The Dollar-Neutral Federal Reserve is Playing the Long-Term Game

US Federal Reserve maintains a steady and Dollar-Neutral approach to interest rate rises that is unlikely to be swayed by near-term fluctuations in the data pulse.

The Federal Reserve's September policy update provides important clues for what will now drive the path of US interest rates, and therefore the Dollar, for the remainder of 2017.

Instead of using the near-term data pulse to determine whether interest rates should rise or not, analyst Kathleen Brooks at City Index observes the Fed to have apparently shifted to adopting a prescribed set-course, as illustrated in the outcome of the recent September meeting.

Recent soft data suggested the Fed might not make a third rate hike in 2017, and might not stick to its previous plan of three hikes in 2018, yet in the end they maintained a stance set in earlier meetings.

However, the long-term game appears to be the central concern, and there is nothing in it for the Dollar it would appear.

“We could not find anything decisively hawkish (relative to expectations) that could justify the Dollar rally. In all likelihood some market participants may have been expecting a more cautious stance that did not materialise and responded by bidding the greenback higher as the probability of a rate hike in December has now risen,” says Chiara Silvestre, Economist at UniCredit Bank.

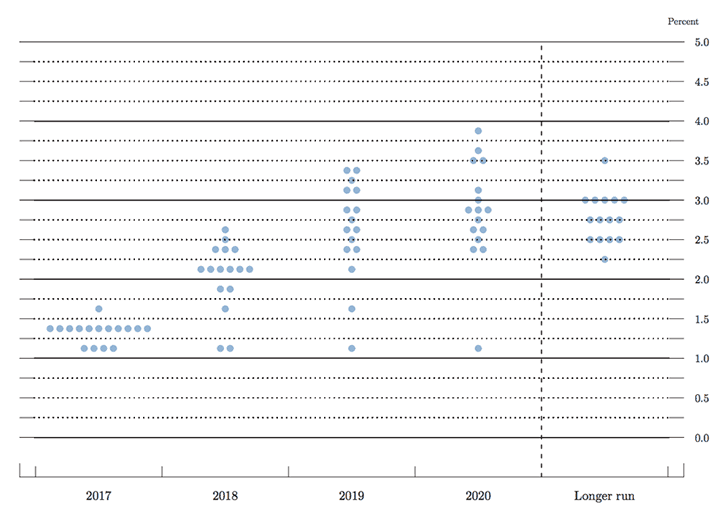

Fed member’s meet and vote to set interest rates but also make forecasts about where they think interest rates will be in the future, which is represented graphically on the Federal Reserve website as the ‘dot-plot’ in the Summary of Economic Projections.

Above: The dot-plot graph. Each shaded circle indicates the value (rounded to the nearest 1/8 percentage point) of an individual participant’s judgment of the midpoint of the appropriate target range for the federal funds rate or the appropriate target level for the federal funds rate at the end of the specifed calendar year or over the longer run. One participant did not submit longer-run projections for the federal funds rate.

The future expectations of each of the 16 members of the Fed are represented by a dot on a graph at a level where they expect rates to be at a given moment in time.

Whilst analysts expected the dots to fall at the September meeting, reflecting misgivings about growth and inflation, in the end officials barely changed their views and the dots remained broadly unchanged.

“We doubt that this is a game-changer for the USD since markets are unlikely to fully price the December hike for now and will not fully converge with the 2018 dot-plot not least because there is considerable uncertainty about Fed leadership next year,” says Manuel Oliveri with Credit Agricole.

Credit Agricole maintain the view that the USD would need to see either major fiscal stimulus or a broad acceleration in inflation to post a sustained rally.

Does Data Even Matter? Depends Where you Look

“Investors should remember this shift, data may not be the most important driver of asset prices anymore. The Fed is on a set path to normalise rates and shrink its balance sheet, and it thinks that the economy can handle that even if inflation is below target,” says Brooks.

If it seems difficult to believe that the Fed might ignore its own lower inflation forecasts and still wish to raise interest rates, yet it seems so - the explanation, according to Brooks, lies in the robust performance of the labour market, which carries with it the promise of higher inflation.

“The FOMC has weighed up the low unemployment vs, low inflation debate and decided to side with low unemployment, assuming that inflation will catch up at some stage,” says Brooks.

Of course this is an assumption based on economic theory which does not always work in practice.

Take Japan, for example, there too they have very low unemployment but still have a deflation problem.

All over the world, in fact, there seems to be a problem with static wages which despite the low general level of unemployment seems to be inhibited from shifting higher.

If Brooks is right, and the Fed is set on a path of tightening no-matter what then the one metric it may still be keeping an eye on is wage data, which is already of significant importance due to the low wage/low inflation/high employment problem.

The High Employment Low Inflation Connundrum

The exact reasons why inflation appears to be stubbornly low despite historically high levels of unemployment are a source of continued debate, and mystification, amongst policy makers and central bankers.

“The trend could reflect the lingering after-effects of the global financial crisis,” suggests Bloomberg’s Daniel Moss in piece exploring the paradox of low inflation and high employment.

Another reason for low inflation, which has been posited by the governor of the Bank of Japan, is a “deflationary mindset” – which seems to describe a psychological blockage amongst the populace at large, which includes a reluctance or fear of demanding higher wages, taking financial risks and spending more liberally.

The deflationary mindset appears to have spread even to infect trade unions in Japan.

“BOJ officials feel let down by labor unions that, they complain, haven't been anywhere near aggressive enough in annual wage negotiations with employers,” adds Moss.

Yet there are other reasons too: increasing automation has lowered the cost of production and a shift away from manufacturing jobs to lower paid service sector jobs has been put forward as another cause.

Globalisation has also dampened wage growth as an increasing number of services can be outsourced to other countries where they can be done cheaper.

But do these exogenous dampening factors now mean the link between unemployment and inflation has been broken?

Not according to Canadian based Fidelity Investments, who say there is still a link but that it is weaker.

They refer to the Phillips curve which describes the link between inflation and unemployment, and note how more recently the relationship has failed to track the expectations of the curve as exactly as it used to, and has grown more dispersed.

The link between unemployment and inflation is weaker than it used to be, says the firm.

Yet they do not think the link is has completely broken down, and argue that since we're now close to full employment, wage inflation will come, “although the peak for this cycle will be low compared to history,” said Fidelity (reported by Buisiness Insider).

All Central Banks Together

Returning to the debate around the the Federal Reserve, however, and CityIndex’s Brooks notes how the change of mindset at the Federal Reserve is being mirrored by central banks elsewhere, such as the Bank of England (BOE) for example.

“If the Bank of England moves in November for similar reasons to the Fed (a willingness to look through high inflation in favour of a tight labour market) then we could see the world’s major central banks all take a hawkish stance in union (bar the BOJ), which is a new phenomenon nearly 10 years on from the financial crisis,” says Brooks, adding:

“All of them (the ECB is likely to announce an end to its APP programme in the coming months) seem to have decided to the time has come to reduce the extremely accommodative stance adopted in recent years and start bringing some normality to financial conditions, and potentially to financial markets.”

Nor does the City Index analyst expect to see a fall in the stock market, as she sees investors hungry for yield over stimulus which explains the quick recovery in stock indices on the morning after the Fed meeting.