above: File photo of EU Commission President Ursula von der Leyen. Photographer: Etienne Ansotte. © European Union, 2020. Source: EC - Audiovisual Service.

- Market rates at publication: GBP/EUR: 1.1582 | GBP/USD: 1.3686

- Bank transfer rates: 1.1350 | 1.3403

- Specialist transfer rates: 1.1500 | 1.3590

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

A potential ban or limit on vaccine exports to the UK from the EU has been credited by numerous foreign exchange analyst we follow as being behind a recent decline in the value of the British Pound, however this fear is potentially overblown says Stephen Gallo, European Head of FX Strategy at BMO Capital Markets.

Gallo tells clients in a research briefing out this week that the vast majority of the vaccine doses destined for the arms of UK residents were in fact always due to be manufactured in Britain and that for Sterling other factors could be behind a recent decline.

The call comes at a time of underperformance by Sterling and ahead of a Thursday decision by the European Union on whether or not to block the export of vaccines to other nations and how such a block might work.

The European Commission on Wednesday tasked EU member states to consider if vaccine exports are "justified" ahead of a Thursday meeting of EU leaders at the European Council, where it is expected any final decision would receive a stamp of approval from the bloc.

Image courtesy of the European Commission

Concerns have been expressed in the UK press and amongst foreign exchange practitioners that the move could potentially slowdown the UK's rapid vaccine rollout and ultimately delay the full reopening of the economy, which in turn has potential negative implications for Sterling.

"If vaccine exports are effectively blocked, the pound could depreciate further against both the dollar and the euro," says Asmara Jamaleh, Economist at Intesa Sanpaolo.

