Pound-to-Euro Exchange Rate: Higher, but Curb Your Enthusiasm

Image © Pound Sterling Live

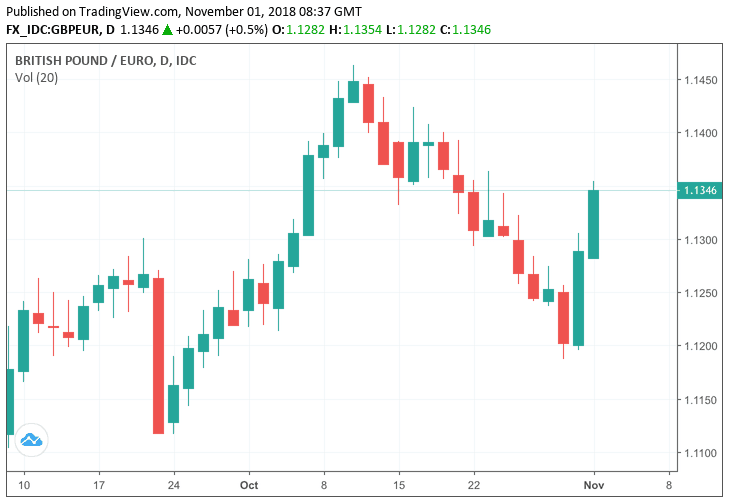

- Sterling recaptures ground lost in October

- Sterling considered oversold after recent sell-off

- We don't see prospect of surge extending above 1.1450 near-term

The British Pound is witnessing a strong short-term run higher against the Euro at the start of the new month and has reversed over half of the decline suffered over the past three weeks in less than 48 hours, but we are wary that selling pressures will emerge closer to a notable ceiling in the market.

The gains come as market participants felt they might have been too negative on Sterling in light of the potential for a Brexit deal being struck over coming weeks.

"GBP is oversold," says James Rossiter, a foreign exchange strategist with TD Securities. Rossiter says there is further potential for the currency to go higher if the Bank of England strikes an optimistic tone at this Thursday's policy meeting.

However, the lion's share of the Pound's rally is owed to Brexit negotiations where a series of rumours over the past 24 hours has fuelled a recovery in the Pound-to-Euro exchange rate from sub-1.12 to record a current daily and weekly high at 1.1350.

Sterling bounced yesterday after Brexit Minister Dominic Raab said he was hopeful of a deal with the E.U. on the terms of the UK's departure being struck by November 21.

This morning The Times reports that Theresa May has settled a deal covering the trade in services, giving Sterling a further boost ahead of this morning's PMI data, Inflation report and Bank of England meeting.

"More than anything else, this highlights the fact that the Pound reacts faster and more to good than bad news. I'm not sure it tells us a great deal about the longer-term outlook," says Kit Juckes, a foreign exchange strategist with Société Générale.

Concerning the outlook for the Pound against the Euro, do we see this really continuing?

Our immediate answer would be no.

Firstly, the above news reports are rumours, and rumours are there to be denied. We do not doubt the authenticity of the reports, but we must remember any developments that are not from the mouth of Michel Barnier are not gospel.

Indeed, the man himself jumped on Twitter early afternoon to deny the reports:

"Misleading press articles today on Brexit & financial services. Reminder: EU may grant and withdraw equivalence in some financial services autonomously. As with other 3rd countries, EU ready to have close regulatory dialogue with U.K. in full respect for autonomy of both parties."

We expect this pattern of rumour and denial to extend until negotiations either fail or result in a deal.

Secondly, the Pound appears to merely be trading within a range markets are comfortable holding until that concrete resolution to Brexit negotiations is delivered, be it a deal or no deal.

Therefore, we would expect Sterling strength to fade near the October highs located at around 1.1450.

1.1250 is widely considered to be a long-term fulcrum for the exchange rate as a study of charts suggests the pair has gyrated around this point for months now. It is a point of equilibrium in the current regime and therefore those watching this exchange rate should expect moves either side to ultimately be short-lived.

The big trends that lie ahead will most likely start when the status of the future relationship is known, and judging by ongoing headlines, this could come as early as November 21.

Advertisement

Bank-beating GBP/EUR exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here