June Rate Hike at the Fed is Still Very Much On the Table, Says Nordea

Fears that the US Federal Reserve (Fed) could scrap plans to raise interest rates by a quarter of a percent in June are exaggerated.

“We continue to expect the next rate hike in June, followed by another hike in September,” says analyst Johnny Bo Jakobsen at Nordea Bank in a note seen by Pound Sterling Live.

If his prediction comes good the Dollar is likely to rise rather than fall as it is supported by higher interest rates.

Of late expectations on the pace of interest rate rises at the Fed have waned as US economic data releases disappoint against expectations. Last week Q1 GDP data read at 0.7%, well below expectations for more a more robust figure.

This has had impacted on the Dollar which continues to underperform against its main rivals.

But, Jakobsen is optimistic on the US economic outlook pointing to increasing employment costs and wage growth as signs that inflation will move higher prompting a rate rise from the Fed.

And due to seasonal volatility in GDP, employment may be a better gauge of the health of the economy.

“According to the headline employment cost index, private-sector wages rose at 3.2% annual rate in Q1, up from a 1.9% pace in Q4,” says Jakobsen.

Compared to a year earlier wages were 2.4% higher in Q1 – an acceleration from the 2.3% in Q4 2016, and in the private sector wages rose 2.6% compared to last year.

The growth in earnings appears to come from the labour market nearly reaching full employment and Jakobsen dismisses arguments that the Phillips Curve, which correlates wage gains to unemployment, is dead.

Doubts about whether a June hike would go ahead began after the release of Q1 GDP which showed only a 0.7% rise - well below market expectations of 1.0%.

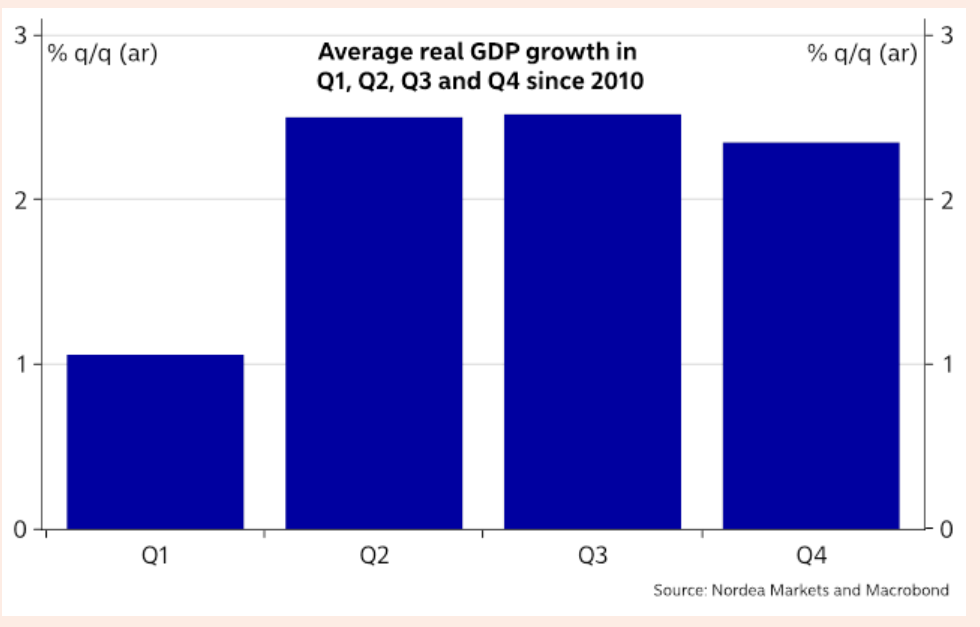

The Dollar was surprisingly unreactive after the GDP result was released and this was probably due to the fact that Q1 GDP has come to be expected to undershoot in Q1, due to seasonal effects.

“We attribute a good share of the weakness in Q1 to seasonal adjustment problems, and we therefore believe markets and the Fed will largely dismiss the data given the recurring pattern of Q1 weakness in recent years,” says Jakobsen.

There is a good chance, therefore, of a bounce back in GDP occurring in Q2.

The pace of economy is estimated at 2.0% annually, which is above the 1.8% Fed target but well below President Trump’s 3-4% target.

Jakobsen says that the unspectacular growth rate is due to long-term structural factors.

“The lacklustre pace stems from trends that started before the Great Recession and are continuing largely unabated: stubbornly weak productivity gains and slowing labour force growth,” says Jakobsen.

For this reason, he thinks Trump’s goal of 3-4% is unrealistic.

But it is worth pointing out that the Atlanta Federal Reserve's Nowcast model suggests Q2 GDP growth at a staggering 4.3%.

"The model, which is highly accurate for pointing out the weakness in US Q1 GDP is suggesting a strong acceleration," says Lars Merklin at SEB.

But does calling the Q1 data correctly allow them to call Q2 data correctly too?

Not necessarily argues Merklin pointing out that Nowcast relies heavily on assumptions as opposed to real data.

"But it suggests the US economy could be in for a steep acceleration. The model sees growth as coming from deomstic consumption, inventories and investments."