Pound Sterling Gaps Higher vs. Euro on Monday, but Negative Bias Remains Entrenched

Image © Adobe Images

- German manufacturing in contractionary territory

- Euro broadly weaker

- But technical forecast suggests GBP/EUR to stay under pressure

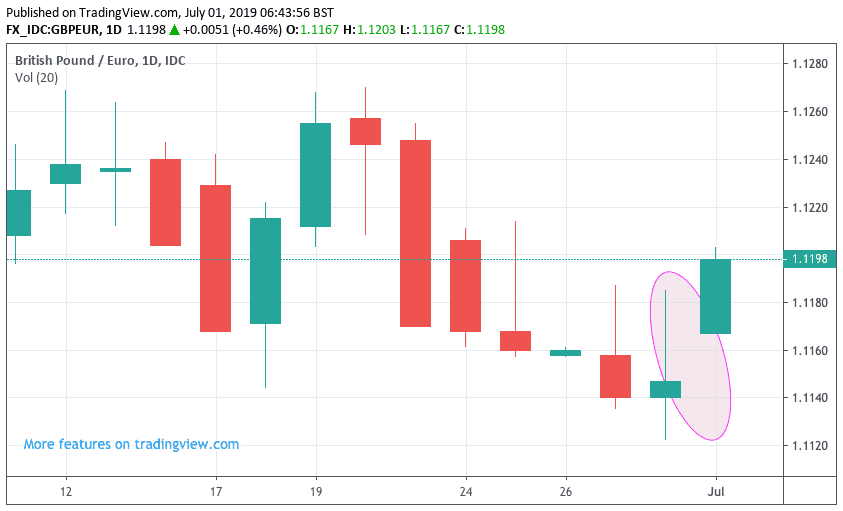

There was a strong start for the British Pound on Monday, July 1 with the UK currency briefly jumping back above €1.12 amidst a landscape of broad weakness in the Euro.

The Pound-to-Euro exchange rate 'gapped' higher from Friday's close at 1.1147 to record an opening rate of 1.1167.

At the time of writing the exchange rate is quoted at 1.1197 but it had been as high as 1.1203 in Asian trading:

What is behind the jump? If we look at the broader market we get the sense that this is more of a Euro story as opposed to a sign of a sudden resurgence in interest in Sterling.

The EUR/USD exchange rate is quoted lower by 0.44% at 1.1323: we suspect this is dragging other Euro 'crosses' - such as EUR/GBP - lower.

German data out on Monday confirmed an ongoing slump in the European economic powerhouse: the second release of the June Manufacturing PMI read at 45, disappointing markets which expected a more robust reading of 45.4.

A reading below 50 suggests the sector is in contraction, therefore the data will only cement concerns that the German economy is in the midst of a protracted slowdown. "Germany's manufacturing PMI remains well inside contraction territory as the sector continues to suffer in the face of global trade tensions, an autos slowdown and lingering uncertainty," says Phil Smith, Principal Economist at IHS Markit.

The French headlines were revised down to 51.9 while separate data in Spain and Italy were poor.

The Spanish PMI slid to 47.9, from 50.1 in May, while the Italian index slumped to 48.4, down from 49.7 in the month before.

"Another grim set of manufacturing data in the Eurozone," says Claus Vistesen, Chief Eurozone Economist at Pantheon Macroeconomics. "New orders fell for a ninth month running, driving down production, forcing firms to eat into existing work backlogs to ward off the worst of the slowdown in output. Needless to say, this trend is not sustainable amid still-falling new orders, warning of downside risks to production growth. In addition, the broad-based slowdown is now eating into the labour market; manufacturers in Spain, Italy and Germany all recorded falling employment."

A further potential cause for the Euro's under-performance could be a lack of agreement last night by EU leaders on filling the European Union's top jobs, particularly that of the European Central Bank (ECB).

Talks on the matter are set to continue today.

Overnight reports highlight that Angela Merkel's compromise plans (Frans Timmermans as EU Commission President and Manfred Weber as European Parliament President) have reportedly run into strong resistance.

"With the EU Parliament convening tomorrow, pressure is high to make appointments for the three top jobs up for grabs - Commissioner, Council President, and ECB President," says a briefing note from TD Securities.

Currency markets are most likely focussed on the ECB appointment, as the next President will have a significant bearing on future monetary policy, and hence the Euro.

Front-runner, Germany's Jens Weidmann, has clearly not found the backing he would have hoped for, perhaps because he is certainly the more 'hawkish' of the existing candidates. i.e. he would like to see higher interest rates at the ECB.

His appointment could well be interpreted as a positive for the Euro: "we think that any initial move in EUR would be based on a simple, knee-jerk Weidmann (up) or not-Weidmann (down) reaction," say TD Securities.

The Bank of Finland's Olli Rehn is being seen as a 'compromise' candidate for the job as he is neither French or German. "Rehn would be an easy "neutral" appointment to make (as he's not French or German) if negotiations for the big political jobs remain seized up," say TD Securities. "Rehn is the most dovish of the bunch, as he's the only one who has repeated Draghi's sentiment from the Sintra conference, that "In the absence of improvement... additional stimulus will be required." So he should be seen as more of a continuity candidate, carrying on Draghi's dovish and activist stance."

His appointment could therefore weigh on the single-currency.

While the GBP/EUR exchange rate starts the new week, and month, on a firmer footing, we note that the broader direction of travel remains lower.

"GBP will continue to underperform most major currencies because the risk of a no‑deal/hard Brexit on 31 October remains high," says Joseph Capurso, a foreign exchange strategist with CBA. "Boris Johnson (the front runner to replace Theresa May as Prime Minister) warned again he does not rule out suspending Parliament for a short period to force through Brexit at the end of October."

We continue to watch for further comments from Johnson on matters of the economy and Brexit, believing this to be a key focus for markets at present.

Our technical editor, Joaquin Monfort, wrote ahead of the new week that the GBP/EUR exchange rate is likely to extend lower based on his studies of the market:

"The pair will probably continue declining after a short period of sideways activity in a range roughly between 1.1120 and 1.1190."

The main reason for expecting some range-trading is that the RSI momentum indicator is converging with price action. This occurs when price makes a new low but momentum does not mirror it. This happened on Friday, June 28, when price made a new low at 1.1121 but momentum did not. The convergence was an early warning of the bounce that occurred after the new low.

The S1 monthly pivot at 1.1125 is a mild support level. Monthly pivots are a reference point used by professional traders both as a gauge of the trend and as a support or resistance level in themselves.

A break below 1.1115 would provide confirmation the pivot was broken and the downtrend was set to continue. Such a move would be expected to reach 1.1050 in the week ahead.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement