GBP/USD Week Ahead Forecast: Holding the Line

- Written by: Gary Howes

- GBP/USD finding some short-term support

- Scope for modest rebound in coming days

- UK PMIs are the data highlight

- As U.S. data calendar calms

Image © Adobe Images

The Pound to Dollar exchange rate retreated further last week but the losses remain relatively constrained and we see the potential for some slight upside in the coming days.

To be sure, we are in an incredibly low volatility environment in global FX, despite the market's focus on fading U.S. Federal Reserve rate cut expectations, suggesting the odds of a sizeable move in the coming days remain slim.

Although the technical picture is relatively bearish in the short term, we see some decent support building:

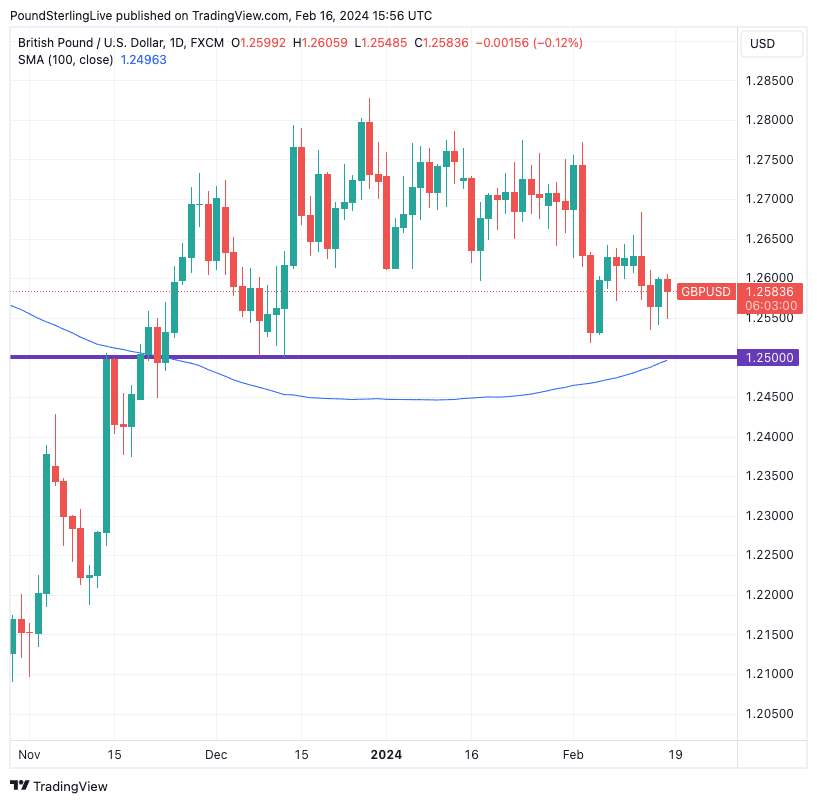

"GBP/USD is trading back in the mid-$1.25 region and has retested its 200-day moving average. Should this key support give way, we're eying the 100-day moving average, located at $1.25, as the next downside target in the short-term," says George Vessey, lead FX strategist at Convera, the payments firm.

Above: GBP/USD at daily intervals with the 100-day MA annotated.

The above-mentioned support can eventually break as the USD/Fed repricing story may yet have further to run owing to the surprisingly strong U.S. economy that negates the need for rate cuts anytime soon.

Under such circumstances, "we think the dollar has a bit more runway to appreciate," says Thomas Flury, FX Strategist at UBS, "we think the limits remain around EURUSD 1.05, USDCHF 0.90, GBPUSD 1.23, and near USDJPY 152."

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Shaun Osborne, Chief FX strategist at Scotiabank says GBP/USD support at 1.2530 looks firm on the long-term chart now, but it is still nursing a net loss on the week and spot has struggled to hold minor gains on the session.

"A clear move above 1.2610 would give the pound a bit more technical support and put spot on course for gains towards the mid/upper 1.26s," he says.

For the week ahead, the downside looks pretty well protected by the above-mentioned support levels, and the prospect of a near-term rebound is possible, given the light U.S. event calendar.

The light calendar limits the market's ability to further aggressively push back on existing expectations for the first Federal Reserve rate cut to fall in June. Recall it is this expectation that has underscored the USD rally of 2024.

Track GBP and USD with your own custom rate alerts. Set Up Here

The data is looking third-tier in nature, with S&P Global's PMI series and existing home sales due Thursday. Ahead of this, watch the release of minutes of the Fed's most recent meeting due Wednesday, although the information will prove data.

'Fed speak' will be more interesting, with Bostic and Bowman due on Wednesday, Jefferson and Cook on Thursday and Waller on Friday.

The highlight of the UK data calendar is the release of PMI survey data for February, due 09:30 GMT, where confirmation of a strengthening in economic activity is anticipated to have extended from January's solid figures.

Markets look for the manufacturing PMI to have recovered slightly to 47.1, services to have edged up to 54.4 and the composite to have eased to 52.7.

The lesson of the immediate past is that the British Pound is now proving more reactive to negative data surprises, which leads us to expect that any gains that follow positive surprises in the data will be limited.

Instead, the biggest moves are likely to follow downside misses in the data, which suggests risks are pointed lower heading into Thursday.

A case in point is the significant selloff in Sterling following December's retail sales miss, which contrasts with the almost indifferent market reaction to the arguably larger upside surprise that came a month later with the release of January's figures.

So, while the Pound-Dollar can potentially put in some gains over the coming days, they are liable to be limited in nature.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks