Dollar Powers Ahead After U.S. Retail Sales "Crush" Expectations

- Written by: Gary Howes

Image © Adobe Images

The Dollar was near multi-month highs against the Pound, Euro and other major currencies following another blowout economic data release.

The Pound-Dollar exchange rate fell to 1.2451 in the minutes following news retail sales rose 0.7% month-on-month in March, more than doubling the 0.3% figure expected by the market.

"US retail spending smashed forecasts last month, suggesting that underlying consumer demand remains remarkably healthy," says Karl Schamotta, Chief Market Strategist at Corpay.

The control group measure of retail sales - which excludes gasoline, cars, food services, and building materials - surged 1.1% in March, topping forecasts set at 0.4%.

Total receipts at retail stores, online sellers and restaurants jumped 0.7% m/m, up 2.4 y/y over a year prior.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The prices-paid component hit its highest levels since last May, which is consistent with evidence U.S. inflation rates are accelerating again.

Market expectations for the number of rate cuts to come from the Federal Reserve in 2024 have fallen dramatically in the face of rising inflation, with Société Générale being the latest major institution to warn it no longer expects the Fed to cut rates in 2024.

Dollar exchange rates have risen amidst this shift in expectations, while stock markets have come under pressure.

"The path for further US dollar appreciation from here remains clear with the US CPI data forcing markets into a rethink on the starting time for the first rate cut from the Fed," says Derek Halpenny, a foreign exchange analyst at MUFG Bank Ltd.

Corpay's Schamotta says Fed Chair Jerome Powell could have little choice but to reset the clock on rate cuts in upcoming appearances.

"The central bank’s repeated assertion that policy rates are in "restrictive" territory - perhaps defined by the difference between the real Fed Funds rate and the Holston-Laubach-Williams estimate of the "natural" rate of interest - look ever more difficult to justify, with activity indicators following market valuation-driven indicators in pointing to a wholesale loosening in financial conditions," he says.

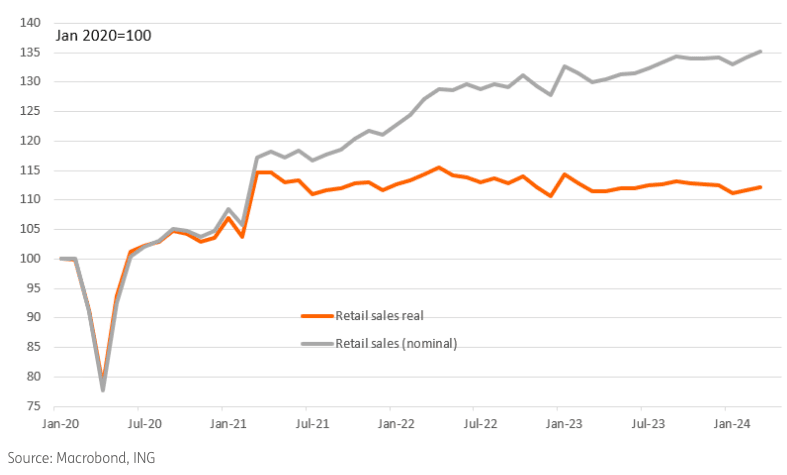

However, elevated inflation rates might be flattering the impression of a booming economy, says James Knightley, Chief International Economist at ING Bank.

"We have to acknowledge that the retail sales number is a nominal dollar growth rate and with inflation running so hot this is accounting for much of the growth. Real retail sales, i.e. retail sales adjusted for inflation, are much weaker and essentially have been flat for the past three years," he explains. (See ING's chart, above).

Knightley says income growth is slowing, savings are being exhausted and the cost of borrowing on credit cards is at multi-decade highs.

"We expect spending and inflation to slow, but until it does the Fed won’t be contemplating rate cuts," he adds.