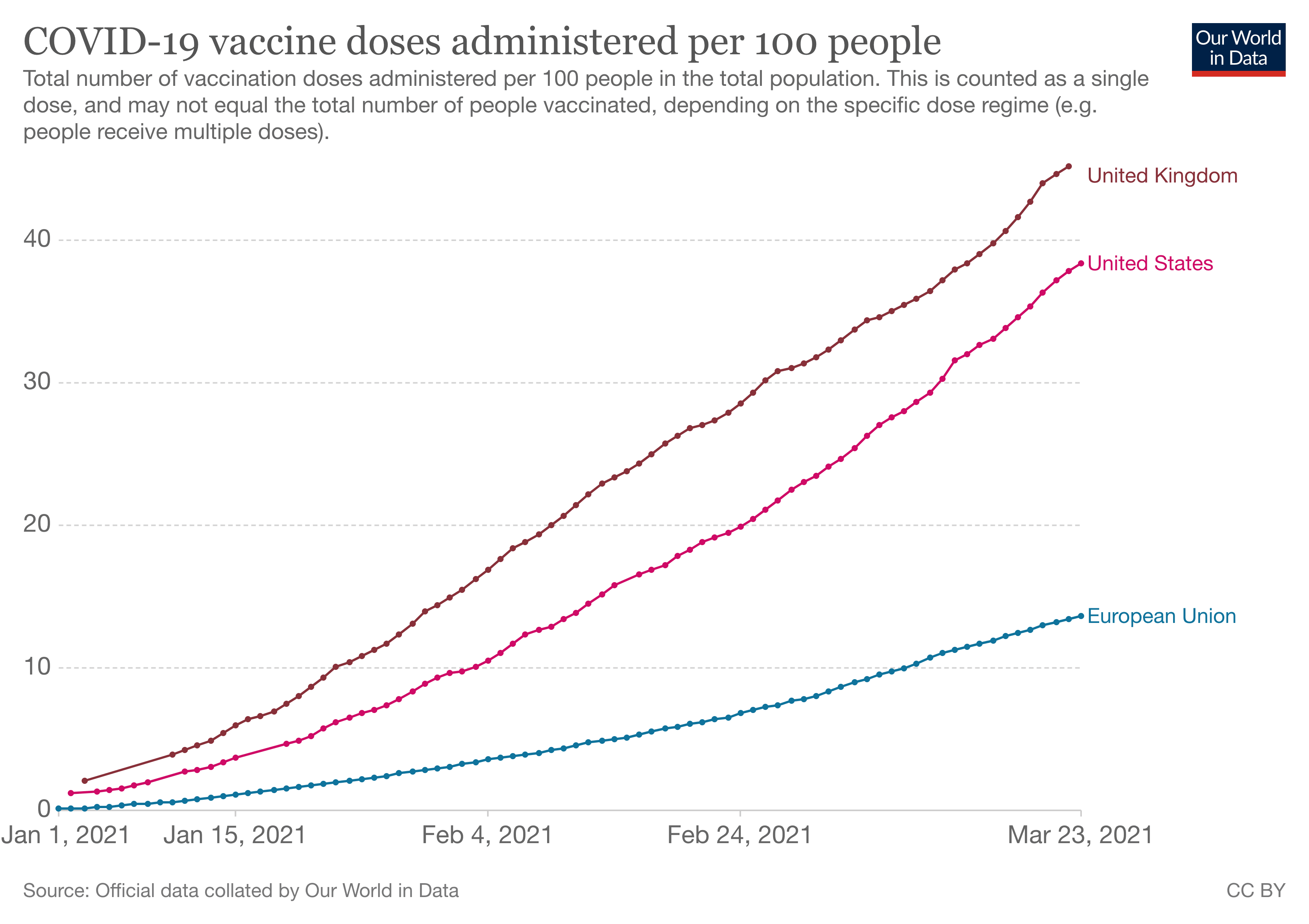

"Sterling fell to six-week lows amid an uncertain outlook for U.K. supplies of the coronavirus vaccine. The EU reportedly is to decide this week whether to ban vaccine exports to Britain as the bloc lags behind the U.S. and Britain in rolling out vaccinations, a scenario that undermined recovery prospects. The more upbeat outlook for the U.K.’s recovery hinges on its rapid inoculation rollout," says Joe Manimbo, Senior Market Analyst at Western Union.

"The growing risk of a serious disruption to the vaccine supply chain weighed on the euro and pound, while boosting the US dollar," says Raffi Boyadjian, Senior Investment Analyst at XM.com.

The developments come as Sterling struggles to make headway against the Dollar and Euro: the Pound-to-Euro exchange rate (GBP/EUR) has pulled back from levels above 1.17 achieved last week to 1.1160 and the Pound-to-Dollar exchange rate (GBP/USD) has retreated from 1.40 back to 1.3700.

But BMO Capital's Gallo has researched the numbers and supply dynamics of the UK's vaccine rollout programme and believes says that while concern has understandably hit Sterling exchange rates, concerns centred on an EU vaccine export ban could be overblown.

"In terms of the impact on the real economy, the UK has not received any of its 100 million doses of the Oxford/AstraZeneca vaccine from the EU, apart from a small batch produced at the Leiden (Netherlands) plant," says Gallo.

He says the vast majority of the 100 million doses the UK will receive will be made either in the UK or in India.

Supply constraints to the UK vaccine programme are expected to become evident from March 29 for about a month, according to government communications to vaccination centres.

The reason for the constraints were said to due to the delay of a shipment of 5 million vials of the vaccine from India's Serum Institute which was scheduled to supply 10 million doses in March.

The composition of the UK's vaccine supply chain was clarified, albeit inadvertently, on Wednesday when Italian police inspected an AstraZeneca plant in Italy and an Italian newspaper was quick to report that 29m vaccines were being "hoarded" ahead of export to the UK.

AstraZeneca confirmed later that these were in fact intended for both EU and Covax consumption (Covax being the programme to supply lower and middle income countries).

An AstraZeneca spokesperson told the media 13m doses of the vaccine in Italy were awaiting for quality control release to be dispatched to COVAX as part of their commitment to supply millions of doses to low income countries.

A further 16m doses were awaiting quality control ahead of dispatch to European countries, the spokesperson said none were destined for the UK.

This confirms a view that there is a potentially limited impact of any imminent vaccine export ban on the UK's programme and that the real crux of the supply question in fact lies in India.

News out midweek meanwhile give reason for concern as it was reported India had placed a ban on export of vaccines to all countries given the rise in covid-19 cases that had started to engulf the nation.

"No exports, nothing till the time the India situation stabilises. The government won’t take such a big chance at the moment when so many need to be vaccinated in India," a source told Reuters.

It is unclear how many doses are due to be passed from India to the UK but Gallo says the expected 100 million doses to be supplied by AstraZeneca to the UK nevertheless covers the entire adult population for a two-dose regimen, particularly given an expectation that take up of the vaccine will probably be less than 100%.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

He adds it's quite likely that the government has already been advised to place a precautionary order for extra doses, in view of the EU's threat to block exports.

Gallo says the Pound can therefore not be considered to have been overbought following its recent rally on the "basis of a potential EU vaccine export ban."

However, BMO Capital "do acknowledge that the GBP is running into headwinds as global risk appetite ebbs, and profit-taking in EUR short positions ensues on the non-USD crosses".

Andreas Steno Larsen, Chief Global FX/FI Strategist at Nordea Markets says his research suggests the British Pound is still relatively undervalued and that the UK should maintain a 'vaccination advantage' that continues to support the currency in the foreseeable future.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"The UK is by the way the very clear front-runner in the entire Western vaccine race, which is a reason why the GBP has had such a fantastic 2021 so far. The removal of the no-deal Brexit tail risk risks also compounded the pound rebound early 2021. Going forward, we assume that the GBP optimism continues due to a successful vaccine roll-out in the UK," says Larsen.

Larsen cites three reasons for the UK's relative success on vaccinations, all which remain relevant even in the event that the EU enacts an outright ban on vaccine exports:

1) The UK’s rapid authorisation of vaccines and subsequent roll out compared to peers

2) A much more clever wording of contracts with suppliers than EU (see Guy Verhofstad's blog for more)

3) It is almost The only country to decide on a de facto 1-jab (or a slow 2-jab) regime of the vaccine, which has proven to be the best approach by now.

Nordea Markets are looking for the Euro-Pound exchange rate to trade a range around 0.83-0.84, which equates to a Pound-Euro range of 1.19-1.2050.