The Pound Rallies on News Raab Expects Brexit Deal within Three Weeks, Records Strong Rebound vs. Euro, U.S. Dollar

Above: Dominic Raab. Image © European Union, 2018 / Source: EC - Audiovisual Service / Photo: Lukasz Kobus.

- Raab says E.U. agrees to U.K. proposal on customs union backstop

- "End now firmly in sight"

- Sterling best performing G10 currency of the day

Pound Sterling has gone from the currency market's underperformer to its undisputed leader in the space of 24 hours thanks to a sizeable leap recorded midweek which owes itself to a positive swing in expectations for a Brexit deal.

The Pound accelerated gains later in London afternoon trading session after the U.K.'s Brexit Secretary Dominic Raab said he believes a Brexit deal is a mere three weeks away.

In a letter to Hilary Benn, chair of the Commons Brexit committee, Raab says he is happy to give evidence to the committee when a deal is finalised, and currently expect 21 November to be suitable.

Raab adds:

"The end is now firmly in sight and, while obstacles remain, it cannot be beyond us to navigate them. We have resolved most of the issues and we are building up together what the future relationship should look like and making real progress."

Raab confirms that the U.K. and the E.U. now “agree on the principle of a UK-wide customs backstop”.

Until relatively recently the E.U. was resisting this.

The Pound is hooked on shifts in sentiment on Brexit negotiations and current headlines represent a swing in a Sterling-friendly direction.

“No Halloween scares today, instead we finally have a concrete date from Raab regarding a Brexit deal being finalised, and the Pound has jumped in response," says Hamish Muress, a currency analyst at OFX in London.

The Pound-to-Euro exchange rate raced higher to record a daily best at 1.1307 on the news, more than reversing the previous day's decline to 1.1185 which also represents October's low.

The Pound-to-Dollar exchange rate quoted a daily best at 1.2829, having recorded a two-month low at 1.2696 on Tuesday, October 30.

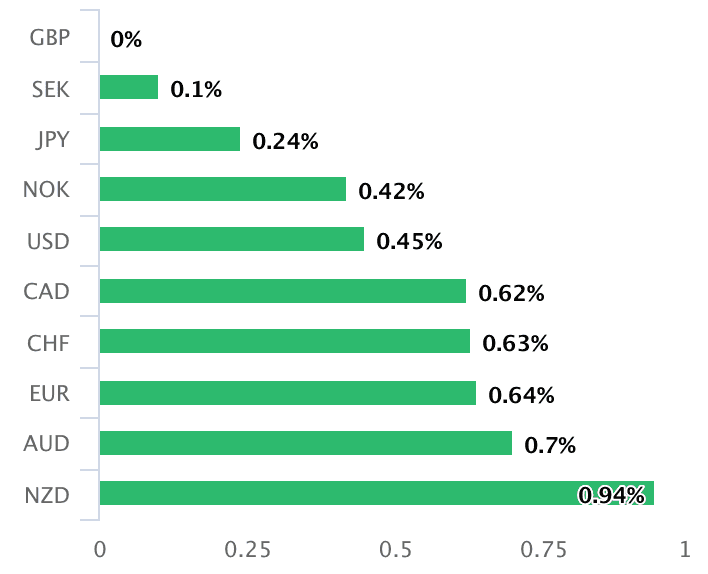

Above: Sterling's performance on October 31. Image (C) Pound Sterling Live.

We reported earlier today that sources close to Brexit negotiations have told the BBC's Political Editor the "main expectation on both sides still appears to be that there will be a deal of some description."

The BBC's political editor Laura Kuenssberg reports her sources as saying it remains "too early" to tell if there is a way of putting together a deal that will be approved by Prime Minister Theresa May's Cabinet.

However, she says May's lead Brexit aide Olly Robbins has been "back and forth" to Brussels, "hoping to get talks back officially soon but right now no landing zone."

The E.U. and U.K. are said to be "exploring again" the same issues of contention, "they are trying to put the same ingredients together to make something that’s politically different and palatable in U.K.," says Kuenssberg.

#GBP jumps, then retreats, on story Dominic Raab says Brexit deal by 21st Nov #GBPUSD pic.twitter.com/BJ9JUUoXGR

— David Morrison (@DavidGKFX) October 31, 2018

With regards to Sterling's outlook, Muress says currency markets will have to wait to see if Raab's date can be stuck to, and if anything leading up to November 21st may cause more market jitters.

"Either way, we have long maintained that the Pound is a stickler for Brexit details, and in the last few weeks we’ve seen very few updates, particularly since the E.U. Summit. The announcement today from Dominic Raab will be welcome news for many, providing a reprieve for the pPound in the face of the surging Dollar, which has seen GBP/USD lose over 3.5% in a matter of weeks," says Muress.

"Sterling could rally if a Brexit deal can be agreed in November, after recent steep losses spurred by fears agreement will not be reached. Those fears depressed GBP/USD to a 10-week low of 1.2697 Tuesday – a mere 35 pips shy of August's 14-month low, a fortnight after it was trading on a 1.32 handle. August's low came amid prior no-deal fears, before GBP rose on hopes for an agreement," says Robert Howard, an analyst on the Thomson Reuters currency desk.

Advertisement

Bank-beating exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here