Pound to Dollar Week Ahead Forecast: Pullback Has Further to Run

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's uptrend against the Dollar could experience a deeper setback this week if U.S. labour market data beat expectations.

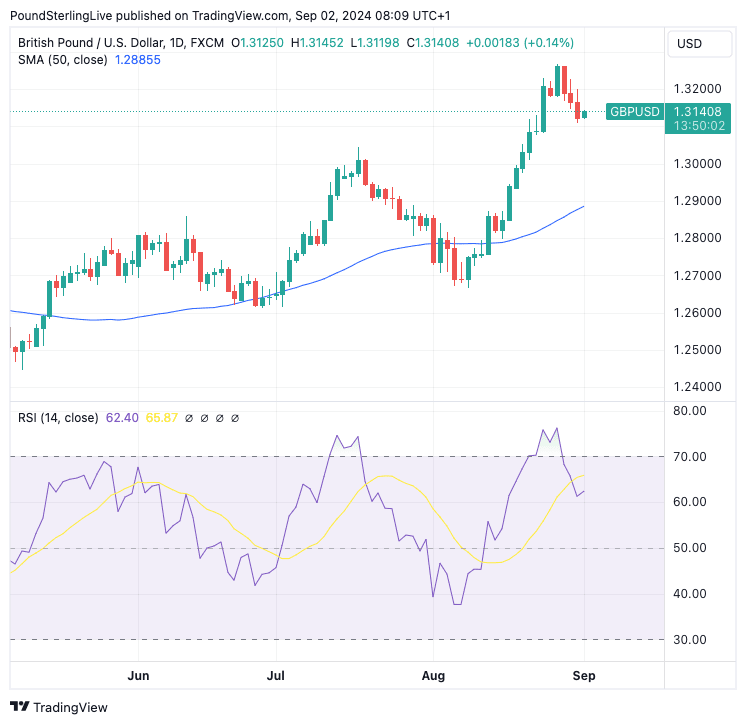

The Pound to Dollar exchange rate last week peaked at 1.3266 but was left technically overbought following successive daily gains. It has subsequently retreated to the early 1.31s, where we find it at the start of the new week.

We can confirm the Relative Strength Index (RSI) has fallen back below 70, indicating that overbought conditions have dissipated. However, separate data shows the market is notably 'short' against the Dollar heading into this week's non-farm payroll report, which raises risks of a deeper pullback if the data comes in strong.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Our Week Ahead Forecast model shows the Pound can fall further in the coming days, potentially taking GBP/USD below 1.31 this week before extending to 1.29 in a three-week time frame.

A study of the charts shows that previous pullbacks in the current cycle have tended to be fairly sizeable: the July-August retreat lasted for three weeks, while the June pullback lasted two weeks.

Looking at the daily chart shows the 50-day moving average has been where the past two pullbacks have faded, which would signal the current retracement can go as low as 1.29:

Above: GBP/USD at daily intervals with 50-day MA in top panel and a better balanced RSI in the lower panel, which signals overbought conditions have unwound.

"A short-term pause can’t be ruled out, but graphical level near 1.2900 should cushion downside," says Tanmay Purohit, a technical analyst at Société Générale.

He reminds us, however, that Sterling is in a medium-term uptrend against the Dollar and setbacks are still viewed as a short-lived countertrend phenomenon. "Defence of 1.2900 could mean persistence in up move. Next potential objectives are located at projections near 1.3320/1.3360 and 1.3580," says Purohit.

Ultimately, the duration of any retreat in GBP/USD will rest on this week's U.S. data, which will determine the size of September's Federal Reserve rate cut.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

A 25 basis point September rate cut is now fully discounted by the market and explains USD underperformance over recent weeks. But the selloff was also linked to rising odds of a 50bp cut, owing to evidence that the economy was starting to slow notably.

We think that the odds of a 50bp cut can recede further on a stronger-than-expected U.S. non-farm payroll report on Friday, which can further bolster the Dollar and weigh on GBP/USD.

"A paring back of Fed rate cut expectations should see the USD recover some lost ground," says a strategy note from analysts at HSBC, which finds the USD now looks cheap relative to fundamentals.

"The incoming data this week has generally supported our view that the US is on track for a soft landing, and if we are right in thinking that payrolls growth will rebound a bit from the surprise weakness in July, the odds of a 50bp cut from the FOMC at its next policy meeting will probably recede further," says Jonas Goltermann, Deputy Chief Markets Economist at Capital Economics.

The market expects a payroll print of 163K for August, up from 114K in July.

Capital Economics forecasts a healthier 170K gain, alongside a small fall in the unemployment rate to 4.2%. Wage growth should remain at 3.6%.

"Together, that would be consistent with a 25bp rate cut by the Fed next month," says Thomas Ryan, North America Economist at Capital Economics.

Lars Mouland, an analyst at Nordea Bank, says Hurrican Beryl, which swept through Texas on July 8th, might have been the main reason the July employment numbers looked so bad.

"We expect a rebound in next week's data will remove some of the recession fears," says Mouland.

He explains that economic activity was also impacted by Beryl as the entire 140K national drop in July housing starts can be traced back to the Southern states, with no discernible changes elsewhere.

Ahead of Friday's job report, we will be covering survey figures in the form of Tuesday's ISM manufacturing PMI, which is seen at 47.5, up from 46.8.

Thursday's ISM services PMI will be watched closely, with the market expecting a print of 50.9 in August, down from 51.4.

Strong PMI figures would see the Dollar firm ahead of the all-important job report.