GBP/USD Week Ahead Forecast: At Risk of Further Slide Unless ISM Data Disappoints

- Written by: Gary Howes

- GBP/USD on cusp of major support

- Following USD's jobs report surge

- ISM survey will be watched closely Monday

Image credit: Garry Knight. Sourced Flickr. Reproduced under CC 2.0 licensing.

The Pound to Dollar exchange rate risks further declines over the coming week unless Monday's release of ISM employment figures dents the Dollar's advance.

The last week ended with a bang for the Dollar following the release of what was described as a "crazy strong" U.S. non-farm jobs report that revealed wags and jobs growth expanded well above consensus expectations in January.

The data buried the prospect of a Federal Reserve rate cut falling in March, prompting a reversal in financial markets that included a rally in the dollar.

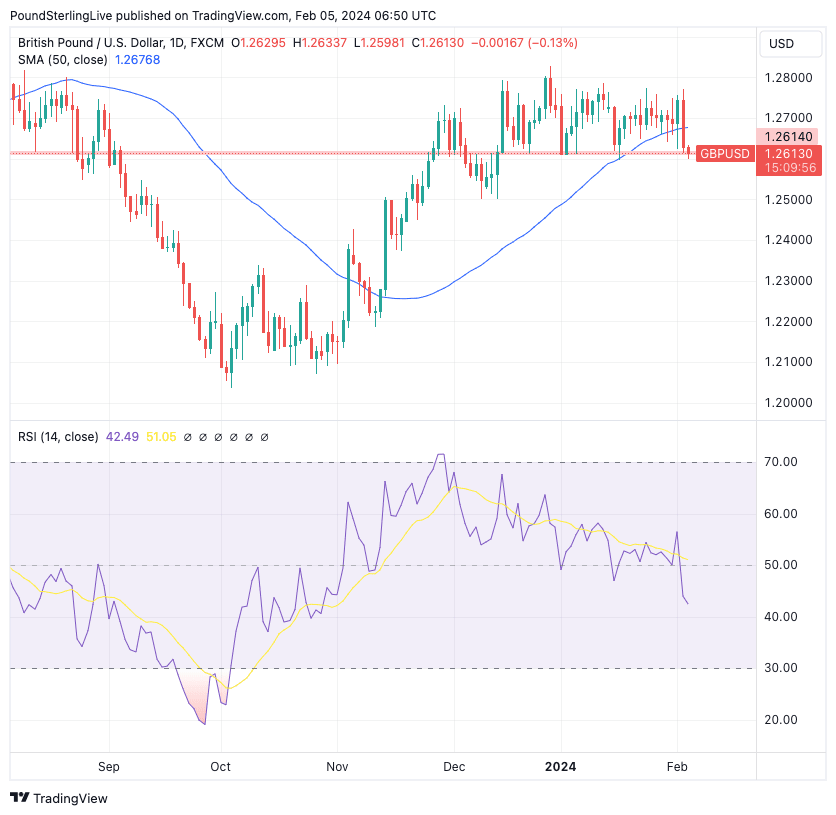

Above: GBP/USD at daily intervals. Track the USD and GBP with your own custom rate alerts. Set Up Here

Gains by the Greenback pushed the Pound-Dollar exchange rate below the 50-day moving average (blue line in the above chart), which hints near-term momentum has switched to the downside.

The pair is meanwhile at the horizontal support line at 1.2640, which has offered notable support at various periods in late 2023 and 2024.

We would look for this support line to hold if the short-term trading range is respected; last week, we reflected on how strong the narrow trading range in GBP/USD was proving, noting a significant decline in volatility for the pair that created predictable trading conditions.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Relative Strength Index (RSI) has deteriorated and suggests momentum has turned to the downside, and if the aforementioned support level breaks, a test of the 1.25 level (December lows) could be tested next.

Should support hold, a return to the range highs at 1.2772-1.28 is possible as the predictable trading range exerts its gravitational pull once more.

The fundamental backdrop is turning in favour of the Dollar, with the 0.90% drop in Pound-Dollar that followed Friday's job report indicating the market has all but given up on hopes for a March rate cut.

"USD bulls continue to charge, owing to blockbuster NFP report last Fri," says Christopher Wong, FX Strategist at OCBC Bank.

The U.S. added 353k jobs in January, with job gains seen broadly across different industries, while the past two months of NFP saw an upward revision of +126k. Topping it all off, wages jumped to a 3-month high at +4.5% y/y vs. 4.1% prior.

The data communicates what the Fed was trying to say just days earlier in its February interest rate decision: it is still too soon to talk about rate cuts.

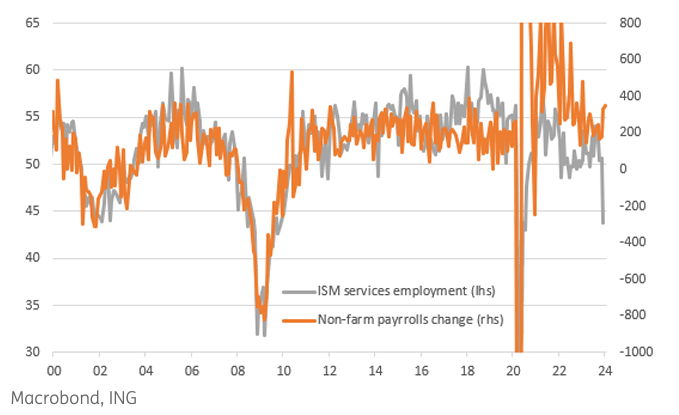

But analysis from ING Bank finds that the non-farm payroll report is at odds with other data prints which suggest a cooling jobs market.

"Labour market surveys are far, far weaker, with both the ISM manufacturing and services sector surveys in contraction territory - indicating job shedding," says James Knightley, International Economist at ING.

Above: ISM's employment monitor suggests the labour market is not as strong as the non-farm payroll report suggests.

Economists will therefore keep a close eye on the ISM services employment index update due Monday at 15:00 GMT.

"It collapsed in January, and if it doesn’t dramatically rebound, then we would be worried that payrolls could soon start to roll over," says Knightley.

Such an outcome would put a lid on Dollar's exuberance early in the week and underpin the support level mentioned in the above technical analysis.

However, should the data point to a robust employment situation, the Dollar can rally as it will cast aside any doubts about Friday's non-farm payroll report.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks