Pound to Dollar Rate Rallies on Betting Odds Shift, Bigger Gains Forecast on a Harris Win

- Written by: Gary Howes

File image of Kamala Harris. Image: Gage Skidmore.

The Pound to Dollar exchange rate rose on Monday as markets reacted to rising odds that Kamala Harris can win Tuesday's presidential election.

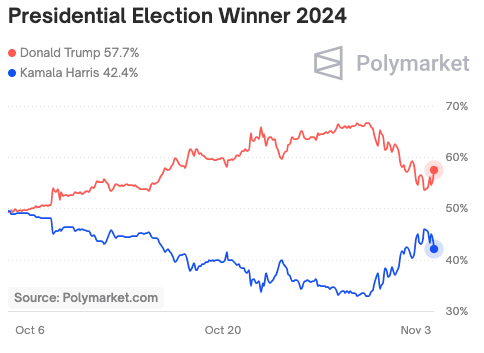

Betting market aggregates now have the odds of a Trump win at around 57%, which is below the high tide marker of 65% seen on October 30.

The Dollar is tracking these odds closely, rising when the odds of a Trump win are up and falling when his odds retreat.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

This speaks of the USD-supportive policy mix proposed by Trump, which would include inflationary import tariffs.

A number of new polls released over the weekend were more favourable to Kamal Harris, with one even suggesting she would register a shock win in Iowa.

The retreat in betting market odds favouring Trump would better reflect the uncertainty in the polls, where the margin of error still suggests a 50/50 toss-up for the outcome.

"Recent polls suggest that Kamal Harris has been gaining favorability in the swing states at the same time as the odds of a Trump win on betting markets continue to fall. Investors at Polymarket and Kalshi still see the former president in the lead. However, Predictit now has Harris narrowly winning the contest," says Boris Kovacevic, Global Macro Strategist at Convera.

We could have a result by Wednesday, and a win for Trump is widely expected to bolster the Dollar, while a win for Harris would have the opposite effect.

Some analysts think a Harris win could see the Pound-Dollar exchange rate return to 1.33.

"EUR/USD and GBP/USD could slump to their Q124 lows or head lower still in response to a Trump victory accompanied by a ‘red wave’ in the US Congress. In contrast, their upside could be limited to 1.10 and 1.33 in the event of a Harris victory and a divided US Congress," says Valentin Marinov, an analyst at Crédit Agricole.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Analysts at TD Securities say a second Trump Presidency would kick-start a sizeable USD rally.

"It would rekindle memories of US Exceptionalism, anchored by tariffs, tax cuts (on Red Wave), deregulation and negative impacts on the global growth outlook. A Harris Presidency brings some USD weakness as Trump risk premia gets unwound with a Blue Wave accentuating the decline in the USD," says TD Securities.

For Pound Sterling, the domestic highlight of the week is Thursday's Bank of England decision, where a 25 basis point interest rate cut is expected.

The cut has long been 'in the price' of the Pound and is unlikely to sway the market. However, the guidance pertaining to the potential for another cut in December will be important.

If the Bank leans towards a second consecutive cut, then the Pound-Euro rate would come under pressure.

However, last week's budget has lowered the odds of a December rate cut and the market now prices a quarterly pace to the UK rate cutting cycle, which is relatively supportive of the outlook.

"GBP should react most prominently to any implicit forward guidance. The FX-yield link has ruptured since the Budget and higher yields have not helped GBP. But higher growth and inflation should lead to a less dovish BoE and support the currency," says Dominic Bunning, FX strategist at Nomura.

The Bank has less opportunity to cut interest rates following last week's budget, where the government announced a significant boost to spending which analysts say could give a 'sugar rush' to the economy next year.

The fiscal expansion is inflationary by nature, meaning the Bank will have to respond by maintaining interest rates at higher levels for longer. Indeed, the Office for Budget Responsibility upgraded its near-term growth and inflation forecasts following the budget and we will be watching for the same at the Bank of England.

Any upgrades to inflation and growth would amount to a strong signal that the Bank of England acknowledges it will have to maintain a tighter monetary policy.

This can support the Pound.

Analysts say the biggest downside risk to Sterling would be a scenario where the Bank lowers interest rates and guides towards another rate cut as early as December.