GBP/USD Week Ahead Forecast: Ominous Signs

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate's late-week slump is an ominous sign and points to the potential for losses in the coming days.

Pound Sterling joined its G10 peers in surging higher in the wake of Friday's weaker-than-expected U.S. job reportweaker-than-expected U.S. job report that raised the odds that the Federal Reserve would cut interest rates before December.

The Pound to Dollar exchange rate spiked to just above 1.26 but soon plopped back down to levels seen before the jobs print. This is despite other currencies maintaining their gains against the Dollar, which immediately signals GBP-specific weakness.

This tells us the market is nervous that the Bank of England will see the slowdown in the U.S. jobs market as the adequate cover they need to turn more dovish and cut interest rates sooner rather than later.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Governor Bailey and his Deputy Dave Ramsden both signalled last month that they reckon the battle against inflation is being won and that they can start cutting before the inflation figures actually confirm this outcome.

Ideally, the Bank would like to cut alongside other central banks in order to minimise financial volatility, particularly exchange rate volatility (early cutters also risk slashing the value of their currencies).

The soft U.S. job report increases the scope for the Federal Reserve to cut rates sooner, and markets are betting this will impact the thinking at the Bank of England. In short, what's dovish for the Dollar is also dovish for the Pound.

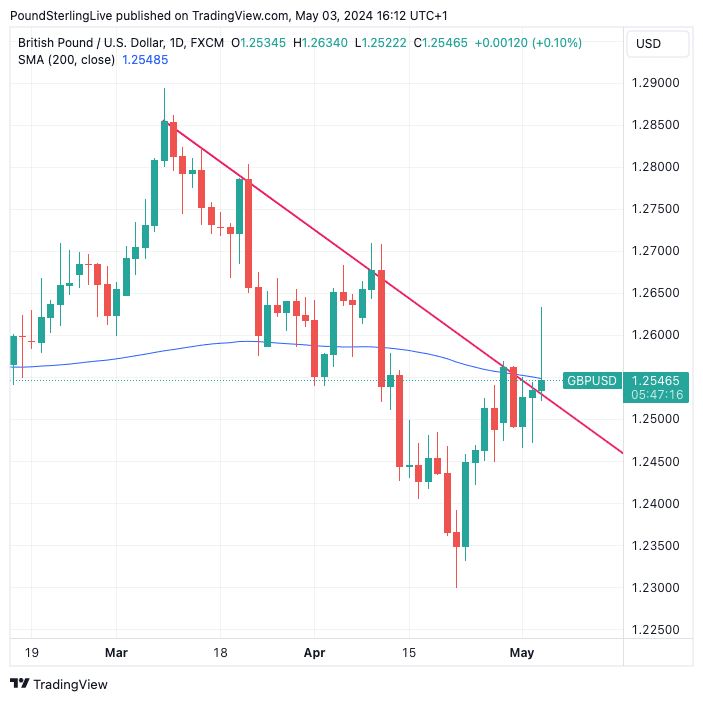

Above: GBP/USD at daily intervals.

We were close to declaring an end to the 2024 downtrend in Pound-Dollar when it broke above the downtrend line on Friday (see the above chart). But the subsequent failure of the rally means this could well be a false break and if Pound-Dollar slips back below the line in the coming days, it could journey to 1.22 this May, which is historically a very poor month for this exchange rate.

Note too that at the time the chart snapshot was taken, the exchange rate had actually fallen back below the 200-day moving average, which suggests a formidable resistance area could be thwarting the upside.

Our Week Ahead Forecast rule is that while below the 200 DMA an exchange rate is in a downtrend, while above it, an uptrend is underway. Maybe the market just needs more information before flipping the trend.

A chunk of that information will be provided on Thursday when the Bank of England gives its latest interest rate guidance and forecasts, which could well confirm a June rate cut is favoured.

This implies more repricing in UK bond markets will be required to take place, at the expense of the Pound.

Paul Robson, G10 FX strategist at NatWest Markets, says the clearest risk to the Pound would be if markets ultimately moved to price NatWest's base case for 100 basis points of interest rate cuts this year. At the time of writing the market is pricing about half this amount.

"The pound is susceptible to BOE risks into the May 9 meeting," says a note from the FX research team at Barclays. "The MPC is gradually pivoting more dovish, as evidenced by Ramsden's recent speech but also more measured statements by Governor Bailey at the IMF meetings."

Track GBP/USD with your own custom rate alerts. Set Up Here

What most economists are in agreement about is the degree of divergence in views on the Monetary Policy Committee. There now exists a full spectrum of thinkers, with Swati Dhingra having long advocated for a rate cut while it was only in March that two members dropped their calls for further hikes.

Recent commentary shows even the centrists are divided (Chief Economist Huw Pill wants to wait it out for longer, while Governor Andrew Bailey and Deputy Governor Dave Ramsden look like they are ready to cut.

"Having voted as a bloc in recent years, the five internal members appear less united than before," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

"The BoE's outlook appears somewhat more uncertain, as the MPC has seemingly become more divided over the need for early rate cuts," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

This means there will be 'new news' on the UK rate outlook next Thursday, and 'new news' can move currency markets.

"We expect the Monetary Policy Committee to reiterate that rate cuts are coming soon," says Goodwin.

When we consider an upside scenario for Sterling, we imagine it would involve the Bank being at pains to signal that nothing much has changed and that while it is pleased with progress on inflation it remains guarded.

This could solidify expectations for an August rate cut. Here we would imagine the Pound recovers towards last Friday's highs, with the scale of any recovery depending on how deep the selloff that is underway in the immediate term extends.

The coming week will be a busy one from a Federal Reserve rate expectations perspective, which is, of course, the main driver of the Euro-Dollar.

On this front we have a host of Fed speakers lined up to give their views on recent data and what they think it means for the policy outlook. This could provide some volatility and provide some churn, but ultimately, it won't be until mid-month that the more important macro releases come through, the highlight being the inflation print.